This opinion piece is part of a series from Energy Innovation’s policy experts on advancing an affordable, resilient and clean energy system. It was written by Michelle Solomon, a senior policy analyst.

In September 2022, residents of Northern California’s rural Humboldt County learned from their utility, Pacific Gas & Electric that it would be effectively impossible to connect new customers to the grid. The mountainous region has only two transmission lines bringing in electricity, and they were at capacity. This announcement halted plans for new housing, slowed economic development, and waylaid the county’s efforts to electrify all city vehicles under its Climate Action Plan.

But timely solutions won’t be easy. PG&E has identified $900 million in needed transmission upgrades, with a ten-year timeline. Since the announcement, the utility has received approval for $46 million of these upgrades, and expects to start connecting some new customers in the county within the next two years.

While Humboldt County’s predicament is particularly acute, it’s not unique. Connecting power plants to the grid has become increasingly difficult, and demand will rise with the clean energy transition.

This problem is severe in the PJM Interconnection, the nation’s largest grid. PJM paused reviewing new projects — mostly wind and solar — interested in connecting to its grid for two years while it works through a backlog, leaving project developers and the region’s climate transition high and dry.

As clean energy demand increases due to improved economics and greenhouse gas reduction goals, transmission’s importance has grown apace. Transmission must expand to move renewables to population centers, tap new technologies, and reduce congestion during extreme weather events, providing affordable, reliable clean energy.

To help address this transmission shortfall and prepare for the next generation electricity system, the U.S. Department of Energy recently released a draft report of the Transmission Needs Study, quantifying the transmission buildout required to bring our country into the future.

We need exponentially more transmission to meet clean energy goals

The Transmission Needs Study tapped new authority from the Infrastructure Investment and Jobs Act to examine more than 200 possible future scenarios from six analyses. The scenarios identify plausible electricity sector pathways differing in parameters including technology mix; clean energy share; and electricity demand growth from sectors like transportation, buildings and industry.

The study identifies scenarios with moderate load growth and high clean electricity share as the most likely outcomes following the Inflation Reduction Act’s passage. However, scenarios with high load growth — where median “high” growth is 225% — and high clean electricity like NREL’s 100% Clean Electricity by 2035 study are more consistent with a trajectory toward a net-zero economy with high electrification of transport, industry and buildings by midcentury.

