The U.S. Energy Information Administration expects solar-powered generation to increase by 35% in 2025 and by 18% in 2026, according to a short-term energy outlook published Thursday. Alongside the rise in renewable energy, EIA expects higher power prices, a modest uptick in demand and a short-term increase in coal generation.

EIA delayed the monthly publication of the STEO by two days in order to rerun models to reflect recent market developments.

“Higher natural gas fuel costs compared with last year will likely lead to higher wholesale power prices in 2025,” EIA said. “We expect the load-weighted average of the 11 regional wholesale prices tracked in the [short-term energy outlook] will be $45 per megawatt hour in 2025, up 19% from the 2024 average.”

Residential electricity prices across the U.S. will average 17 cents/kWh in 2025, rising to 17.6 cents/kWh in 2026, according to the report. Prices averaged 16 cents/kWh in 2023.

Total U.S. electricity generation is expected to rise to 4,430 billion kWh in 2026, EIA predicted, up from 4,410 billion kWh this year and 4,180 billion kWh in 2023.

President Donald Trump signed multiple executive orders on Tuesday aimed at supporting coal mining and coal-fired power plants. Despite that, EIA said U.S. coal production will continue its slide, from 580 million short tons in 2023 to 470 million short tons in 2026.

But the report includes a short-term increase in the forecast of U.S. coal production this year, to almost 490 million short tons, “after stronger-than-expected production in March.”

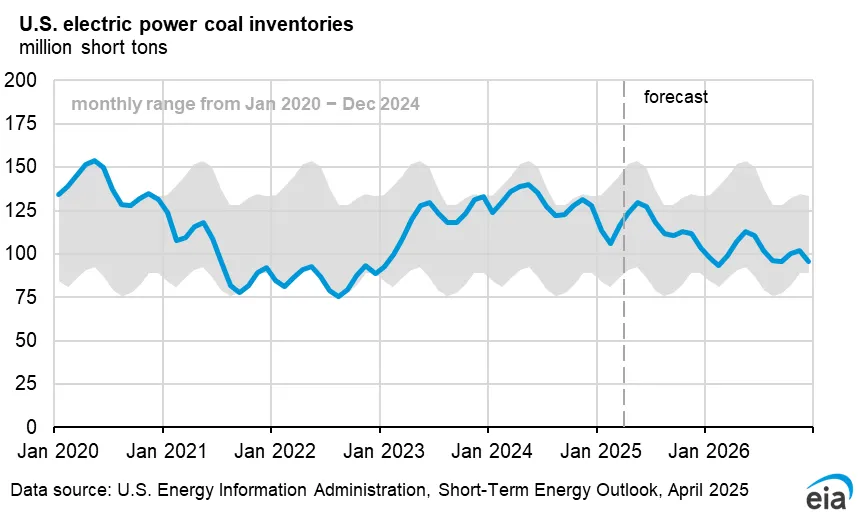

“We expect U.S. power plants will consume 4% more coal this year than they did in 2024, but we expect U.S. coal production will drop by 4%,” EIA said. “With consumption growing and production falling, we expect coal stocks at electric power plants in the U.S. to finish 2025 at 104 MMst, a drop of 19% from the end of 2024.”

“Despite the significant withdrawals from coal stockpiles in our forecast, we revised higher our expectations of year-end coal stocks compared with last month’s STEO because we now expect more coal production this year,” EIA said.

U.S. solar capacity will rise to 153 GW this year and 182 GW in 2026, up from 91 GW in 2023, according to EIA’s forecast. Domestic wind capacity will rise from 147 GW in 2023 to 173 GW in 2026.

“Exports are the leading source of U.S. natural gas demand growth in our forecast,” EIA said. Domestic consumption plus exports will grow by 4% in 2025 compared with 2024, “led by a 18% increase in exports of natural gas by pipeline and as liquefied natural gas,” the report said.

Natural gas demand growth in 2026 will also be driven mostly by growth in LNG exports, EIA said.

Residential and commercial sectors will also contribute to increased demand. “Because of colder-than-normal weather in January and February compared with the same months in 2024 and closer-to-normal temperatures at the end of the year, we expect 9% more natural gas will be consumed annually in 2025 to meet increased demand for space heating,” EIA said.

Natural gas’ share of U.S. electricity generation will remain stable at 40% in 2025 and 2026, down from 42% in 2023 and 2024, according to the STEO.