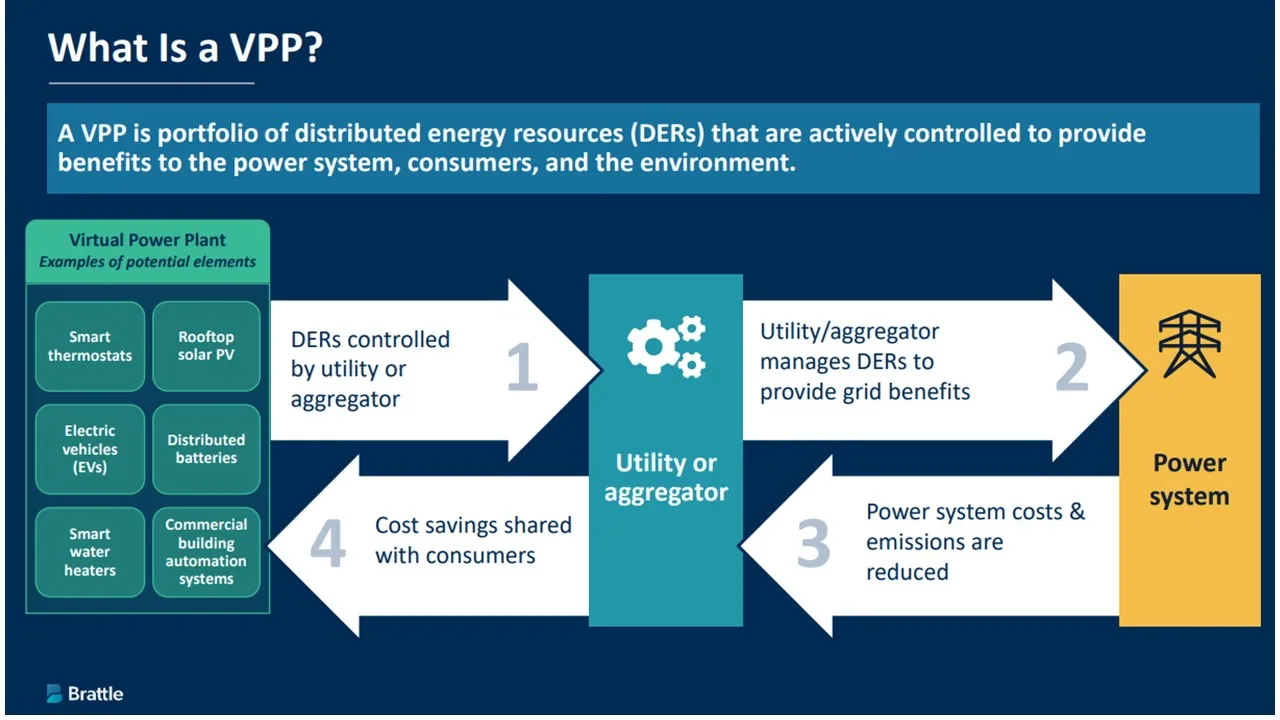

The growth of virtual power plants, which are large portfolios of consumer-owned distributed resources, is about to get a big boost.

