Dive Brief:

- The push for carbon-free energy will drive the growth of small modular reactors, or SMRs, with 300 of them expected to be online by 2050 supplying 731 TWh of power, according to the results of a survey the Nuclear Energy Institute conducted with a subset of its member utilities and released Aug. 5.

- The 19 polled utilities told NEI they plan to invest in SMRs but to date only one, the Utah Associated Municipal Power Systems, or UAMPS, has signed a deal for SMR units. “Honestly, the question is who is going to step up and rate base” SMRs, Jigar Shah, the Department of Energy’s Loan Programs Office director, wrote in an Aug. 12 tweet.

- Cost projections for emerging SMR technologies in an NEI-commissioned study accompanying the survey’s release are questioned by David Schlissel, director of resource planning analysis for the Institute of Energy Economics and Financial Analysts, because they rely on “very unrealistic cost and construction time assumptions.” Of growing concern is the safety of the units because of fighting at and around the largest nuclear plant in Europe in Southern Ukraine, Schissel said.

Dive Insight:

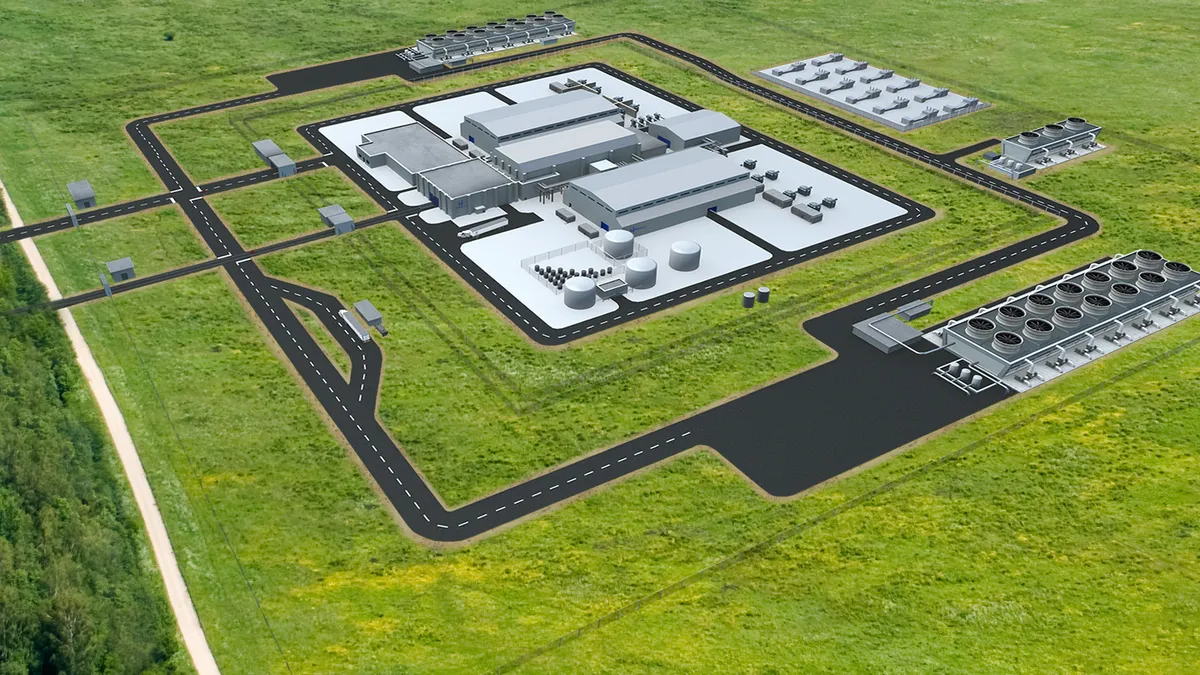

“It’s no longer ‘if’ we build but how can we build fast enough to meet demand,” to enable 300 SMRs to power half the homes in the U.S. over the next 25 years with 90 GW, NEI stated when releasing its findings from its limited poll. Of the19 surveyed, several utilities said they are evaluating installing SMRs at their shuttered coal plants, according to NEI.

NEI only surveyed utilities that have nuclear power in their energy generation mix, and ones without nuclear generation that are considering investing in small nuclear facilities. That includes UAMPS, which signed an agreement with NuScale for six 77 MW SMRs, and PacifiCorp, said NEI’s spokesperson Mary Love. “PacifiCorp is partnering with TerraPower to bring its Natrium design to a retired coal site in Wyoming,” she said.

A study by Vibrant Clean Energy commissioned by NEI estimated the costs of the “first of its kind” SMR at $3,800 per kW at the low end and $5,500 kW at the high end. The higher projected cost factors in possible deployment constraints, such as supply chain limits, license delays and a limited skilled workforce.

“No plants have been built so we don’t know what the cost will be,” said IEEFA’s Schlissel. He said that the history of nuclear energy in the U.S. has consistently shown that costs only escalate from the time a project is proposed to when it is built. He pointed to the Vogtle units 3 and 4 in Georgia, which are years behind schedule and billions of dollars over their initial budget. The two units, jointly owned by Georgia Power, the Municipal Electric Authority of Georgia, Oglethorpe Power and Dalton Utilities, as of May had a total cost estimate of more than $30 billion.

NuScale is the first SMR company to go public in the U.S. and the only one close to having its designed approved for use by the Nuclear Regulatory Commission. “NRC staff is taking the necessary steps to issue the final rule in the near future,” officially certifying the design, Scott Burnell, NRC spokesperson, wrote in an Aug. 8 email.

While the actual cost will be critical to successful commercialization of SMR technologies, plant safety is a close second, more so with Russia fighting in and around Ukraine’s Zaporizhzhia plant, and fears of an explosion causing a catastrophic radioactive release, according to Schlissel.

The American Nuclear Society President Steven Arndt and Executive Director and CEO Craig Piercy backed the the International Atomic Energy Agency protest of risks to the plant and its workers in Ukraine in an Aug. 6 statement.

“Absolutely, more protection is needed” at SMRs, Schlissel said.

NEI did not respond to queries about increasing protections at SMRs given Russia’s invasion of Ukraine.

CORRECTION: We have corrected this story's description of who owns the Vogtle units 3 and 4 in Georgia.