Dive Brief:

-

With Connecticut’s standard offer supply rates for residential customers poised to more than double, Eversource, Avangrid’s United Illuminating and state officials on Monday unveiled measures aimed at easing electricity bills this winter.

-

The utilities intend to provide bill credits to its customers to fast-track the return of earnings from their power purchase contracts with Dominion Energy’s Millstone nuclear plant starting Jan. 1.

-

Connecticut lawmakers are calling for a multi-state hearing into Eversource’s pending “exorbitant and punishing” standard offer rate increase. “Connecticut needs to further tie Eversource's executive compensation to performance,” they said in a Friday letter to Connecticut Public Utilities Regulatory Authority Chairman Marissa Paslick Gillett.

Dive Insight:

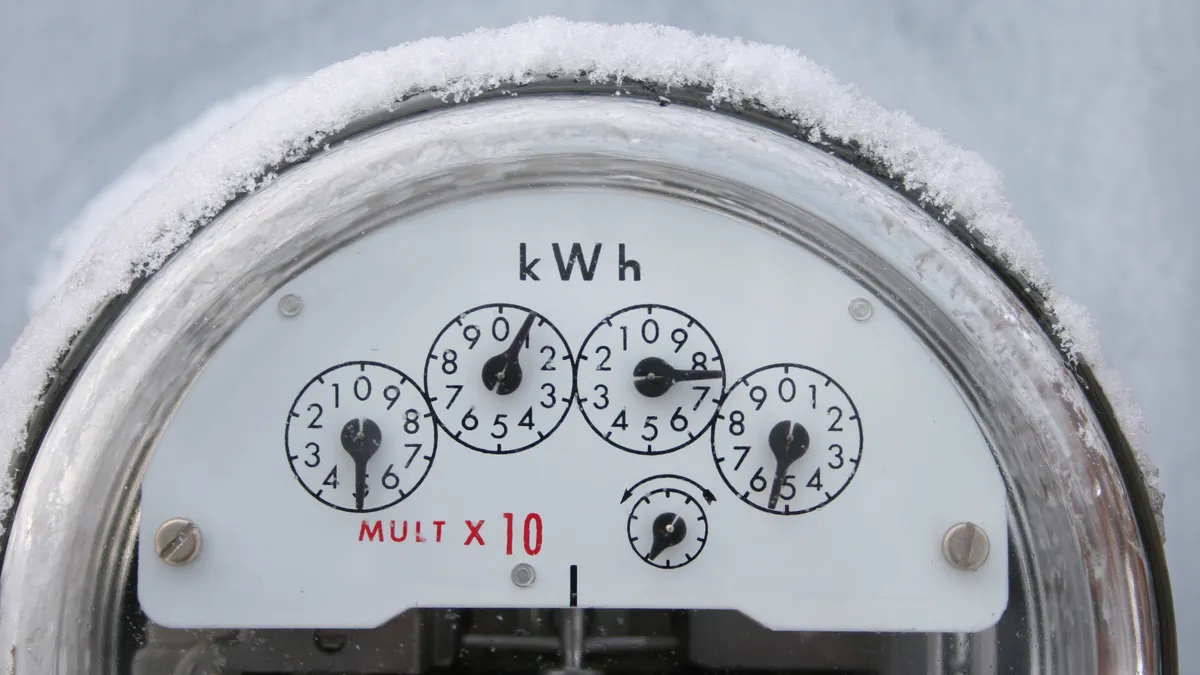

On Jan. 1, Eversource’s standard offer rate for residential customers will soar to about 24.2 cents/kWh for six months, up from 11.5 cents/kWh in the first half of this year, according to the Connecticut Office of Consumer Counsel, or OCC, which represents ratepayers. Residential customer bills will increase by about $84.85 a month, based on using 700 kWh a month, the office said.

UI’s residential standard offer rate is poised to jump to 21.5 cents/kWh from 10.7 cents/kWh, leading to a roughly $79.24 monthly bill hike.

About 90% of Eversource’s residential customers buy electricity through the standard offer and 83% of UI residential customers are on standard offer rates, while the rest buy it from third-party suppliers, according to the OCC. The standard offer rates change every six months based on the results of competitive bids for supply. Eversource and UI do not profit from the standard offer service they provide, according to the office.

In the first nine months of this year, people buying electricity from third-party suppliers saved $10.4 million compared with the standard offer rate, likely because of long-term contracts that were signed before electricity prices jumped after Russia invaded Ukraine earlier this year, according to the OCC. However, third-party supply has cost about $300.6 million more than standard offer supply since January 2015.

As part of the ratepayer relief plan, Eversource and UI intend to provide bill credits equal to the net revenue from their contract with the Millstone nuclear plant, according to a filing the utilities made Monday at PURA, which must approve the proposal. The credits would last for four months starting in January.

Eversource and UI buy power from the Millstone plant for $49.99/MWh under 10-year contracts, according to a report written by staff of the Connecticut Legislature. The utilities can resell that power when wholesale prices are higher, earning them revenue that is returned to ratepayers.

Eversource expects its credit will total about $90 million, according to the filing. The utility expects the credit will reduce residential customers’ bills by about $10 a month, blunting the standard offer increase by 12.5%. The effect on UI customers is still being calculated.

Eversource and UI will also seek approval for a flat-rate credit to help customers with financial hardships. The proposed rate would start in January and last until a new PURA-approved low-income discount rate goes into effect in 2024, according to the utilities.

Under the plan, Eversource shareholders will provide $10 million and UI will provide $3 million to Operation Fuel, a non-profit group that helps low- to moderate-income households pay utility bills. The UI contribution will be part of a pending settlement over bill collection practices during the Covid-19 pandemic, according to the filing.

The rate relief plan is a short-term, consensus-based solution developed between the utilities and Gov. Ned Lamont’s, D, administration, the utilities said.

“This solution is not intended to represent, nor does it achieve, long-term solutions to the energy supply challenges that exist for New England and that both Connecticut and the broader New England region must address on behalf of customers,” they said.

The rate relief plan is a “step in the right direction,” according to Mark Wolfe, National Energy Assistance Directors Association executive director.

“But with heating oil prices approaching record levels and natural gas up by about 28%, these additional payments should be closely monitored by the state of Connecticut to make sure they will be sufficient to address potential public health concerns as families struggle to pay high winter heating costs,” Wolfe said Monday.

Meanwhile, Connecticut lawmakers want PURA to hold a hearing with utility regulators in Massachusetts and New Hampshire, where Eversource also operates, into the utility’s standard offer practices.

“This hearing should encompass the process by which Eversource procures energy, how it forecasts natural gas and other fuel source rates and if it is providing their ratepayers with sufficient protections from excessive increases,” the lawmakers said in the letter to the agency.

Avangrid and municipal utilities are able to buy less expensive power than Eversource, the lawmakers said.

“Shareholders should not receive record dividends when customers are seeing more than 100% increases in the generation rates,” they said.

Earlier this month, state Sen. Norm Needleman, D, co-chair of the Energy & Technology Committee, said he planned to convene a forum to consider ways to improve the electricity market so massive rate hikes don’t occur.

“We understand and share the concerns over the volatile and historically-high fuel prices caused by global events and demand,” Mitchell Gross, Eversource spokesman, said Tuesday in an email. “As our regulators and legislators know, the higher electric bills this winter will be due to the supply cost which is based on market conditions that we do not control.”

Eversource is always ready to work with state agencies and lawmakers and can provide analysis for any proposals they might consider, he said.