Rawley Loken is a senior managing consultant, Amber Mahone is a managing partner and Tory Clark is a partner at energy and environmental economics, also known as E3.

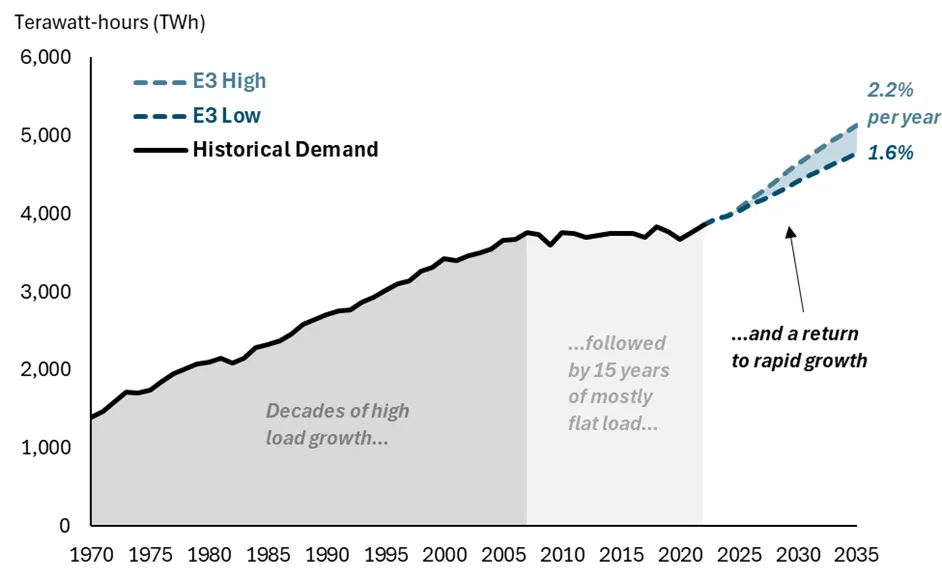

The electric sector is at a tipping point, with new demands from data centers, electric vehicles, heat pumps and manufacturing driving demand growth at a pace not seen in decades, highlighting the need for new grid infrastructure investment and integrated resource planning strategies.

With renewed Republican control of the presidency and Congress, questions abound over which of these trends might be slowed or accelerated. Donald Trump campaigned against the Inflation Reduction Act and Biden-era federal regulations that promote electrification, efficiency and emissions reductions, while asserting goals to increase domestic manufacturing through tariff-based trade policies.

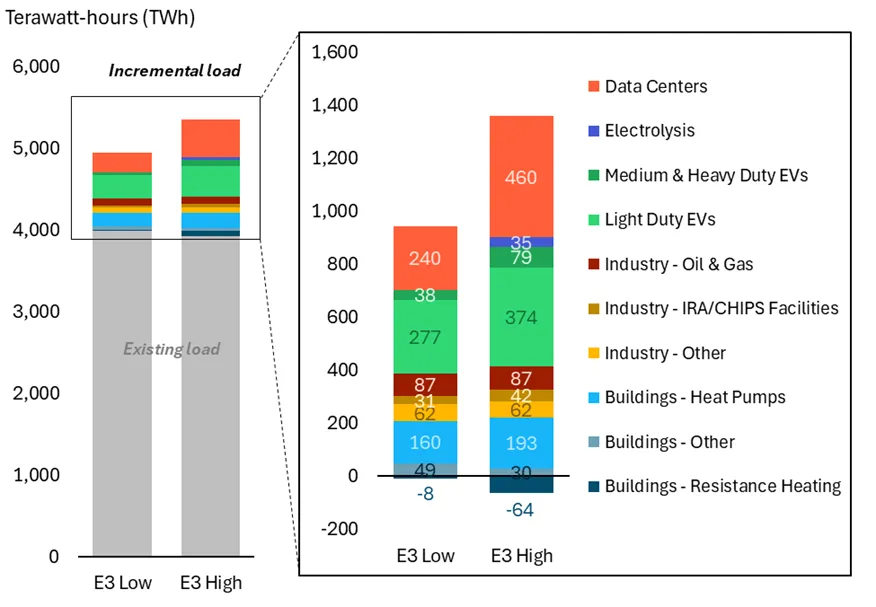

Our analysis of the cumulative impact of technology adoption trends and expected policies on the electric sector, using E3’s U.S. Pathways model, suggests that the recent growth trends are likely to continue and even accelerate under the next administration. We project that U.S. electricity retail sales will grow rapidly and could increase at a rate of 1.6% to 2.2% per year for the next decade under a range of policy and data center growth outcomes reflected in the E3 Low and E3 High scenarios (Figure 1). For comparison, U.S. retail sales of electricity have been nearly flat since 2007, growing at only 0.2% per year.

