Dive Brief:

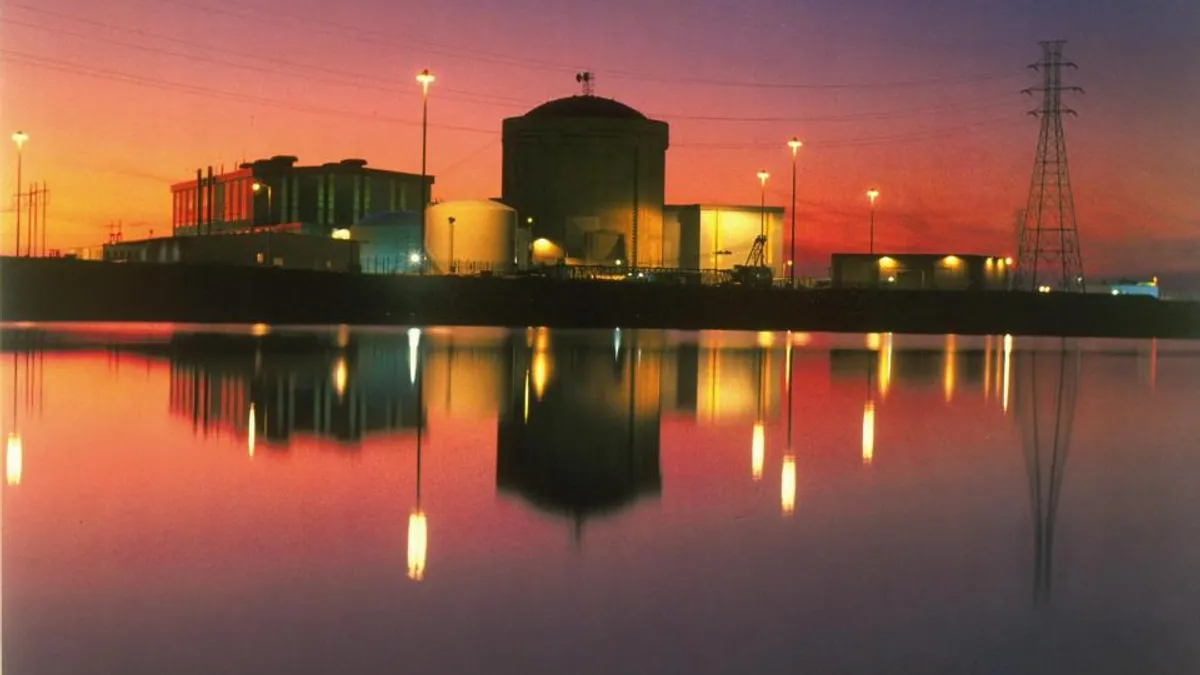

- Comments by South Carolina Gov. Henry McMaster (R) yesterday caused shares of SCANA Corp. to plunge, as the governor said he believed utility subsidiary SCE&G should be forced to pay for the failed development of the canceled V.C. Summer nuclear plant. Ratepayers are currently paying $37 million a month for the project.

- Those comments came after an audit by the state's Office of Regulatory Staff (ORS) concluded there is only a 35% chance SCANA will file for bankruptcy if it is forced to stop charging customers for development of the nuclear project.

- SCANA has strongly pushed back on that finding, arguing it is inaccurate and that the audit included several errors and a misunderstanding of the accounting for the project.

Dive Insight:

Ongoing debate over who should pay for development of the VC Summer nuclear plant could scuttle the $14.6 billion all-stock merger that Dominion and SCANA announced earlier this month. Investors appear to have little confidence that deal will be completed.

The proposed deal valued SCANA at $55.35/share. Now trading around $41/share, SCANA's valuation is 25% below Dominion's offer.

Dominion Energy CEO Thomas Farrell told a South Carolina legislative committee Jan. 16 Dominion would not go forward with the proposed merger if legislators prevent it from recovering costs through customers for the Summer nuclear project. He said SCANA would be "crippled financially" if it is not bought by Dominion.

South Carolina lawmakers have been mulling a retroactive repeal of the Base Load Review Act, a controversial 2007 law that allowed SCANA and its partners to recover costs of the nuclear development. While SCANA has said it will go bankrupt if it cannot recover those costs, the audit from the ORS apparently convinced Gov. McMaster.

According to the Post & Courier, McMaster has informed the state legislature that if they come to him with anything but a full repeal of the law, "I will veto it."

But SCANA says the audit contains fundamental errors.

"The commission should not rely upon ORS's unsupported legal argument that the suspension of revised rates collections is unlikely to force SCE&G into bankruptcy because the ORS opinion is severely flawed due to its fundamental misunderstanding," SCANA said in a Jan. 22 letter to the South Carolina Public Service Commission.

While the audit concludes that whether to write down the value of the assets is "a management decision of SCANA and SCE&G," the utility said the statement is incorrect "and is largely the basis upon which [ORS's] opinion rests."

According to the utility, Generally Accepted Accounting Principles (GAAP) "do not allow company management the discretion to cherry-pick which assets should or shouldn't be written off. To the contrary, it is GAAP that determines whether or which assets should or should not be written off, not the company's management."

If regulators disallow the recovery, "then SCE&G will be required to write off its new nuclear investment. ORS misunderstands this basic accounting requirement," the utility said.

Last July, SCANA announced it would abandon construction of the V.C. Summer nuclear plant, having already spent $9 billion in ratepayer funds. The plant was originally estimated to cost less than $12 billion.

Mismanagement and problems with reactor design from contractor Westinghouse raised final cost estimates to $25 billion. SCANA now faces multiple lawsuits and an SEC investigation into whether it misled shareholders about the project. Its partner, state-owned utility Santee Cooper, could be sold off to help pay for the plant.