Dive Brief:

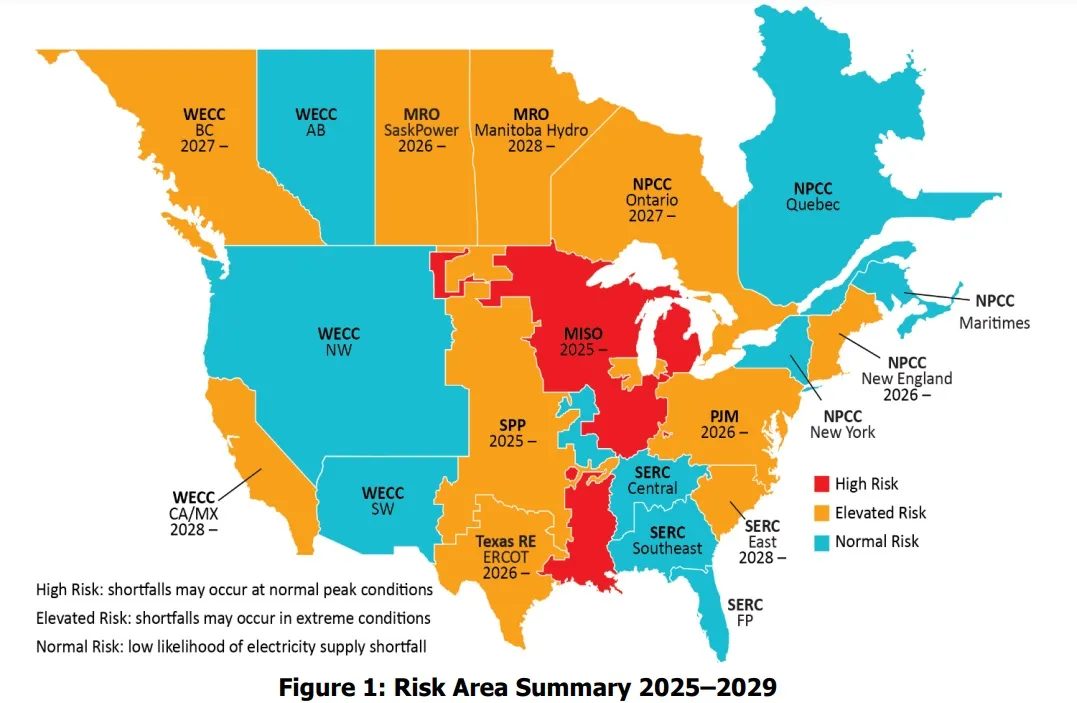

- More than half of North America faces a risk of energy shortfalls in the next five to 10 years as data centers and electrification drive electricity demand higher and generator retirements threaten resource adequacy, the North American Electric Reliability Corp. said in a 10-year outlook published Tuesday.

- Summer demand is forecast to rise by more than 122 GW in the next decade, adding 15.7% to current system peaks, according to the reliability watchdog’s 2024 Long-Term Reliability Assessment, or LTRA. NERC said its 10-year summer peak demand forecast has grown by more than 50% within the last year.

- Federal policies are needed to support energy production, manufacturing and infrastructure, National Rural Electric Cooperative Association CEO Jim Matheson said in a statement. Grid officials have been sounding the alarm around system reliability for years and the most recent LTRA “continues painting a grim picture of our nation’s energy future and growing threats to reliable electricity,” he said.

Dive Insight:

NERC has previously warned about the pace of generator retirements and the changing resource mix, but now says the situation is becoming more urgent as demand forecasts surge and resource additions slow.

The LTRA recognizes confirmed generator retirements of 52 GW by 2029 and 78 GW over the 10-year assessment period. However, announced retirements by generators that have not begun the formal deactivation processes drive the total expected retirements to 115 GW by 2034.

Those retirements are largely being replaced by variable generation, NERC said.

