Mark Spalinger is director of utilities intelligence at J.D. Power.

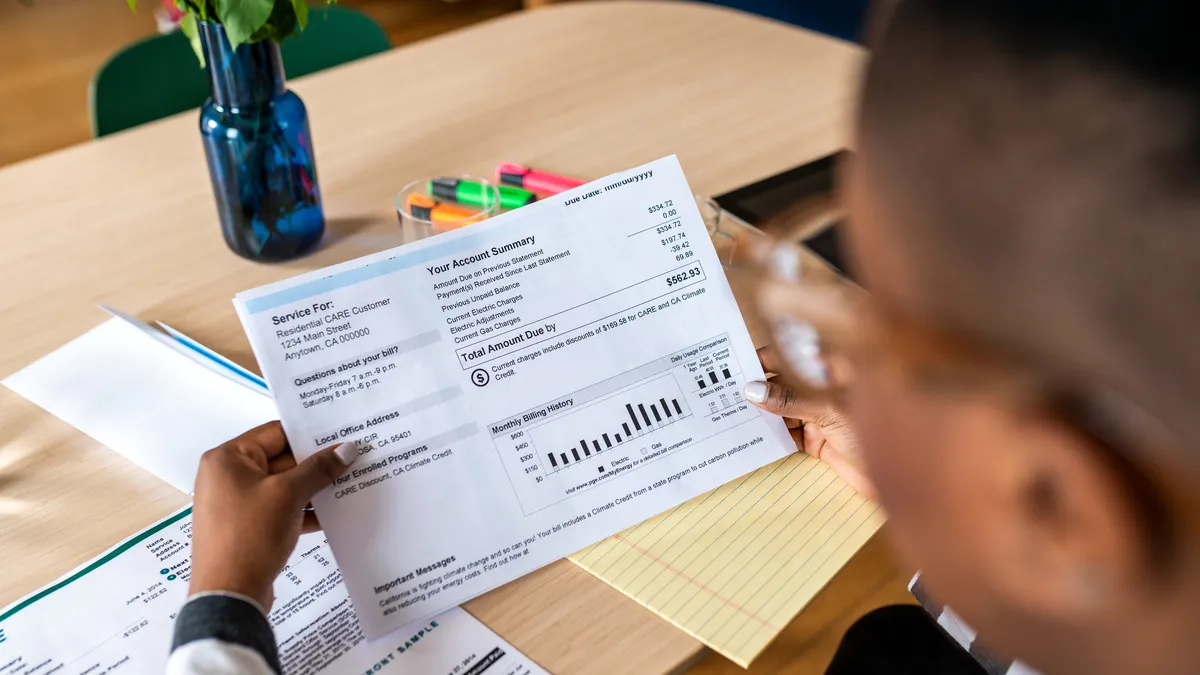

Utilities escaped the brunt of the customer backlash over sky high prices that was expected in 2023, but they can’t hide forever. After hitting record highs in 2022, residential electricity prices have remained elevated throughout 2023, largely due to elevated natural gas prices. While residential electric utility satisfaction has fallen as a result, we’ve yet to see any large-scale public outcry over utility bills. That may soon change.

According to S&P Global Market Intelligence, there are currently 63 electric and 52 gas rate cases pending in 37 states and the District of Columbia. The outcome of these decisions, which have a collective $23.7 billion in consumer rate increases nationwide at stake, could weigh heavily on customer satisfaction with their utilities. Perhaps more importantly, strong customer opposition to these rate cases could leave utilities in the lurch when it comes to raising funds they need to make good on their promises to improve the safety and sustainability of their operations.

Customer satisfaction and rate case approvals

In fact, when tracking the correlation between utility customer satisfaction and utility profitability, J.D. Power has consistently found that higher levels of customer satisfaction one year prior to a rate case are associated with higher returns on equity, or ROE. Specifically, we found that a 10-point improvement in overall satisfaction correlates with an increase in ROE in a range between .02% and .04%. So, in dollar terms, a utility requesting a rate change on an equity base of $1 billion would see somewhere between $200,00 and $400,000 in increased ROE for every 10-point increase in the overall satisfaction score. We also found that utilities with higher overall satisfaction scores are far more likely to receive rate increases that are closer to their actual request than those with low satisfaction scores.

Conversely, lower levels of customer satisfaction correlate to lower returns and lower rate case approvals. Utilities in the bottom quartile of customer satisfaction scores typically receive an approval rate that is between $2 million and $8 million lower than utilities in upper quartiles. That’s a problem when residential electric utility prices are up 27% through the first half of this year and price satisfaction is down 63 points during the same period. Likewise, the average gas bill in America is up 44% through June 2023 while price satisfaction has declined 57 points from a year ago.

This is a frightful scenario for utilities. Demand is higher than ever. Raw material costs continue to remain high. Costs associated with sustainability efforts, including everything from retooling existing operations to rolling out public charging infrastructure, are mounting. Someone is going to have to pay for these things. And, unless utilities break the status quo and start proactively communicating with their customers about the value they deliver, the efforts they are making to improve service, safety and sustainability, and the investments they are making in their communities, customers are going to balk at the current crop of rate cases.

Harnessing the power of brand

A small minority of utilities have recognized this challenge and have begun to address it by investing in their brands. Branding may sound like a discipline that would be more at home in consumer-packaged goods or retail, but utilities have brands too, and those that get the branding formula right are seeing serious results when it comes to customer engagement and customer satisfaction. We recently evaluated the brand appeal of major electric and gas utilities and found that those with the best brand perceptions among customers enjoy significantly higher levels of overall customer satisfaction, which, in-turn, helps smooth the path to rate cases and improved customer support for important initiatives and special programs.

Breaking the status quo

Getting there is not easy. A strong utility brand is not quite as simple as being a provider of reliable gas or electric service. It is the entire experience, from the interaction customers have with staff and the way they pay bills to the detours they need to take when roads are being dug up to replace old infrastructure. Utilities need to realize that each of these is an opportunity to communicate with their customers and, in turn, a moment of truth for their brand identities.

The key here is to break the decades-old mold of utility customers only thinking about their utilities when something goes wrong. Utilities need to seek out moments and points of interaction when their services are having a positive effect on their customers’ lives and proactively associate themselves with those events. Examples include talking about sustainability-related incentives and infrastructure programs; addressing safety with proactive maintenance and community outreach; making senior leaders available for media interviews; and more public discourse.

This transformation will not happen overnight, but steps taken now to bolster utility brands could mean the difference between rate case approval and an adversarial battle for every dollar. Now is the time to get out in front of the issues before they become barriers to growth.