Editor's Note: This article is part of a series on the key issues driving the utility sector today. All stories in this series can be found here.

Right now there are more than 250 million vehicles registered in the United States, and less than 1 million of those are electric. It's a drop in the bucket — so far, anyway — and to date, there has been modest impact on the electric grid.

But the consensus is that mass market adoption of electric vehicles (EVs) is only a few years away, and will bring with it fundamental shifts in how the electric grid is utilized. Utilities see few problems on the generation side, but delivering that energy will require grid upgrades and creates an opportunity to integrate the vehicles in a way that enhances renewables usage and achieves a more nimble and stable grid.

"The technical hurdles have largely been overcome, and now it is more a matter of the business case," John Gartner, director of Navigant's energy practice, told Utility Dive.

There has been "a major shift" in the last few years, Gartner said, with utilities becoming far more proactive in planning for EVs and questioning what an influx of the vehicles could do to their load shape.

"Utilities have really awoken to this opportunity of combining EVs with services to enhance grid operations," Gartner said.

Long time coming

Electric vehicles have long been touted as a smarter, cleaner approach to transportation, but the internal combustion engine has dominated the market for more than 100 years. Despite previous false starts, however, transportation analysts say falling battery costs and advancements in technology are poised to change that equation.

According to Bloomberg New Energy Finance, EVs will represent 28% of global light-duty vehicle sales sometime shortly after 2025, a faster growth pace than the firm previously expected. And last year, the Edison Electric Institute, which represents investor-owned utilities, projected 7 million of the zero-emissions vehicles will be on U.S. roads by 2025.

A lack of options in the electric vehicle market, along with a dearth of charging infrastructure, has so-far held back adoption of electric transportation, Jonathan Levy, vice president for strategic initiatives at EV charging company EVgo, told Utility Dive.

"As we move to a shared economy ... one of the biggest ramifications is we're going to have to do a lot more charging, everywhere."

Jonathan Levy

VP for Strategic Initiatives, EVgo

"It will pick up, but it's just a matter of how quickly," Levy said. "Model availability has been a huge barrier."

While the rollout of charging equipment, particularly in public areas, remains a challenge to the industry, auto manufacturers are significantly upping their game. All major manufacturers are rolling out electric vehicles, with sports cars, crossovers and pickup trucks all in the offing.

"What we need now is massive amounts of public charging and fast charging," Levy said. "As we move to a shared economy ... one of the biggest ramifications is we're going to have to do a lot more charging, everywhere."

Just how many charging stations will be required remains something of an open question, though. And trying to estimate that number through comparisons to gas stations won't work because the vast majority of EV charging is done at home.

There are about 170,000 gas stations in the United States, according to Gartner, and he predicts there will be 6 million residential charging locations in the United States by 2025 — though "many of those will be just wall outlets."

Millions of EVs plugged into the grid will obviously have an impact. While utilities view the new demand as an opportunity to boost revenue and operate their systems more efficiently, there is a growing understanding that electric vehicles can also represent a grid management resource. Among the use cases being considered: managing EV charging to help utilities integrate more renewables, manage peak demand and possibly provide services back to the grid.

"It does seem we're on the precipice of a major revolution," Cassie Powers, senior program director at the National Association of State Energy Officials, told Utility Dive.

"EVs really do have the potential to serve as a resource to the grid, as mobile storage and something to regulate loads," Powers said. "They hold the promise of transitioning the transportation sector … We might see electricity use go up, but we will likely see overall energy use go down."

EVs as a demand management resource

Electric vehicles "are still highly concentrated" on the east and west coasts Powers said, but added "there is a growing excitement in other regions."

California leads the United States in the adoption of electric vehicles, with about 340,000 on its roads in 2017. And the state appears likely to reach its goal of having 1.5 million EVs registered by 2025, and 5 million by 2030. The high adoption rate has led California to spend time examining the the potential grid impact.

Research from the California Energy Commission estimates the state will need about a quarter million electric vehicle chargers in public locations and multi-unit dwellings by 2025, and could see peak demand rise by 1 GW.

An electric vehicle market share of up to 3% — about 7.5 million EVs — would not significantly impact aggregate residential power demand, according to the National Renewable Energy Laboratory (NREL). But even having a couple electric vehicles in the same neighborhood could make delivering that power a challenge.

Distribution transformers may need to be sized up and replaced more frequently, and peak demand will be an issue in some areas, NREL's report concluded. Managing that demand will be essential, and is one of the key capabilities EVs will bring to utilities.