Peak reserve margins fall below the levels required by jurisdictional resource adequacy requirements in the next 10 years “in almost every assessment area, signaling an accelerating need for more resources,” according to the report.

However, “in the face of these pressures ... we’ve observed in this year's LTRA that the resource additions are slower than the industry projected,” Mark Olson, NERC’s manager of reliability assessments, said in a Tuesday call with reporters. “The overall resource capacity on the system has grown slightly since the last LTRA, but it is significantly less than what the LTRA had projected the system would be growing to, and that creates concerns.”

The Midcontinent Independent System Operator faces a high risk beginning next year, with energy shortfalls in some areas possible during normal peak conditions. “Resource additions are not keeping up with generator retirements and demand growth,” the LTRA noted.

The Southwest Power Pool and New England region face an elevated risk, with energy shortfalls possible under extreme conditions beginning in 2025 and 2026, respectively. There are natural gas supply risks in each area, and SPP also faces potential shortfalls if wind generation falls below expectations.

In November, NERC warned that it is concerned about the potential for freezing temperatures to impact delivery of natural gas to power plants this winter.

PJM Interconnection faces elevated risks beginning in 2026. “Resource additions are not keeping up with generator retirements and demand growth,” the LTRA said. “Winter seasons replace summer as the higher-risk periods due to generator performance and fuel supply issues.”

In the Electric Reliability Council of Texas footprint, “surging load growth is driving resource adequacy concerns as the share of dispatchable resources in the mix struggles to keep pace,” NERC said. “Extreme winter weather has the potential to cause the most severe load-loss events.”

“We're seeing demand growth like we haven't seen in decades,” said John Moura, NERC’s director of reliability assessment and planning analysis. “Simply put, our infrastructure is not being built fast enough to keep up with the rising demand. So we're here at a moment where collaboration, urgency and foresight are really non-negotiable.”

The “explosive” demand growth is being driven by new data centers, building and transportation electrification and other large commercial and industrial loads, such as new manufacturing facilities and hydrogen fuel plants, NERC said.

The Electric Power Supply Association, which represents merchant generators, called for policies that support competitive markets in order to meet the rising demand.

“Relying on the integrated resource planning used by utilities and the business model of the last century is no way to meet the moment,” EPSA President and CEO Todd Snitchler said in a statement. “Competitive markets remain the best vehicle to ensure reliability during this transformational period.”

America’s Power, which represents various industries involved in coal-fired power generation, said its analysis indicates utilities plan to retire almost 60,000 MW of coal capacity by the end of 2029 — and the retirements will happen alongside a 128,000 MW rise in demand.

“Fortunately, utilities are already postponing the retirement of power plants in some regions of the country, but utilities in other regions need to follow this trend,” America’s Power President and CEO Michelle Bloodworth said. “With electricity demand exploding due to electrification, data centers, and industrial growth, something has to give, or we will damage our economy and leave Americans without electricity.”

The National Mining Association, which represents coal producers, said “the grid reliability math isn't adding up.”

“An increasingly dangerous situation will be untenable without a sharp change in policy,” NMA President and CEO Rich Nolan said in a statement. “Surging electricity demand is colliding with an unworkable regulatory agenda that is producing self-imposed scarcity, undermining affordability and reliability.”

NMA called on the incoming Trump administration to pursue a regulatory agenda that “addresses this unfolding electricity supply crisis.”

NRECA’s Matheson sent a letter to Trump on Dec. 4 supporting policies that “prioritize investment in American energy production, manufacturing and infrastructure ... We urge you to take a coordinated approach which ensures that energy projects can be built efficiently, effectively, and at reasonable cost.”

Trump said he wants to expedite federal permits and environmental reviews for construction projects worth more than $1 billion. Many infrastructure megaprojects — in particular energy projects — fall in that price range.

NERC’s long-term assessment “points directly to the need for a pro-energy policy agenda that prioritizes reliability and affordability,” Matheson said in a statement. “We urge President Trump and congressional leaders to prioritize reliability right out of the gate next year before it’s too late.”