Power system modernization with artificial intelligence, or AI, is being slowed by a lack of access to system data for AI training, tech and power sector experts agree.

“Data is AI’s oil, gas, wind and solar all wrapped into one,” Alexandr Wang, founder and CEO of tech market leader Scale AI, told the House Committee on Energy and Commerce April 9. “Every major AI advancement is grounded in data shaped by human expertise,” and “to win on AI, we must turn our data asset into an advantage.”

Utilities want to win with AI, too, power system executives and analysts agree.

“The grid is one of the most complex machines on the planet,” and is “primed for digitalization,” said Southern California Edison Senior Vice President, System Planning and Engineering, Shinjini Menon. Data to fuel that digitalization is vital “because there is not enough time, money, or resources on planet earth” to continue using past practices, she added.

The power and tech sectors have partnered to address barriers to data accessibility in the Open Power AI Consortium led by the Electric Power Research Institute, or EPRI. And regulatory and technology innovations are opening data access. But important disagreements about cybersecurity and utility customer rights must still be resolved, experts told Utility Dive.

What data and why

Many stakeholders see new AI capabilities as a tool to address the power system’s enormous reach and complexity.

“This is not your grandfather's AI because it is not just machine learning, but it still needs data to learn,” said EPRI President and CEO Arshad Mansoor. And that data has “many different sources, including regional system operators, utilities, researchers, private sector device manufacturers, third party analysts, and cloud and software providers,” he added.

“An estimated 95% of all data is behind utility cybersecurity and customer privacy walls,” added EPRI Executive Vice President and Chief Financial, Risk, and Operations Officer Swati Daji. EPRI’s Open Power AI initiative will “create, develop and curate data sets as an open repository of solutions for the whole industry.”

It will also create “a sandbox for testing and validating use cases,” and “a feedback loop for sharing lessons learned,” Swati said. The open repository data can be integrated with utilities’ protected data for further AI modeling, and, as grids modernize, utilities will be able to better manage the infrequent peak demands that require so much utility spending, she added.

Another initiative is the “One Digital Grid Platform” developed by component manufacturer Schneider Electric in partnership with Microsoft and data provider Esri as a “grid data hub,” said Schneider Electric’s Digital Grid CEO Ruben Llanes. It will “ingest data from utility smart devices” and “enable real-time insights, predictive analytics and automation,” he added.

Both initiatives will advance utilities’ capabilities to use data from AI-enabled grid edge intelligence to “disaggregate customer usage and orchestrate flexible consumption,” Menon said. That will, however, require “distribution system investments for wires, software and communications technologies,” she added.

Planned together, “incremental investments in control room and system edge technologies can keep costs of upgrades affordable,” Menon said. An AI-enabled utility system “might do 10 million computations in the time it now takes to do 10,000 computations,” which will allow “more comprehensive planning and more granular, real-time system operations,” she added.

Even with the 15 million customer-owned smart devices expected on SoCalEdison’s system by 2045, AI tools can monitor system data “and call human operators’ attention to where key decisions are needed,” Menon said.

Policy work is accelerating to enable greater data access by all power system stakeholders.

Policy to drive data access

Data access has been the subject of recent federal, state and utility policy initiatives.

At the federal level, both the bipartisan AI framework proposed in 2023 by Sen. Richard Blumenthal, D-Conn., and Sen. Josh Hawley, R-Mo., and the PREPARED for AI Act introduced last year by Sen. Gary Peters, D-Mich., and Sen. Thom Tillis, R-N.C., include provisions for data protection and sharing. Neither has been enacted.

But in 2024, utilities and regulators continued to address access to customer data from advanced metering infrastructure, or AMI, at the state level, according to the most recent state policy action update from the North Carolina Clean Energy Technology Center.

