Dive Brief:

-

A performance guarantee requirement for Dominion Energy Virginia’s 2.6-GW offshore wind project is “untenable,” Robert Blue, Dominion Energy chairman, president and CEO, said Monday during an earnings call.

-

The company is considering appealing a decision issued Friday by the Virginia State Corporation Commission, or SCC, that puts unprecedented cost risk onto the utility, according to Blue.

-

Meanwhile, Dominion Energy Virginia has paused hooking up new data centers in part of northern Virginia and last week asked the PJM Interconnection to approve a $500 million to $600 million, 500-kV transmission line to begin easing constraints in the area, company officials said during the call. The utility is accelerating other transmission projects so it can meet demand from data centers, a rapidly growing part of the utility’s customer base, Blue said.

Dive Insight:

The SCC last week approved a rate rider for recovering the cost of Dominion’s $9.8 billion offshore wind project and related onshore transmission facilities.

The commission ordered Dominion Energy Virginia’s customers to be held harmless for any shortfall in energy production below the project’s expected 42% annual net capacity factor, measured on a three-year rolling average.

“Meaning, of course, that roughly half the time, it would be above that level and half below,” Blue said. “Effectively, such a guarantee would require [Dominion Energy Virginia] to financially guarantee the weather, among other factors beyond its control, for the life of the project.”

The performance guarantee creates an unprecedented layer of financial one-way risk for the utility and is “inconsistent with the utility risk profile” expected by investors, Blue said.

“There are obviously factors that can affect the output of any generation facility, notwithstanding the reasonable and prudent actions of the operator, including natural disasters, acts of war or terrorism, changes in law or policy, regional transmission constraints or a host of other uncontrollable circumstances,” Blue said.

As part of its shift away from fossil-fueled power generation, Dominion Energy Virginia expects to ask the SCC this quarter to approve about a dozen utility-owned solar and energy storage projects totaling at least $1.5 billion, Blue said.

The solar supply chain continues to be challenging, with prices for certain components still elevated, according to Blue. “However, our plans remain largely de-risked,” he said.

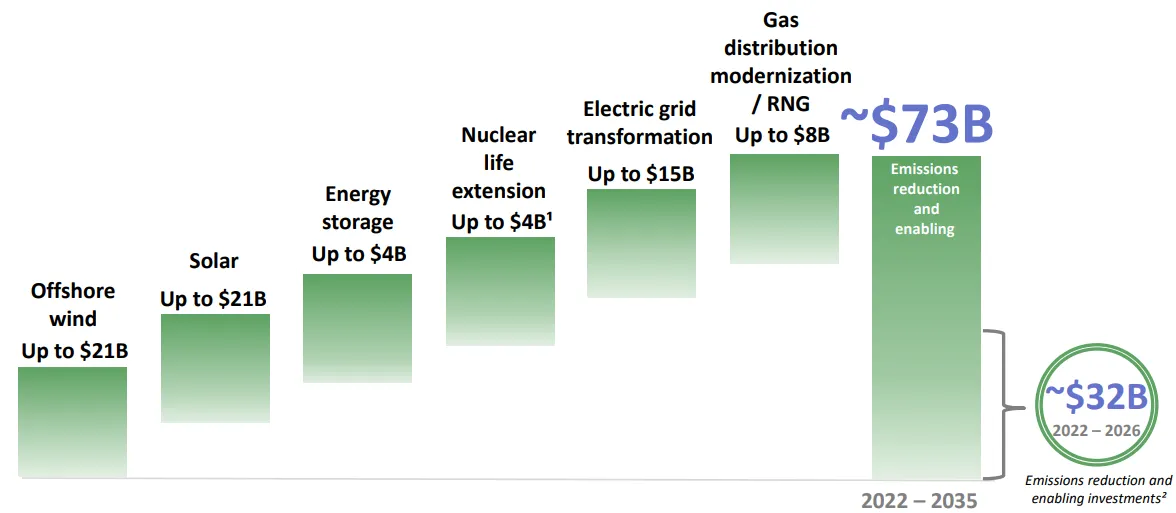

Dominion Energy expects to spend about $32 billion reducing its carbon dioxide emissions from 2022 to 2026 and up to $73 billion through 2035.

Meanwhile, data centers in northern Virginia have grown to about 2,600 MW of load and constitute about 20% of Dominion Energy Virginia’s electric sales, according to Blue. PJM expects data center load in the utility’s service territory to grow by another 2,600 MW by 2027, he said.

As a result, Dominion Energy Virginia is speeding up by several years plans for new transmission and substation infrastructure in part of eastern Loudoun County, Blue said.

The utility expects to restart new connections in the “near term,” but the area needs two new 500-kV transmission lines, he said.

The issue won’t immediately affect Dominion Energy Virginia’s sales growth, but it could slow sales growth in the 2024-2025 time frame, according to Blue.

”We're not at the limits of our facilities today, but we need to act now to alleviate transmission constraints in the future,” he said.