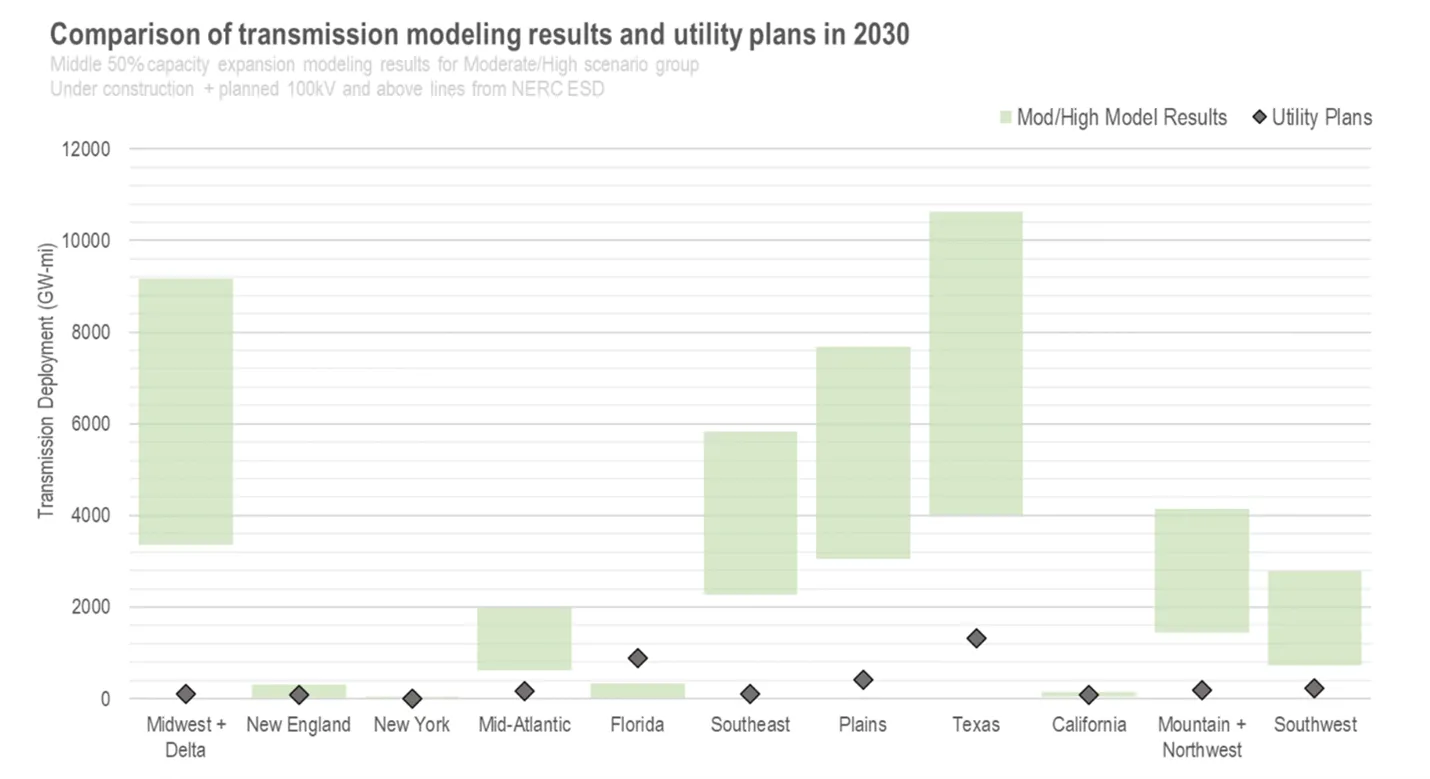

For each of these categories, DOE highlights the need for expanded regional transmission line development and interregional transfer capacity. For the moderate/high scenarios, the median new transmission need is 47,000 gigawatt-miles (GW-mi) of high voltage lines by 2035, a 57% growth from today’s system, with 120 GW of cumulative transfer capacity needed between all regions.

Transmission needs are significantly higher in the high/high scenarios, underscoring the need to continue expanding the grid to support high levels of electrification across the economy; the greatest needs are in the Plains, Midwest, and Texas. This median transmission expansion is 115,000 GW-mi by 2040, doubling today’s grid capacity, with 655 GW of interregional transfer capacity — more than six times the current interregional transfer capacity.

Interregional transmission capacity can significantly reduce the cost of renewables buildout, is a key reliability resource, and provides high economic value by enabling electricity imports from regions with excess electricity supply to those with high demand. Lawrence Berkeley National Lab found that in 2022, single interregional transmission links alone could provide $200-$300 million in savings in several locations.

U.S. transmission development is far behind, but making progress

According to NREL’s 100% clean electricity study, these high load growth and high clean electricity futures would require building 91,000 miles of new high voltage interregional transmission lines by 2035. This appears unattainable when it takes 10 years on average to move a transmission line from conception to operation, and only 386 miles of high voltage transmission were built in 2021. The projects required are not even in the pipeline — the Needs Study says all regions are behind on utility planning for even the moderate/high scenarios, let alone the high/high scenarios.