"Demand response is the lowest hanging fruit," Gartner said. Electric vehicle chargers are "technologically capable" of receiving and responding to signals and it is easy to enroll customers in programs, as they are similar to thermostat offerings.

"Most of the activity" will surround demand response programs, at least initially, Gartner told Utility Dive. But there is also a broad focus on load shifting and providing incentives to avoid charging at peak times.

Utilities want to shift demand to times when there is excess solar generation, using EVs as a sponge to soak up more green power. And they would reduce charging in the early evenings, when demand peaks and energy prices rise.

EV charging companies are also using the environmentally-friendly aspects as both a selling point and a service.

Honda is working with eMotorWerks to offer drivers in southern California a service to help them determine the most environmentally-friendly charging times. The charging stations are also integrated with the California ISO, allowing them to participate in demand response events.

EVs for renewables integration

In some ways, demand response, load shifting and peak management have all merged into a general "demand side management" category, as the underlying technologies have become more advanced. While demand response is often thought of as an emergency resource, called on when electricity supplies are low, a recent report from the Smart Electric Power Alliance (SEPA) highlights its potential in a wide array of situations.

Specifically, SEPA notes that demand response programs can help act as a "sponge" for excess renewable generation. And electric vehicles, which can flexibly ramp up and down their demand, are an ideal grid resource.

EVs "hold the promise of transitioning the transportation sector … We might see electricity use go up, but we will likely see overall energy use go down."

Cassie Powers

Senior Program Director, National Association of State Energy Officials

"Managed charging is a form of demand response," SEPA explained in its report, allowing the vehicle to receive signals from a utility, load balancing authority or other party, to reduce the rate of charge or curtail charging altogether. "Further, these signals can direct a vehicle to start charging to absorb excess generation from renewable energy resources, like solar and wind."

But utilizing electric vehicles to optimize renewables, or for any use case, will require the right mix of state policies to ensure the proper infrastructure is built and programs are developed. Allowing for more holistically-integrated charging infrastructure will require careful siting and market development, Powers said, all in an effort to ensure "the future of mobility is clean and electric."

NASEO recently developed a rubric for assessing the effectiveness of electric vehicle policies, and Powers said the research turned up a few surprises, including the extent to which utility communications can help sway customer decisions.

"EVs are rapidly growing, but policies still play a really important role in sending signals to the private sector," Powers said. "What we will likely see next is an attempt to harmonize fuel advancement with mobility as a service and autonomous vehicles."

Electric vehicles are likely to play a major role in the in both car- and ride-sharing.

In April, EVgo announced it will construct an electric vehicle fast charger network for General Motor Co.'s car sharing brand available to Maven Gig Chevrolet Bolt drivers. Uber recently began urging its drivers to go electric, and providing some incentives. Last year, Lyft made commitments towards providing electric vehicle rides.

As more fleets go electric, utilities are starting to consider a wider range of benefits they might provide to the grid.

V2G: The future of EV integration?

As the batteries powering EVs become larger, the next logical step in grid integration would appear to be two-way power flows, referred to as Vehicle-to-Grid, or V2G. In these scenarios, not only can the demand from electric vehicles be finely managed, but the EVs themselves could send power back to the electric grid if needed.

There are multiple barriers to V2G being a grid resource, including battery degradation and automaker warranties. But many believe it is only a matter of time before those issues are addressed.

"We've seen a few pilots being considered in California and Hawaii on the V2G front. They're usually way ahead of everyone else, and if they are still in the pilot phase, there is a long way to go."

Autumn Proudlove

Senior Manager of Policy Research, North Carolina Clean Energy Technology Center

"It's certainly possible in theory," Autumn Proudlove, senior manager of policy research at the North Carolina Clean Energy Technology Center, told Utility Dive.

"People are very optimistic, but I don't know that the technology is quite there yet," Proudlove said. "We've seen a few pilots being considered in California and Hawaii on the V2G front. They're usually way ahead of everyone else, and if they are still in the pilot phase, there is a long way to go."

SEPA calls V2G "more conceptual than commercial," though it says the technology is likely to develop over time. Aside from the technical barriers, the group notes that vehicle manufacturers will need to be on board so as not to invalidate warranties, and there will be additional hardware expenses, interconnection permits and engineering requirements of grid operators and utilities.

Gartner said V2G is likely to first show up in fleets, where multiple vehicles would work together to send energy back to the electric grid. It's a matter of having "sufficient volume," he said.

"A whole fleet of buses, then it can get interesting," Gartner said. "It's a matter of scale and economics. You're starting to see it happen in pilot projects," he said. But he expects it will be several years before a full array of projects is in place.