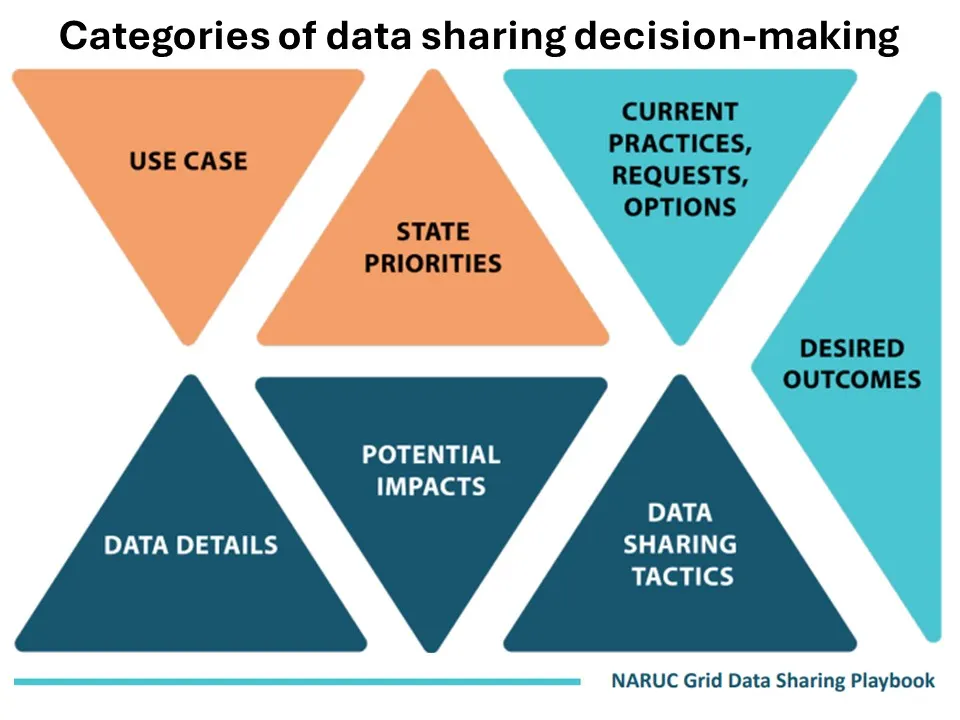

According to the 2023 National Association of Regulatory Utility Commissioners Grid Data Sharing Playbook, all electric system data can be shared, but not personal, demographic, or program participation data that identifies customers. And that data access can enable system benefits, limit negative impacts and clarify the difference between “need to have” versus “nice to have” data, it added.

There are problems with access to both grid data and customer data, said Chris Villarreal, founder and president of consultant Plugged-In Strategies and a playbook co-author. Playbook practices can accelerate DER interconnection and enable economy-wide electrification by speeding data access and providing transparency and customer data protections where needed, he added.

Important data sharing policy work is ongoing in several states.

New York’s 2040 grid flexibility potential could avoid nearly $3 billion per year in power system costs, according to a new Brattle Group assessment for the state’s Grid of the Future proceeding. But implementing that flexibility potential “will require a massive amount of data, some of which is not measured or available,” said Brattle Managing Energy Associate and study co-author Akhilesh Ramakrishnan.

Utilities must invest to “measure and collect” data, and build “a single point of interaction and a single data format” to streamline access, Ramakrishnan added.

In Phase One of the California Public Utilities Commission’s R. 22-11-013 planning proceeding for DER growth, a Data Working Group was established to improve data access. It will “address rules and requirements on data access,” including standards for accuracy, customer privacy and utility compliance with regulatory requirements, the working group said.

Accessible real-time data would allow all available resources “to be used to balance supply and demand without spending hundreds of billions of dollars” for system upgrades, said Jon M. Williams, CEO of distributed battery provider Viridi.

In Massachusetts, lawmakers recently enacted Senate Bill 2967, which calls for “implementation of advanced metering data access protocols.” DER advocates endorsed the law, but utilities want a regulatory change.

Eversource Energy “fully supports” data access, and suggests “a common statewide portal using a virtual central data repository” rather than a “traditional database” that could “duplicate costs” and create “security vulnerability,” said Eversource Senior Vice President of Customer Operations, Digital Strategy, and Chief Customer Officer Jared Lawrence.

In Minnesota, regulators approved “open data access standards,” and approved $563.7 million for Xcel Energy to deploy smart meters and wireless communications to support them, according to Citizens Utility Board Executive Director Annie Levenson-Falk.

Utilities were also required “to collect and share aggregated or anonymized, disaggregated customer energy use data,” Levenson-Falk said. But Xcel’s denial of the first request for that data, as a potential threat to customer privacy or security, is now being challenged, she added.

Other key state efforts are ongoing in New Jersey, Arkansas, Illinois and the District of Columbia.

A consistent focus of these proceedings is the use of AI-managed distribution system data to enable aggregated DER and virtual power plants, or VPPs, to be integrated into system operations.

Distribution system data is key

There is growing stakeholder agreement that to obtain, share and use distribution system data, investments in DER management systems, or DERMS, will be necessary.

