The post has been updated to include information from the State regarding legislation to stop SCANA from charging customers to recover V.C. Summer nuclear construction costs.

Dive Brief:

- Dominion Energy CEO Thomas Farrell said yesterday he is "optimistic" that South Carolina lawmakers and regulators will approve the company's bid to purchase SCANA Corp. before the end of the year, with approval from SCANA shareholders expected in May.

- Dominion's proposed acquisition of SCANA will turn heavily on whether it's utility subsidiary is allowed to recover the costs of the failed VC Summer nuclear development.

- While a long-term decision is being made, a proposal from Republican lawmakers in the House would halt SCANA subsidiary SCE&G from charging customers for the project. According to The State, the proposal could trim customer bills by $27/month.

Dive Insight:

Dominion officials say they believe their offer for SCANA will ultimately win over decision-makers in South Carolina, who now are facing a high-profile choice on whether customers should continue to pay for the VC Summer nuclear debacle.

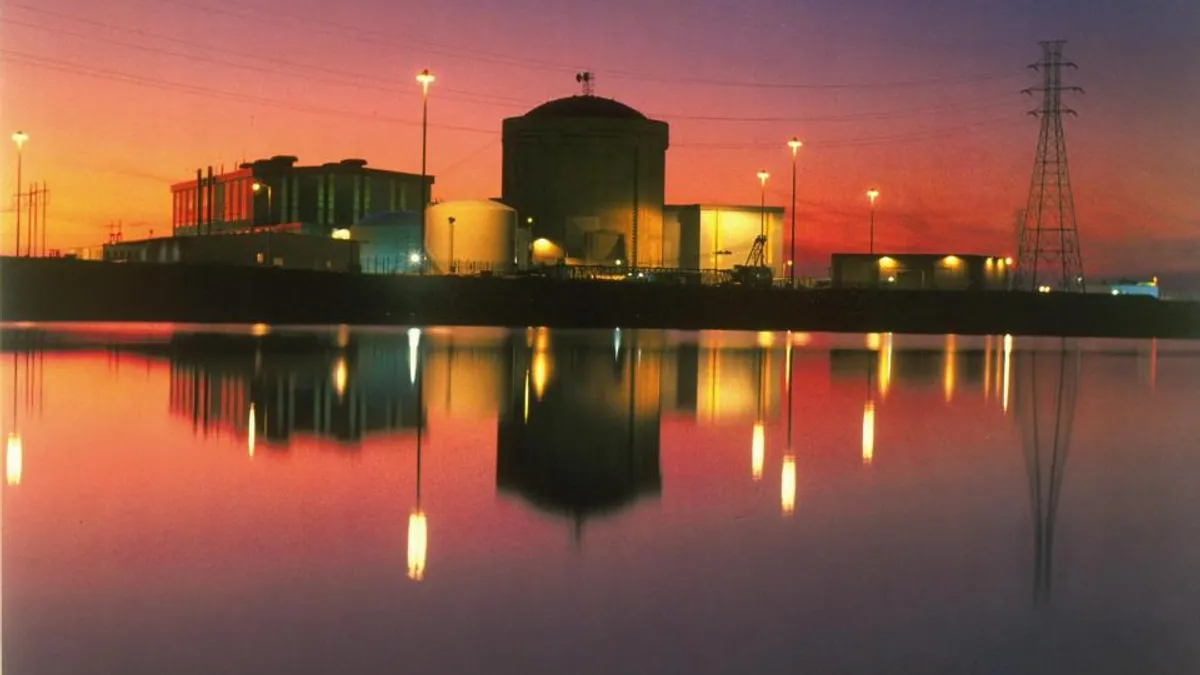

Last year, SCANA announced it would abandon construction of the V.C. Summer nuclear plant, having already spent $9 billion in ratepayer funds. Customers are currently paying $37 million a month for the project, thanks to a controversial 2007 law, the Base Load Review Act, which allowed the utility to begin recovering its investment in the nuclear project. There have been calls to repeal that law, particularly amid accusations that SCANA and its partner on the project, state-owned utility Santee Cooper, knew much earlier than the development was failing.

If SCANA is not allowed to recover those costs, there is a significant chance the company will file for bankruptcy. If that happened, Dominion indicated its $14.6 billion all-stock merger proposal would be off the table.

A new proposal in the state's House would give customers at least temporary relief. Lawmakers were set to discuss a measure on Tuesday that would block SCE&G from charging customers until a final decision has been made on recovery.

It is not clear how the proposal would impact Dominion's offer, given that SCE&G could ultimately be allowed to recover its costs.

Farrell said the company has filed a regulatory proposal with South Carolina Public Service Commission, along with other state regulatory filings and the application for Hart-Scott-Rodino clearance. The company participated in a legislative hearing to explain its proposals to lawmakers considering possible changes to the Base Load Review Act.

"We are optimistic that our proposal will be viewed favorably by law makers and regulators, and we can complete the transaction later this year," Farrell said.

The company has made progress on other investments as well. The Atlantic Coast Pipeline would run more than 600 miles from West Virginia to southeastern regions of Virginia and North Carolina. Dominion will own the largest share and is working with partners Duke Energy, Piedmont Natural Gas and Southern Company Gas.

Construction in Virginia of the 1,588-MW Greensville County combined cycle power station "continues on time and on budget," Farrell said. The project is approximately 73% complete and commercial operations are anticipated later this year.