Dive Brief:

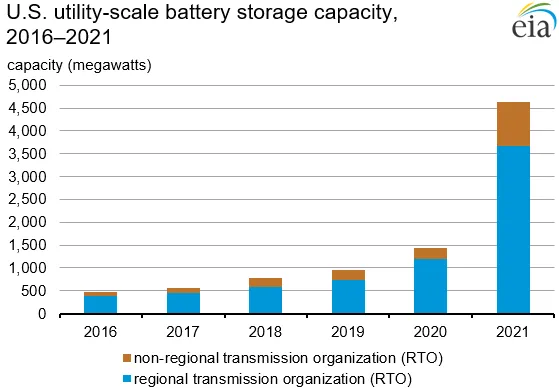

- Battery storage capacity in the United States more than tripled in 2021, growing from 1,438 MW in 2020 to 4,631 MW, according to the U.S. Energy Information Administration. More than 100 utility-scale projects were brought online last year, the agency said in a July 5 Electricity Monthly Update.

- The growth occured as storage use cases have expanded, EIA noted. Batteries have been used to provide ancillary services since 2016 but arbitrage, load management and the consumption of excess renewable generation applications saw “significantly increased levels of participation.”

- Utility-scale storage capacity in the United States was less than 500 MW in 2016, but declining battery prices have helped spur the development of projects. That trend may be reversing, at least temporarily, as a new report from BloombergNEF predicts battery prices will rise this year, for the first time in more than a decade.

Dive Insight:

Ancillary services, including frequency response and the provision of spinning reserves, continue to make up a significant portion of battery applications, EIA said. But the list of use cases has been growing along with the nation’s battery capacity.

“Accompanying this sharp increase in capacity, how battery storage capacity technologies are deployed has also significantly shifted,” EIA said.

Arbitrage was cited as a use case for more than half of batteries installed last year, representing 2.7 GW of capacity, and in the California Independent System Operator service territory the figure was more than 80%. In those instances, storage operators charge batteries when prices are low and discharge them as demand on the grid rises.

“Load management was another application that saw a significant increase in battery storage capacity,” the agency added. This technique attempts to flatten a grid’s demand profile, and the use case “saw a 744 MW increase in capacity in 2021, rising from 110 MW in 2020 to 854 MW in 2021,” EIA noted.

Batteries are often developed alongside wind and solar generation, allowing them to soak up clean energy at times when demand is low. More than 93% of the battery capacity added last year was co-located with solar, EIA noted. “This use case gained 1,086 MW of capacity in 2021 and is reflective of the continued industry-wide growth of paired renewable and storage capacity,” the agency said.

Possibly slowing the rollout of more storage capacity, however, global battery prices are expected to rise slightly this year, to an average of $135/kWh, according to a July 5 report from BloombergNEF. Supply chain constraints and the rising cost of metals like lithium, cobalt and nickel, are behind the rise in price, the firm said.

It would be the first increase in battery prices since 2010, BNEF said — though the price increase is expected to be modest, up from $132/kWh in 2021.