Dive Brief:

-

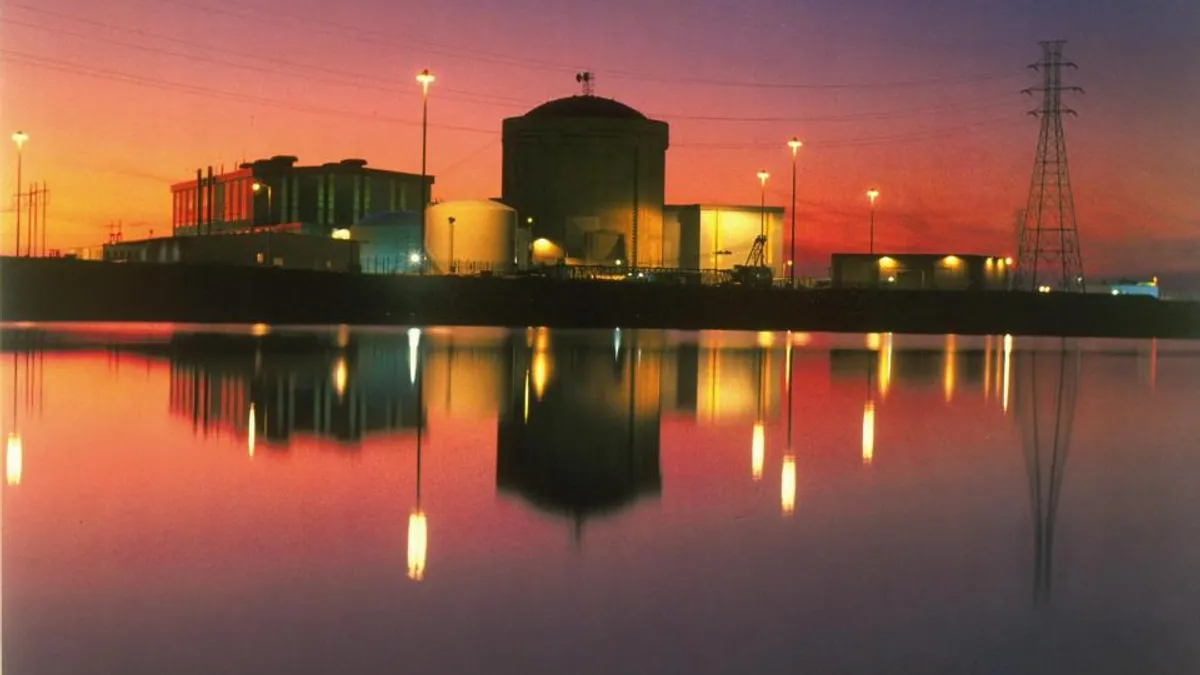

Dominion Energy’s proposed acquisition of SCANA could end South Carolina Electric & Gas’ woes over the failed V.C. Summer nuclear project — but it comes with a big caveat.

-

The deal is contingent on the usual regulatory approvals, but they are more highly charged in the wake of the abandoned nuclear project, and it would require South Carolina lawmakers to step back from efforts to limit how much the utility can charge customers for the failed project.

-

Some South Carolina lawmakers seemed to be encouraged by the deal, but they also were reluctant to embrace it, and indicated that could be just a first step in a resolution on the nuclear debacle.

Dive Insight:

While the failure of the V.C. Summer nuclear project falls directly on SCANA subsidiary SCE&G and the utility’s partner, state-owned utility Santee Cooper, South Carolina lawmakers helped facilitate the project.

In 2006, the state’s General Assembly passed the Base Load Review Act, which allows utilities to charge customers for construction projects while they are being built. The rationale was that paying capital costs during construction would reduce overall costs by lowering interest payments over time.

Some of those same lawmakers have now responded to the failure of the Summer project by filing legislation that would prevent SCANA and Santee Cooper from increasing electric rates to pay for the failed $9 billion project. If that were to happen, it could scuttle SCANA’s deal with Dominion.

The legislation was filed in December before the General Assembly went on break. It will be taken up again when they return on Jan. 9.

In a call with analysts to discuss the deal, Dominion CEO Thomas Farrell said he had met with key players in the situation and said he had “lengthy and fulsome” discussions with them and was “pleased with where things stand right now.” Those players include Gov. Henry McMaster (R), Speaker of the House Jay Lucas (R) and Senate President Pro-Tempore Hugh Leatherman (R).

Farrell told analysts that there were significant regulatory and legislative protections built into the deal and that any changes that have an “adverse economic impact on the financials” would end the agreement.

"We’re observing strong pressure in the state legislature to pass laws that would rollback how much of the cost of the failed V.C. Summer nuclear facility that SCANA can pass on to ratepayers,” Timothy Fox, vice president at Clearview Energy Partners, told Utility Dive. He says several “key policy ‘gatekeepers’ in the South Carolina legislature explicitly support swift legislative action.”

“It’s a step in the right direction, but there’s still a number of questions that have to be answered,” Senate Majority Leader Shane Massey, a Republican who chairs the Senate committee investigating the Summer project and a sponsor of the recently introduced legislation, told local media. “I’m still having difficulty with customers continuing to pay for V.C. Summer. Regardless of who the entity is, I think it’s a difficult sell to ask customers to continue paying anything toward V.C. Summer.”

Senate Minority Leader Nikki Setzler, a Democrat and a sponsor of the legislation seeking to limit how much ratepayers pay for the Summer project, voiced more support for the deal. “The ratepayers are going to get money back, which is a huge plus,” she said.

Fox also pointed out that while Dominion’s offer includes refunds and reduced rates for South Carolina customers, the utility company could face criticism from North Carolina lawmakers, who might ask if the deal is in the best interests of their constituents.

The proposed acquisition calls for Dominion to make a $1.3 billion cash payment to SCE&G customers within 90 days of the closing of the deal. The new combined entity would lower rates by about 5% to reflect a refund of $575 million previously collected from customers and the effect of the lower corporate tax rate in the just passed federal tax bill. Farrell said if there are more savings from the tax cuts, those also would be passed on to customers. Dominion also said it would take a $1.7 billion write-off on existing capital and regulatory assets from the Summer expansion project. That would have the effect of shortening to 20 years the time customers would have to pay for the project. Under the current plan customers would pay for the project over 50 or 60 years.

SCE&G customers have already paid about $1.4 billion for the project to cover financing costs over the past nine years. Under current law and regulations, SCE&G customers would still be on the hook for about $3.5 billion for the failed nuclear project.

McMaster, in a statement, said the deal represents “progress,” but also expressed concern that the deal only addresses SCE&G’s portion of the failed project and not Santee Cooper’s 45% share of the project. McMaster has called for the sale of state-owned Santee Cooper, and press reports say there are several suitors, including Dominion. In the conference call, Farrell declined to address the Santee Cooper situation.

How the situation will play out remains to be seen. Many lawmakers in South Carolina are “really, really unhappy” about the failure of the Summer project.

“They are on the war path,” Paul Patterson, an analyst with Glenrock Associates, told Utility Dive. “This deal presents more challenges than the average merger, not that there is an average merger – they are all unique – but this one is a little more unique.”