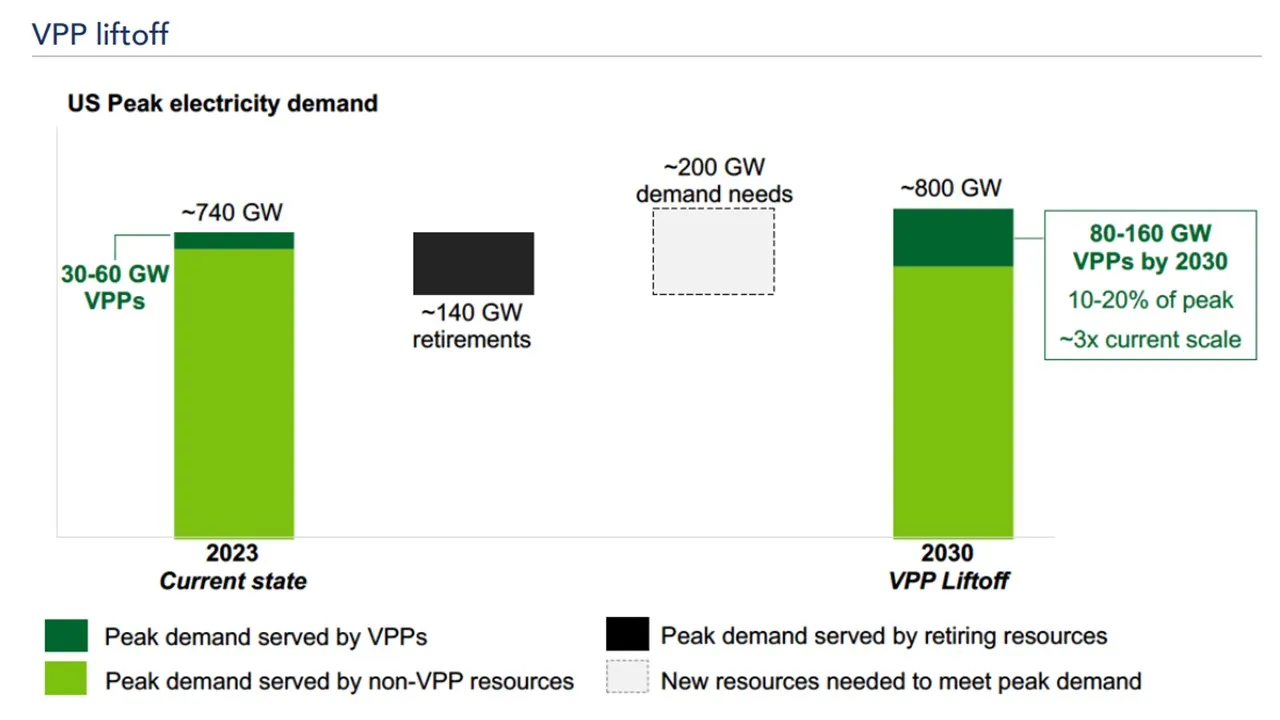

VPPs could meet as much as 160 GW of the 200 GW of U.S. peak demand needs in 2030, and reduce power system costs by $10 billion annually, according to a 2023 report from the Department of Energy. But VPP growth could be limited by the lack of common standards in their aggregated distributed energy resource components, developers and advocates say.

Common standards allow utilities or aggregators to “orchestrate” diverse DER like rooftop solar, batteries and electric vehicles in a full range of power system services, proponents say.

“Without interoperability standards, VPPs cannot reach scalability, affordability, and reliability as soon or as efficiently as they will be needed” to meet the coming variability, growing load and extreme weather events the power system faces, said Arshad Mansoor, CEO of the Electric Power Research Institute, which is leading two standardization initiatives. “Now is the time to bring VPP stakeholders together,” he added.

Standardized interoperability can help simplify and expand the needed adoption of DER and the needed integration of VPPs into utility planning and wholesale markets, the DOE report said.

System operators “must have visibility of connected DER devices, be able to signal the devices, and be confident they responded to the signal,” said Lon Huber, senior vice president, pricing and customer solutions, with Duke Energy. For that, “the entire VPP ecosystem should be standardized by a multi-stakeholder collaborative,” he added.

The big unanswered questions advocates are now confronting, however, are what the standards should be and what technologies will be needed to optimize performance. EPRI, international software platform provider Kraken and others are joining to acknowledge and answer these questions.

Flexibility becomes vital

Transportation, building and industrial electrification will lead to new electricity demand dynamics, including higher and more time-varying demand spikes, analysts agree.