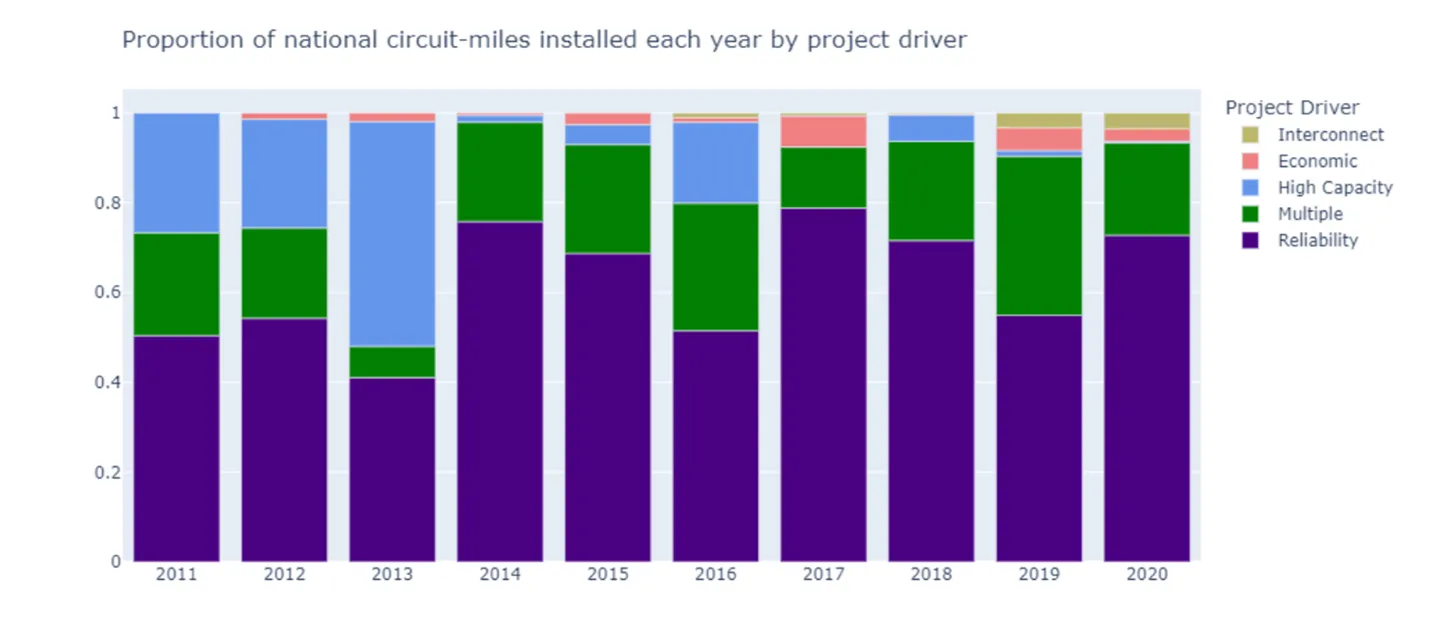

Transmission faces barriers at almost all phases of development. Planning is short-sighted, and too few lines are even being proposed. Once a line is proposed, permitting becomes a challenge, particularly across multiple states. Multi-state line costs must be shared between states, and cost allocation is a key point where many projects fail.

The utility business model is also a source of delay: Because inter-state lines fall under Federal Energy Regulatory Commission jurisdiction, many utilities opt to maintain control and build shorter lines serving narrow needs within their own territory.

However, interstate and interregional transmission lines have advanced in the past year. Four projects representing more than 2,400 miles of high voltage line are moving forward across the country and the Biden administration is supporting another five projects in earlier phases of development spanning an additional 1,200 miles. MISO also approved another 2,000 miles of high voltage lines as phase one of four in a new multi-value transmission planning process.

While these 5,600 miles in high voltage lines would be almost ten times the national average of high voltage transmission buildout since 2016, they are all still years away from carrying electricity. Reaching our clean energy goals requires urgent action.

Accelerating transmission buildout requires action across all levels of government

These acute transmission needs have driven policymaker attention toward reforming the transmission deployment timeline. Aspects of proposed federal permitting bills would provide much needed relief to transmission hold ups, such as improved authority for FERC in inter-state cost allocation and backstop siting authority. However, coupling these provisions with streamlined permits for fossil fuel projects and concerns regarding environmental reviews have torpedoed reform efforts.

Cost allocation is a particular area where federal action is necessary to ensure disagreement over payment for lines does not derail their progress. These delays are embodied by the Grain Belt Express. Planned to cross four states, state regulators in Missouri did not find their state’s benefits strong enough to justify the ratepayer costs and denied the project. The project is moving forward now, after the developer agreed to provide more electricity directly to Missourians, but the delay has cost nearly ten years.

By providing FERC the authority to allocate costs to states according to benefits, Congress can help transmission lines avoid one of the most significant sources of delay. A current FERC Notice of Proposed Rulemaking aims to increase the commission’s role in cost allocation and bring states in to resolve conflicts at earlier stages. This approach could help balance state resource control with the flood of low-cost new technologies, consumer benefits and public policy goals.

The IIJA also recently expanded FERC’s siting authority within “National Interest Electric Transmission Corridors,” which will be identified by a bottom-up applicant-driven process and may prioritize existing rights-of-way. While this approach may avoid some conflicts that waylaid past corridor designation, it requires interested developers, utilities and states to propose corridors. Utilities and developers should work with stakeholders to identify and propose corridors of interest, then use this authority to shrink development timelines.

States can proactively advance transmission lines too, exemplified by New Mexico’s establishment of a state transmission authority. The state’s Renewable Energy Transmission Authority has successfully enabled lines, including the interregional SunZia line, by undertaking planning and stakeholder engagement processes and acting directly as a project co-developer. State transmission authorities can also help move interstate planning forward and represent states at FERC to help accelerate cost-allocation processes.

Dawn of the transmission age?

DOE’s study confirms that regardless of which load growth or clean energy range we ultimately reach, we need to build orders of magnitude more transmission in the next decade than we did in the last.

Transmission is garnering the focus of policymakers, investors, system operators, utilities, and clean energy advocates, and development is accelerating. With a combination of additional state and federal policy, we may just have a shot at re-energizing the U.S. grid.