Dive Brief:

-

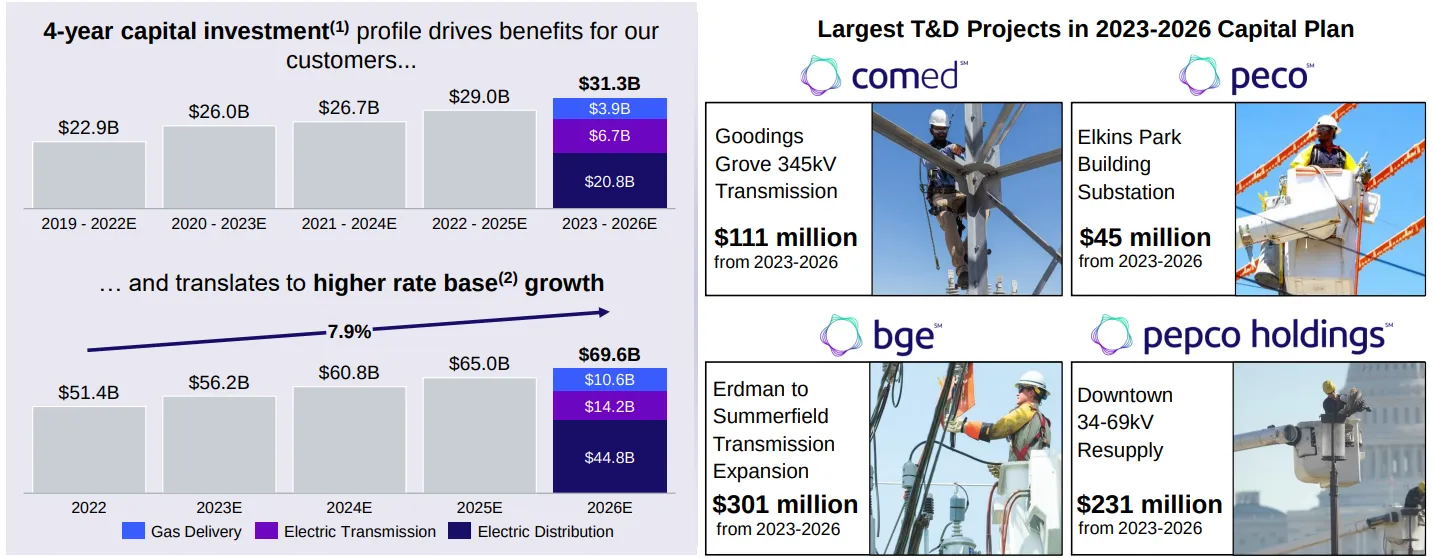

Exelon expects to spend $31.3 billion on capital projects over four years starting this year, increasing its rate base by about 8% annually, company officials said Tuesday during the company’s fourth quarter earnings conference call.

-

Exelon’s utilities had a combined return on equity last year of 9.4%, the highest since 2019, and the company expects the ROE to range from 9% to 10% over the next four years, according to Jeanne Jones, Exelon chief financial officer.

-

“As we balance the required progress on the energy transition with customer affordability, we continue to challenge ourselves to deliver maximum customer value at the lowest cost possible,” Calvin Butler, Exelon president and CEO, said.

Dive Insight:

Customer needs and industry trends support utility investment growth, according to Exelon.

The Chicago-based company invested $7.2 billion of capital last year.

“The ability to execute on this level of investment with the confidence that we're aligned with our jurisdictions is a key element of our success,” Butler said.

Exelon increased its expected four-year spending plan by $875 million, to $31.3 billion, since its Jan. 10 analyst day presentation. Over that span, Exelon expects to spend $20.8 billion on distribution assets, $6.7 billion on transmission and $3.9 billion on gas delivery, according to the earnings presentation.

The spending plan is $2.3 billion more than the prior four-year plan, according to Jones.

Last year, Exelon’s utilities connected their customers to nearly $600 million of energy assistance, an increase of more than $100 million from 2021, Butler said.

Exelon’s average electric rates are 23% below those of the top 20 U.S. cities, according to Jones.

The company remains focused on keeping its costs down, she said.

“Our ability to deploy $31 billion of capital … at affordable rates amidst persistent inflationary pressures would not be possible without a resolute focus on managing costs,” Jones said.

Exelon’s operations and maintenance expenses grew by 1.7% a year from 2016 through 2023 compared to a 3.2% average inflation rate, according to Jones.

The company keeps costs down partly by investing in technology and processes, such as a recent pilot to conduct tree trimming work using specialized drones that reduce a two-day job for a human crew to 45 minutes of drone deployment, Jones said.

Exelon’s comprehensive income fell 8.9%, to $2.26 billion last year from $2.48 billion in 2021, while its total operating revenue jumped to $19.1 billion from $17.9 billion in the same period.

Exelon has more than 10 million customers in Delaware, the District of Columbia, Illinois, Maryland, New Jersey and Pennsylvania through its transmission and distribution utilities: Atlantic City Electric, BGE, Commonwealth Edison, Delmarva Power & Light, PECO Energy and Potomac Electric Power.