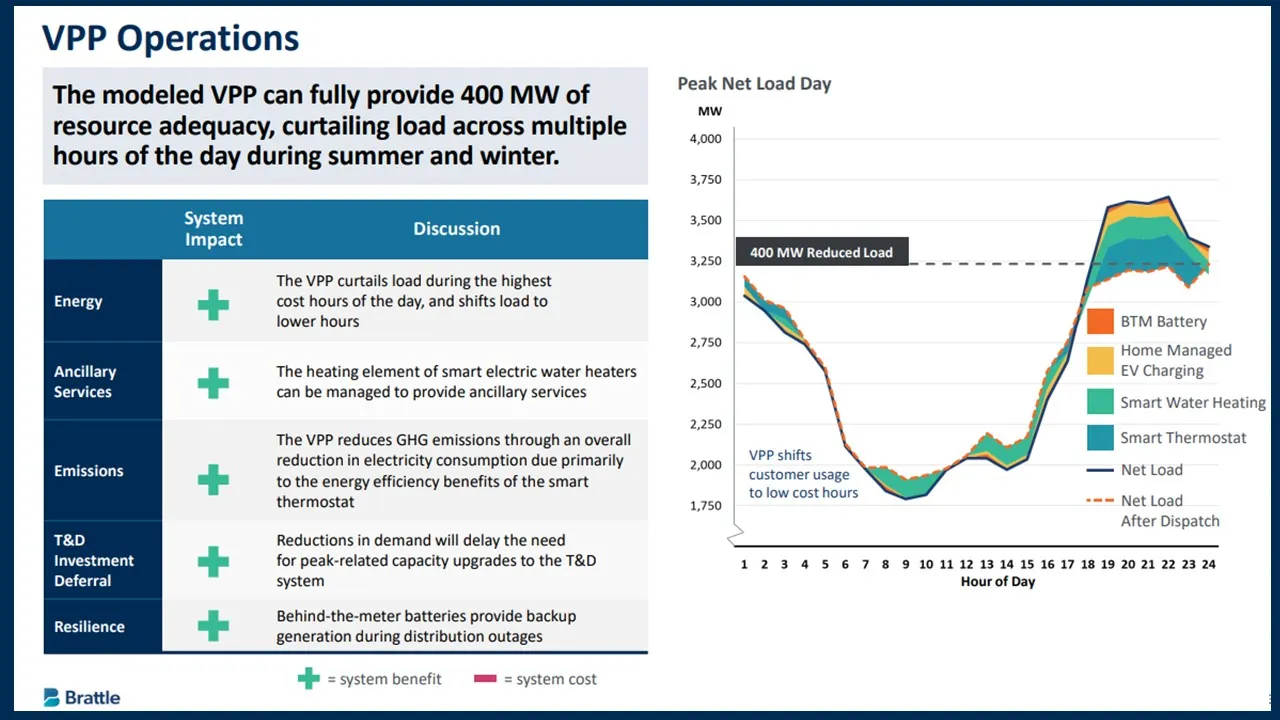

VPPs can make automatic small shifts in customer energy use to “when electricity is cheaper and cleaner,” said Ben Brown, CEO of Renew Home, which operates 3 GW of VPPs and is targeting 50 GW by 2030. “Demand flexibility across thousands of homes” is “a significant peak capacity resource” and “helps balance power system supply and demand,” he added.

VPPs are “likely the only way” to manage electrification “at a reasonable cost and on the timeline we need,” DOE Loan Programs Office Director Jigar Shah said in a recent interview.

With the enormous growth of electricity load, the flexibility of VPPs “is the only way to match demand and supply,” agreed Sunrun Head of Grid Services and VPPs Chris Rauscher. Demand from electrification will grow but VPPs “will consistently bring down the peak,” and “create incremental capacity” on the power system, he added.

VPP flexibility has also strenghtened resource adequacy in California and Arizona, relieved stress on transmission and distribution systems in New York, and reduced system costs for customers in Utah and Vermont, according to a September Rocky Mountain Institute report.

But “fully realizing” VPP flexibility will require full integration of VPPs into power system planning and operations, the report said. And device standards to ensure more consistent, reliable dispatch — and more accurate and timely dispatch signals are “critical” to VPP integration — it added.

The “potential $10 trillion” cost to upgrade the U.S. distribution system to meet current electrification goals can also be avoided by “a system that rewards flexibility,” said Kay Aikin, CEO of distribution level software solutions provider Introspective Systems.

Using flexible VPPs allows “staged distribution system investment” as load grows, Aikin said. “Many utilities are beginning to see VPPs relieve system congestion, and their interest in flexibility is growing,” she added.

A key step toward flexibility is DER interoperability standards, EPRI and other advocates say.

Standards to meet complexity

The aggregation of customer-owned devices at the distribution system level introduces a new complexity into power system and market operations, industry stakeholders agree.

Many, even in the electric power industry, do not realize how limited visibility into the distribution system is in today’s legacy distribution system, said Association of Edison Illuminating Companies Vice President, Technical Strategy, Elizabeth Cook. “Regulators and policymakers need to allow utility investments in foundational distribution system sensor and measuring technologies,” she added.

The communications technologies and software platforms now being used “are not dynamic enough” to capture the potential benefits of today’s dynamic DER technologies, Cook continued. But obtaining the needed distribution system baseline information and modeling data will require “a systematic overhaul” of technology and operations, she said.

To advance the overhaul, and enable VPPs to provide system flexibility and reliability, EPRI and Kraken are launching their Mercury initiative to develop interoperability guidelines and practices for DER, said Kraken Chief Marketing and Flexibility Officer Devrim Celal. The initiative will begin by developing a leadership group of VPP stakeholders, Celal said.

Like the Bluetooth Special Interest Group that was founded in 1998 and developed wireless device standards, VPP stakeholders will identify DER communications protocols, Celal said. The greater visibility and more accurate control of the component devices “will enable VPPs to better balance loads, reduce system congestion, and interact with wholesale markets,” he added.

An effort will follow to bring an even wider range of VPP stakeholders into EPRI’s Flexible Interoperable Technologies, or FLEXIT, initiative. The initative’s objective is to go beyond Mercury by simplifying DER integration “through standardizing service definitions and interfaces; and to develop a future-proof implementation strategy,” EPRI said.