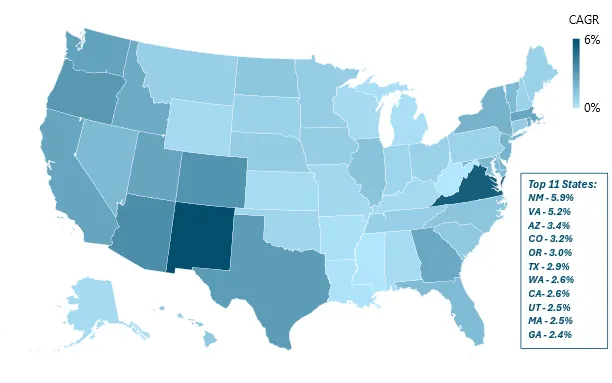

While electricity demand is expected to increase across the U.S., the rate of growth will vary widely by state (Figure 2). States with the highest projected electric load growth rates include those with the largest growth in data centers (e.g. Virginia) and those with new grid connected load from the oil and gas sector (e.g. New Mexico). States with aggressive electrification policies (e.g. California, Washington, Oregon, Massachusetts) also see high load growth driven by electric vehicles and heat pumps.

The next decade of load growth will be driven by EVs and data centers

Vehicle electrification and data center expansion combined represent 60%-70% of new electricity growth over the next decade in our scenarios, while new industrial and manufacturing growth and heat pumps in buildings are each expected to account for only around 15%-20% of new growth for the U.S. as a whole (Figure 3).

Data center growth rates are based on E3’s recent review of published forecasts. The E3 Low scenario uses the median growth rate from that review to estimate around 32 GW of new data center load by 2035 (240 TWh), while the E3 High scenario uses the high end of the forecast range to estimate 62 GW of new load over same period (460 TWh). Both forecasts assume faster data center growth over the next five years and a gradual slowdown between 2030 and 2035. Interconnecting that much new load to generation will represent a significant challenge for utilities, which is exacerbated by the fact that future data center demand remains highly uncertain.

Electric vehicle sales are likely to increase, even if the next administration repeals the Biden-era federal vehicle emissions standards, due to consumer fuel savings and the potential continuation of state-level policies like California’s Advanced Clean Cars II program, which has been adopted by 11 other states and the District of Columbia, as well as state-specific incentives and low-carbon fuel standards.

The EPA estimates that EV market share for passenger vehicles is still likely to increase from 10% today to 47% by 2032 if current federal policies were rolled back, as is the case in the E3 Low Scenario. If California’s Advanced Clean Cars II program is halted by the Trump administration, EV sales would likely drop further, but the magnitude of the impact will depend on how manufacturers respond. Auto manufacturers may continue to voluntarily comply with many aspects of California’s program, as they did under the first Trump administration. The E3 High Scenario assumes a 68% EV market share by 2032 assuming Biden-era federal policies and state program remain in place.

Domestic onshoring policies from the IRA and CHIPS Acts could lead to around 30-40 TWh of new manufacturing load by 2035. While the IRA manufacturing tax credits could be in jeopardy under the new administration, many Republican lawmakers have already called for their preservation. Likewise, new proposed tariffs under the Trump administration could lead to an increase in domestic manufacturing over the long-term. However, it is uncertain what the final tariff policy will look like and how much it will influence domestic manufacturing load over the next five to 10 years. Elsewhere in industry, the significant trend towards electrification and grid interconnection of oil and gas loads in the Permian Basin could add almost 90 TWh of new industrial load by 2035.

In buildings, we estimate the increase in demand from heat pumps in buildings to be between 150 TWh and 190 TWh over the next decade. We expect a continuation of the historical upward trend in heat pump space heater sales, even in states that do not require or incentivize heat pumps in their building codes, due to customer economics in states with relatively warm climates.

In 2023, 46% of newly constructed homes were built with heat pump space heating. Even with an anticipated roll-back in IRA customer incentives for purchasing heat pump space heaters in the E3 Low scenario, we do not expect significant changes to space heating adoption numbers at the national scale. However, the Trump administration could seek to weaken finalized DOE standards for residential water heating or other appliances, resulting in higher electricity demand from resistance heating and other appliances as shown in the E3 Low scenario.

Meanwhile, electricity demand for new hydrogen production remains uncertain, but seems unlikely to materialize in a major way over the coming decade. The E3 Low scenario assumes that the IRA 45V clean hydrogen tax credits are repealed or changed such that electrolytic hydrogen is not deeply incentivized, while the E3 High scenario assumes that the 45V tax credit is maintained and around 35 TWh of electrolysis load develops by 2035 based on the DOE database of planned electrolysis projects.

Proactive planning is needed

Regardless of federal climate and energy policy rollbacks over the next four years, the U.S. electric sector will need to plan for load growth at levels not seen for 20 years. The compounding effect of data center load growth and electrification will add load faster than it will be offset by energy efficiency and distributed energy resources in buildings, while new manufacturing facilities will add significant point sources of electricity demand.

Proactive electric grid planning, including integrated system planning of distributed energy resources and distribution, transmission and generation assets, is needed to ensure timely investments in reliable grid infrastructure. Likewise, investments in grid controls, energy efficiency and flexible load management will be important to manage the cost of serving these new electric demands.

While the U.S. has not seen sustained and rapid electric load growth for the past 15 years, we have navigated periods of high growth in the past. With proactive planning, we can turn technological progress to our advantage, minimizing costs and environmental impacts along the way.