Dive Brief:

-

The Texas and California grid operators’ generator interconnection processes are the best among U.S. regional transmission system operators, according to an interconnection scorecard released Monday by Advanced Energy United.

-

The PJM Interconnection came in last with a D-minus followed by ISO New England at a D+, with both grid operators scoring especially poorly on their use of regional transmission planning and the usefulness of their interconnection alternatives, such as sharing or transferring existing interconnection points.

-

The report’s results can be used as a baseline for assessing ongoing interconnection reform efforts across the country, according to AEU. “Strong implementation of [the Federal Energy Regulatory Commission’s] recent reforms will be an important first step toward improving the interconnection process, and it’s also clear that additional reforms will be needed,” Caitlin Marquis, AEU managing director, said in a statement.

Dive Insight:

The AEU report centers on one of the key barriers to ensuring that new power supplies can reliably replace retiring power plants: the grid interconnection process.

About 1,350 GW of planned generation and 680 MW of energy storage was seeking to connect to the U.S. grid at the end of 2022, according to an April report by Lawrence Berkeley National Laboratory.

“As is widely recognized, and this scorecard confirms, the progress towards completing those interconnections is agonizingly slow and puts system reliability at risk,” the report states.

The scorecard — drafted by consulting firms Grid Strategies and the Brattle Group — is based on public data and interviews with 12 generation developers and engineering firms. It assesses interconnection efforts looking at six categories, with the most important being the interconnection process results, including success rate, speed and cost certainty.

The report’s authors found major differences across regions in specific categories, with some regions having elements of the interconnection process that could be considered “best practices.”

The report’s authors gave the California Independent System Operator strong marks for its proactive upgrades to its transmission system, transparency and cost sharing approach. “CAISO’s use of mitigation strategies to bring projects into operation until upgrades are constructed is also appreciated by interconnection customers,” the authors said.

ERCOT received kudos for “processing a high volume of resources on a reasonable timeline and at reasonable costs.” But the Texas grid operator lacks proactive regional transmission planning to address system constraints, according to the report. This leads to high levels of generator curtailment, a major impediment to deploying new generation resources, the authors said.

Among the seven regional grid operators, PJM and ISO-NE scored the lowest for their interconnection processes.

There are “few bright spots” for PJM, according to the report. “It appears that PJM stuck with a sub-par serial process too long and its transition to a cluster process has frozen opportunities for new projects,” the authors said. “PJM has not planned its system to create headroom for new resources, other than its recent process concerning [New Jersey] offshore wind.”

It is too soon to assess PJM’s revamped interconnection process, according to the report.

The report’s assessment of PJM is based on conditions and practices that no longer exist, said Jeff Shields, a spokesman for the grid operator. “We have been meeting process milestones since implementation of the reforms in July 2023, and expect to process about 72,000 MW in projects by mid-2025 and 230,000 MW over the next three years,” he said, noting more than 90% of those projects are renewable energy or energy storage. “That is real progress.”

Further reforms will likely be needed to meet the needs of the energy transition, Shields said.

Parts of ISO-NE’s system are highly constrained, making it likely that planned projects will trigger significant system upgrade costs, the report’s authors said. “Those upgrades, as well as planned transmission expansions, are difficult to build, making it difficult to bring projects online,” they said.

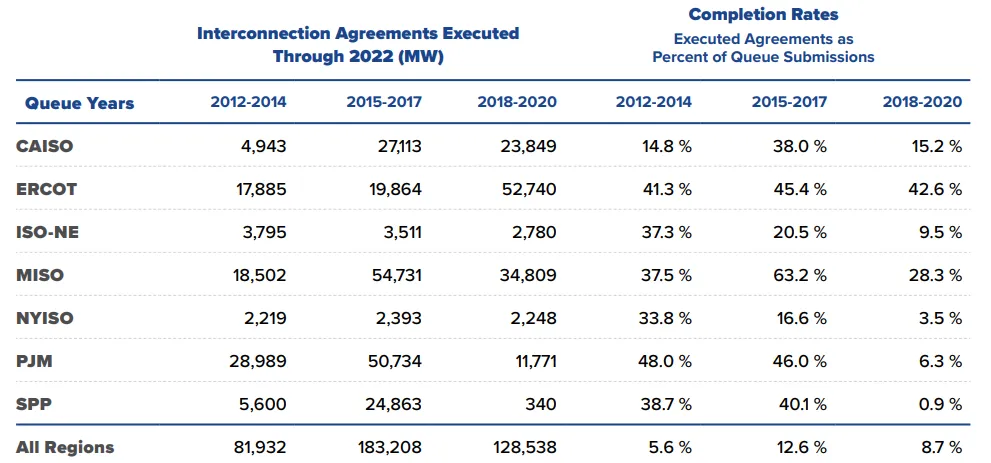

ERCOT and the Midcontinent Independent System Operator had the best interconnection agreement completion rates from 2018 to 2020, at 42.6% and 28.3%, respectively, according to the report.

For interconnection requests submitted in 2018 to 2020, the completion rates for ISO New England, the New York Independent System Operator, PJM and the Southwest Power Pool fell to less than 10% because of the high number of submissions and slow progress in completing the study process, according to the report.

“Completion rates below 10% reflect a lack of sufficient upfront information and/or a deficient and burdensome process,” the report said. “The uncertainty and slowness of the interconnection process creates a perverse incentive for interconnection customers to submit even more proposals, which can create a negative feedback loop.”

The regional grid operators are set to file their plans for meeting FERC’s new grid interconnection requirements by April 3. FERC’s interconnection reforms, issued in July, aim to establish baseline improvements to the interconnection process, including by setting firm deadlines for grid operators to review interconnection applications.

Editor’s note: This story has been updated to include comments from PJM.