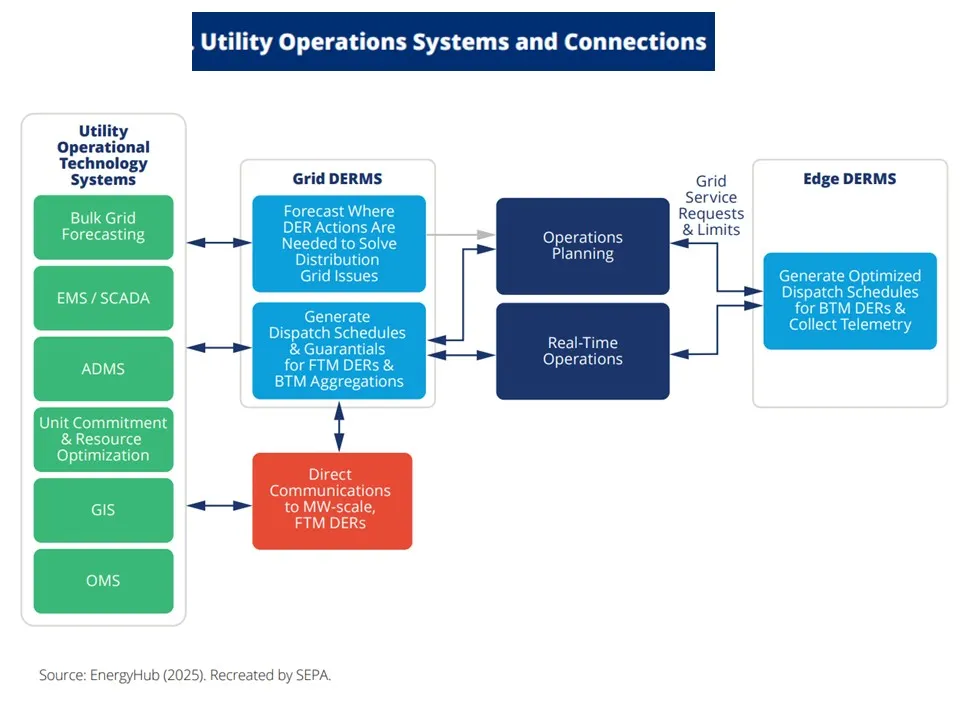

Each of the two types of DERMS is “a collection of multiple software systems interacting with utility operational and information technology systems and business processes,” according to an April Smart Electric Power Alliance, or SEPA, white paper. Together, they can “enable a new paradigm for grid operations” that “no single software system can deliver,” the paper said.

Edge DERMS “manages large numbers of behind-the-meter DER of multiple types, like batteries, thermostats, and EVs, from multiple DER manufacturers,” SEPA said. Grid DERMS “is tightly interconnected with a utility’s distribution [operating] systems and focuses on managing larger front-of-meter DER, and aggregated customer-owned DER,” it added.

“More actively managing and integrating DER can improve grid reliability, power quality, and system resilience, and provide economic value to both utilities and customers,” SEPA said. And “uncoordinated DER can increase peak system demand, create distribution system overloads or voltage violations, and increase the risk of cascading blackouts,” it added.

A Grid DERMS may be roughly $10 million to $20 million, and an Edge DERMS tends to be less than $10 million, depending on the utility system’s complexity, said SEPA Senior Director, Grid Strategy, and paper co-author Lakin Garth.

If DERMS deliver convincing system data, utilities will be able to use DER aggregations and VPP for the same flexible system services other dispatchable resources offer, utilities, DER advocates and analysts agree.

Edge DERMS are already disaggregating behind the meter customer energy usage to solve the peak demand challenge and alleviate the need for distribution system upgrades, said Jesse Demmel, chief technology officer for DER aggregator and Edge DERMS provider Uplight.

“Data to provide more services is available, but it is siloed across utility planning, operations and customer service departments and difficult to assimilate into a single platform,” Demmel added.

With investments in DERMS, emerging AI modeling can assimilate a “single pane of glass” platform with visibility that connects customers to the utility control room, Demmel said. The investments will pay for themselves by using data to identify the most cost-effective upgrades, he added.

“DERMS investments are definitely needed, along with investments in hardware, operations and measurement technologies,” and “DER will benefit the system,” agreed Brattle’s Ramakrishnan. AI may not, however, completely resolve utility concerns about security or reliability because blaming an operator’s decision on an AI recommendation “will not satisfy regulators or customers,” he added.

Plugged In Strategies’ Villarreal agreed. AI “might increase system modeling capabilities, but a single integration of all resources would be expensive and computationally complex,” he said.

AI operating at the distribution system level may, however, eliminate data sharing concerns because “it will follow the power flow to the data it needs to optimize system resources and show why that data should be available,” Villarreal added.

Clarification: The story was updated to clarify that Eversource supports the use of a common statewide portal with a virtual central data repository.