The following is a contributed article by David Littell and Michael Hogan, senior advisors at the Regulatory Assistance Project.

The majority of us now carry smartphones in our pockets. Yet imagine if the rules of the telecom market had advanced only as far as the advent of the digital telephone technology of the late 1990s. That mismatch of 21st century technology and 20th century regulation is analogous to what is currently being seen in many regional wholesale electricity markets, even as the power system is increasingly populated at all levels by advanced resources.

To its credit, the Federal Energy Regulatory Commission (FERC) sees the need to move forward and keep pace with the most innovative U.S. states, which have embraced a 21st-century approach. FERC is taking on important reforms to wholesale market mechanisms, including the practices of regional transmission and independent system operators (RTOs/ISOs) relating to capacity markets. Supply and demand technologies have evolved dramatically in the last 20 years, but the rules and tools for ensuring cost-effective reliability have not. To its credit, this FERC sees the burning need to move forward and keep pace with, rather than hold back, the most innovative states.

FERC's clear guidance on PJM's Effective Load Carrying Capability (ELCC) proposal is a reform case in point. ELCC is intended to address criticism that energy storage is not receiving proper credit in the region's capacity market. That market was designed around serving system peak demand with conventional dispatchable generation, and despite revisions over the years, it still is. This has led to ongoing problems with how to properly value the reliability contributions of storage and variable renewable resources in PJM. To address this, ELCC seeks to measure the additional load the system can serve with a given resource, without a change in the prevailing standard of reliability, thus "effective load carrying capability."

It is no mean task to adapt a market mechanism that is designed to address this question in the context of a significantly different mix of resource characteristics, without compromising cost-effectiveness or reliability. The ELCC proposal does a workable job of amending the current PJM capacity market rules in order to better recognize the contribution of storage, wind and solar to system reliability.

It's a dynamic calculation — the ELCC credit changes as reliability risks shift with changes in the relationship between load and generation over time. So, if the period of highest reliability risk shifts from late afternoon to winter mornings, the ELCC credit will shift too. That's generally how it should work, with credit for reliably serving consumers' electricity needs tracking the changing patterns of reliability risk. The ELCC approach is not perfect, but it's a definite improvement.

FERC had a similar take, saying the approach "appears to be just and reasonable," albeit subject to some important tweaks. FERC rejected PJM's filing as unjustly discriminatory, specifically objecting to a transitional floor on capacity prices for incumbents. FERC suggested PJM can refile the ELCC without the floor, ideally with transparency improvements on how the valuation model calculates ELCC for different resources. While that seems the obvious choice, it may face obstruction from those generators that have benefited from being shielded from competition from batteries.

FERC has more work to do. While eliminating the capacity mechanisms altogether does not appear to be in the cards anytime soon, much can be done to shift focus back to the effectiveness of the energy and ancillary service markets, which can do a better job of incentivizing performance and delivery of energy — from all potential sources — instead of the focus on generating capacity that has a demonstrated history of failing to deliver as promised. The energy and ancillary services markets are more suited to and capable of signaling the most efficient investments in the flexibility needs — from whomever can provide it most cost-effectively.