“Diverse stakeholders including utilities, DER manufacturers, VPP aggregators, researchers, and government agencies, will help develop a public VPP aggregation and technical framework for a utility-to-aggregator interface,” EPRI’s Mansoor added.

Because current VPP-utility interfaces are unique to each aggregator or utility, VPP integration requires costly “custom software” and “months or years” to complete and implement, Mansoor said. “In the worst cases, the effort required outweighs the benefits,” but standardization and interoperability can change that, he added.

“VPPs are built and used now, but they will not be scalable, reliable, and affordable without standardization and interoperability,” Mansoor continued. “VPP flexibility will still be valuable as energy, capacity, and ancillary services, but manufacturers will not invest in enabling VPP products, and the value will not be fully integrated into markets,” he said.

Key stakeholders agree.

With multiple technologies working together, VPP deployment “can scale to serious numbers,” said Duke’s Huber. Standardization through “a multi-stakeholder collaboration” will allow the needed system visibility, controls and communications for “device discovery, device enrollment, device orchestration, and device data exchange” in VPPs at scale, he said.

Another effort to streamline VPP deployment is a model tariff designed by law firm Keyes and Fox for Solar United Neighbors “to set compensation at the full value of the service,” said Keyes and Fox Partner Beren Argetsinger. They also designed model legislation to expand VPPs into new jurisdictions, he added.

Further DER standardization is not necessary for Sunrun, which primarily provides residential solar-plus-storage VPPs that are already “operating at scale with reliability and predictability,” said Sunrun’s Rauscher. “Utility program administrators do, however, need to standardize software for automated notifications of the need for peak load reductions to aggregators and customers,” he added.

Other stakeholders see the need for more fully standardized interoperability among utilities, aggregators and DER technologies to enable VPPs to earn the full value they can provide.

From standards to value

More value will come as VPPs expand from residential solar and storage to the full range of smart customer-owned DER technologies with standardized interoperability, including electric vehicle chargers and smart thermostats and home appliances, aggregators and utilities said.

Currently, monetizing VPPs is largely limited to “the portion of value that doesn’t require advanced controls and communication,” said Brattle Group Principal Ryan Hledik. But “streamlined communications” allowing “improved interoperability” can make managing the “fragmented set of technologies and software packages” affordable, he added.

A grid edge distributed energy resources management system, or DERMS, can streamline communications, Hledik and other VPP advocates said.

A grid-edge DERMS is the middle layer between customer-owned devices and the dispatch of devices in response to utility signals, said Erika Diamond, senior vice president and head of customer solutions for DER aggregator EnergyHub. An aggregator’s software can make a VPP operational and cost-effective within months and relieves the utility of grid-edge complexities, she added.

A grid-edge DERMS can use aggregated DER “to replace traditional resources,” agreed Schneider Electric Digital Grid Product Marketing Manager Monika Jovic in a July webinar.

Different opinions among aggregators about the need for DERMS may depend on the DER components of a VPP.

Each utility wants to manage its distribution system resources differently, said Sunrun’s Rauscher. “Any utility in the country can have a VPP program today” using residential solar and storage because aggregators have already made the needed investment in independent software platforms, he added.

Sunrun can also manage DER other than solar and batteries and is integrating devices like smart thermostats and heat pumps, Rauscher continued. But “there is a cost for that,” and the longer-term revenue certainty does not justify the cost of integrating “with each individual utility software platform,” he added.

The Mercury and FlexIt initiatives are intended to establish interoperability standards that expand the range of potential VPP resources while returning value for the services they provided, other VPP stakeholders said.

“A solar and storage VPP may run without a DERMS, but a grid-edge DERMS could enable any DER device to be a grid asset,” Diamond said. “Utilities are adopting individual DER programs but don't know how to value a program that can dispatch the many different customer-owned DER across the distribution system 24/7 to meet system needs,” she added.

The visibility provided by a DERMS gives operators a “surgical” ability to use the customer-owned DER at specific locations in specific ways to meet specific needs, agreed Brattle’s Hledik. “Coordinating and simplifying” supply and demand balancing may not, though, streamline the integration of VPP operations with the many utility tariffs and programs and diverse markets, he said.

But standardization and interoperability will enable utilities to affordably scale VPP products so that markets will value and respond to them, EPRI’s Mansoor said. And that will lead to market rules that can integrate those products, he added.

“The power system is likely to need a lot of flexible resources in the coming decade,” EnergyHub’s Diamond said. “It will take all the flexible resources that are available,” and the projected value of that flexibility is likely to make VPPs “totally scalable and affordable,” she added.

The Mercury Initiative launches Dec. 5, the FlexIT Initiative will follow early in 2025, and as key power sector stakeholders join, their input will determine the course of the initiatives’ development, EPRI’s Mansoor said.