Dive Brief:

- Demand response participation in wholesale electricity markets grew 8% between 2017 and 2018 to reach 29,674 MW, according to a new report from the Federal Energy Regulatory Commission.

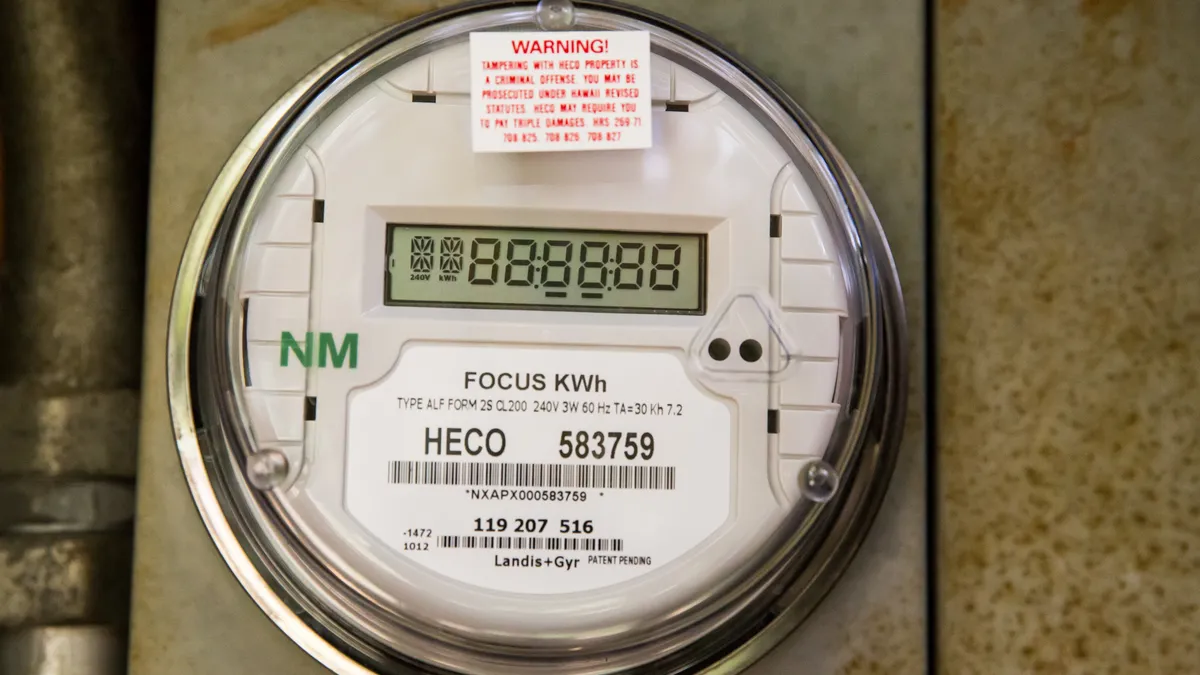

- The growth is tied to the proliferation of smart meters, which are now the most prevalent electric meter deployed in the United States. In 2017 an estimated 78.9 million advanced meters were operational nationwide, representing a penetration rate of 51.9%.

- The report also found a 12.3% decline in potential peak demand savings from retail demand response programs, though the data appears to have some errors. Analysts also say load management programs are growing but utilities may be classifying them in ways that make direct comparisons difficult.

Dive Insight:

Estimates of smart meter installations vary slightly between sources, but FERC's report aggregates the data to show a consistent growth trend that reflects the simultaneous rise in demand response.

The data shows a 5% increase from 2016 to 2017 in installed advanced metering. And since FERC's last annual assessment was released, electric utilities in Arkansas, Hawaii, Indiana, Minnesota and New Jersey have been either authorized or approved for greater deployments.

"These programs aim to improve customer engagement, limit the frequency and duration of outages, and establish a foundation for other grid modernization activities," FERC staff wrote. The report is required by the Energy Policy Act of 2005.

"State regulators across the country largely appear to support advanced meter investments," FERC staff concluded.

With smart meters backing demand management capabilities, the report found overall demand response participation in the wholesale markets is growing. Last year, overall demand resource participation in the wholesale markets increased by approximately 2,133 MW, according to the report. Regions with the strongest growth included the California ISO and Midcontinent ISO, while participation decreased most in ISO-NE.

Participation of demand response in the wholesale capacity, energy, and ancillary services markets increased to 6% of peak demand in 2018, according to the report.

However, FERC's analysis also showed that nationwide total potential peak demand savings from retail demand response programs decreased by 12% or 4,417 MW between 2016 and 2017, from 35,924 MW to 31,508 MW.

Most of of the decrease — roughly 3,300 MW — was "due to lower reported savings by Oklahoma Gas and Electric (OGE) Company," according to the report.

An OGE spokesperson said those figured are inaccurate.

"Our entire system is a little over 6,000 MW and there is no way we have a program that could account for a reduction of 3,300 MWs," spokesperson Brian Alford told Utility Dive in an email.

Alford also said that neither of the utility's load reduction programs has seen a sharp change in customers over the past four to five years. Much of the data in FERC's report comes from the U.S. Energy Information Administration (EIA).

"We will continue to check the numbers we have submitted to EIA to see if there was an error on our part," Alford said.

A FERC spokesperson told Utility Dive that the agency "doesn't attempt to confirm the accuracy of the information reported to EIA, or of the data that EIA publishes."

Analysts say demand response programs have been growing consistently.

"We generally see growth in utility [demand response] programs," Navigant Research Director Brett Feldman told Utility Dive in an email. "There is more interaction between retail and wholesale DR, so there might be some double-counting or confusion over where a program fits."

Feldman also said Navigant sees more-targeted demand response programs, like non-wires alternatives, as opposed to system-wide programs. "So that might impact growth on a macro level while still showing growth where it is most needed," he said.