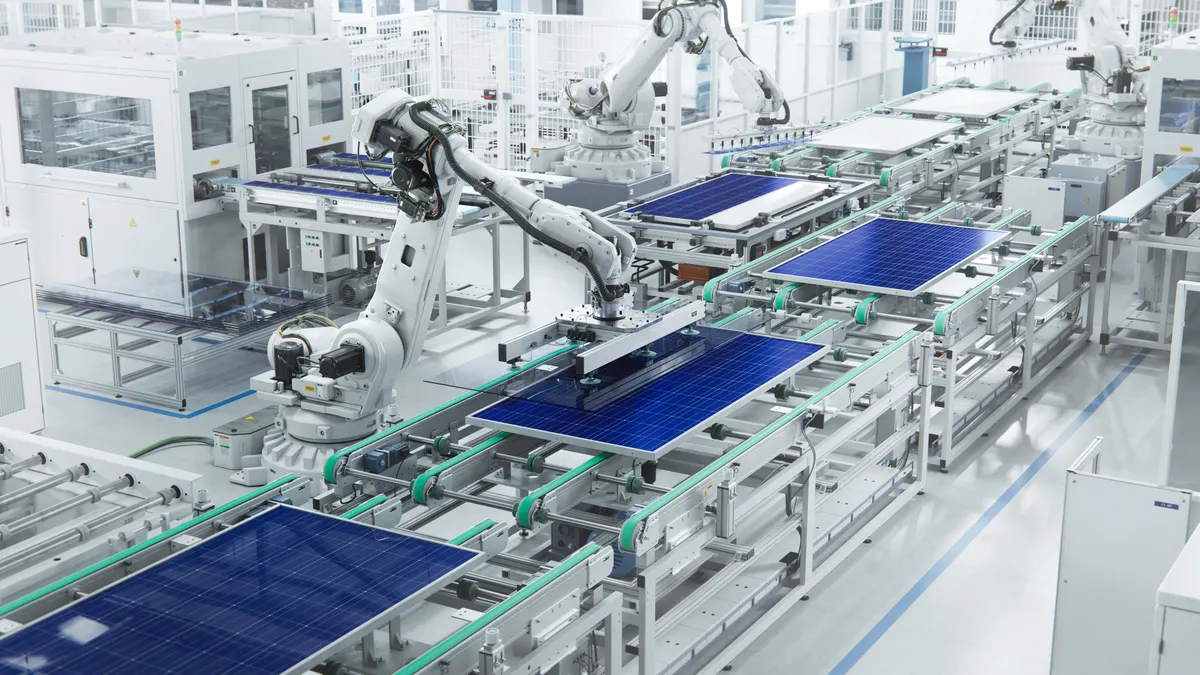

As noted, the rules governing the various capacity mechanisms were designed around fossil and nuclear plants that dominated grids in the years the markets were organized in the late 1990s. Yet wind, solar, battery storage and demand resources are vastly more economic and capable today than they were two decades ago. The structure of the capacity markets in PJM, ISO-New England and New York ISO have created a multi-billion-dollar annual revenue stream that is especially beneficial for fossil gas plants, and less so for other resources capable of making valuable contributions to reliability. But the beneficiaries will fight changes that affect their revenue.

As we've learned the hard way, reliability mechanisms that seemed appropriate two decades ago, including the original capacity market designs, no longer fit the bill. PJM customers paid billions a year for resources that failed to perform during the 2014 polar vortex. In California, last August's supply-related load curtailments extended into hours that have traditionally been considered "shoulder" rather than peak hours. In Texas in February, a fossil-gas-dominated system, designed to serve rapidly growing peaks reliably during hot Texas summers, failed catastrophically in the middle of winter. And capacity markets everywhere habitually over-procure capacity and under-procure capabilities for grids confronting new and mounting reliability challenges.

We are now in a fundamental transition to an electricity system of sophisticated clean energy generation and decentralized, distributed resources. These resources have more potential value, not less. As is often the case in our federal system, key states are leading the way with creative approaches to renewable and distributed resource integration. The federal rules governing the markets also need to transition.

Modern grids need fast-ramping and flexible resources at all levels to deliver affordable, reliable electricity. Markets must fully leverage the rapidly improving capabilities of wind, solar, batteries and flexible loads to deliver the evolving portfolio of reliability services the system will need, often more quickly, accurately and affordably than traditional generators.

Securing the responsive grid systems we need is no longer simply about capacity, if it ever was — it's about ensuring a portfolio of resource capabilities that can adapt to the evolving nature of resource "adequacy" in low-carbon power grids. The ELCC concept and decision is a step forward as FERC begins to take a series of hard looks at wholesale power markets.