While V2G could accelerate the degradation of vehicle batteries, all EV batteries will need to be replaced at some point and this will create a pipeline of used batteries which can still have another eight to 10 years of life remaining.

According to Gartner, a typical EV battery would be replaced after about 10 years, having lost about 10% to 15% of its capacity over that time. While they may no longer be suitable to power a car, there is growing interest in second life uses for the batteries.

Wärtsilä and Hyundai Motor Group earlier this year partnered to develop uses for second-life EV batteries, which are expected to begin flooding the storage market within a decade. Hyundai estimates that in 2025, there will be 29 GWh of second-life EV batteries available.

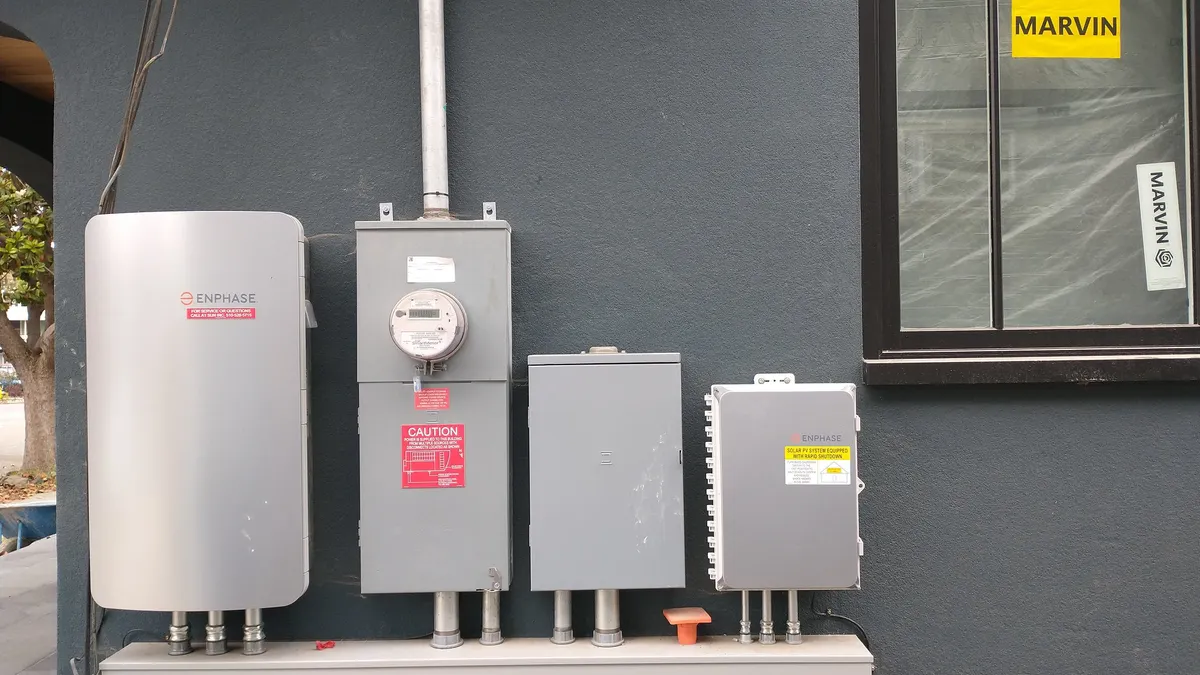

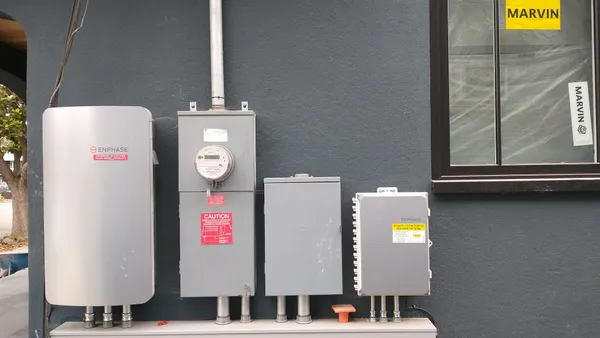

EVgo is using second-life batteries at a charging station in Union City, Calif., to reduce its reliance on the electric grid during times of peak demand.

"We believe there will be a lot of second-life batteries [available] in the marketplace in the coming years," EVgo Vice President of Market Development and Product Strategy Terry O'Day told Utility Dive. "When they're done being used for cars, that doesn't mean they are now useless batteries ... It just means typically they don't put out the same horsepower."