Dive Brief:

-

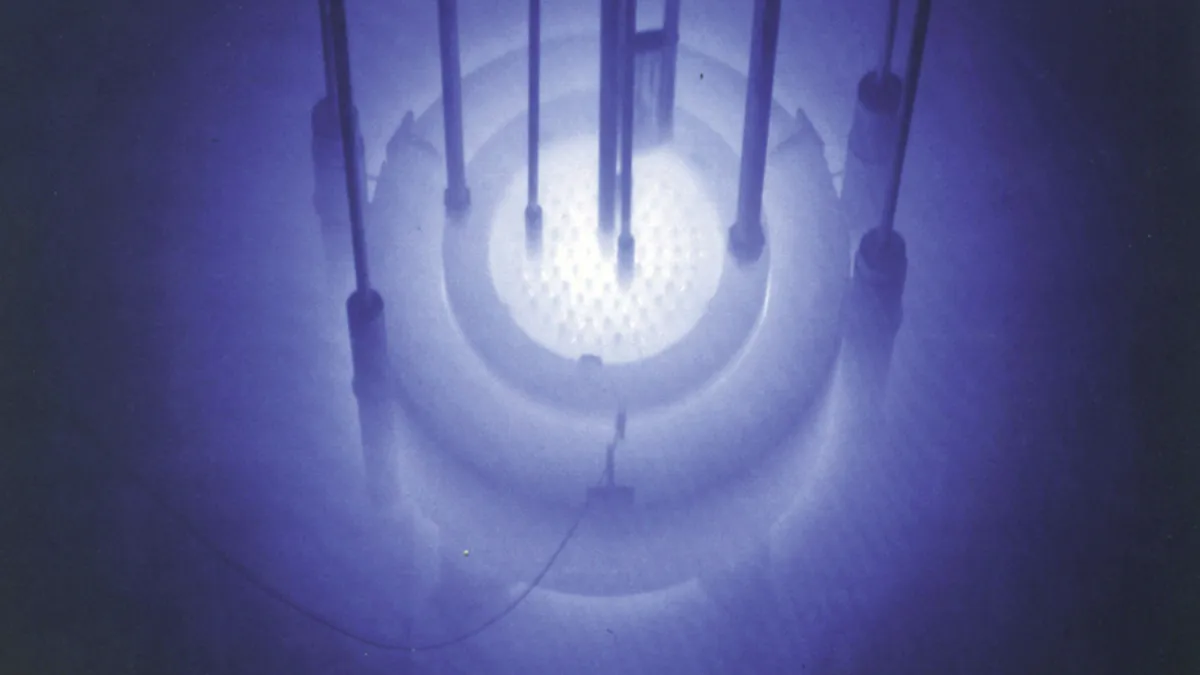

A recent report from the U.S. Department of Energy identifies the need for energy resilience and how small modular nuclear reactors can fill that need.

-

The DOE report highlights and makes recommendations for the use of small modular reactors by the Tennessee Valley Authority at a site in Oak Ridge, Tenn., adjacent to a national nuclear and security facility.

-

Separately, the Nuclear Regulatory Commission has approved NuScale Power's design approach that eliminates the need for electrical power to maintain safe operation of the reactor during an emergency.

Dive Insight:

Small modular reactors are one of those technologies that always seems to be on the brink of commercialization. That could be a function of the enthusiasm of SMR advocates, but two recent developments indicate there could be some progress toward having an actual SMR begin deployment.

The Nuclear Regulatory Commission has to approve a reactor design before it can be deployed and, therefore, before anyone would consider including it in a project application.

A handful of companies have begun discussions with the NRC about such an application, but only one, NuScale Power, has actually submitted a design certification application.

The company submitted its application about one year ago and the staff report on the application is expected in September 2020, NRC spokesman Scott Burnell told Utility Dive.

More recently, the NRC signed off on one of the safety aspects of NuScale's design. NuScale said the agency signed off on "a key aspect of its design approach" by agreeing that safety-grade electrical power is not needed to perform the reactor's safety functions.

NuScale's reactors do not rely on pumps to circulate water to cool the reactor, but instead rely on gravity, convection and conduction to circulate the water as it heats up over the reactor and then cools down again. "It goes to the inherent safety of our design," NuScale spokeswoman Mariam Nabizad told Utility Dive.

Companies like NuScale say SMRs are not only safer than conventional reactors, they are also cheaper and can be built more quickly and scaled up as needed – NuScale's SMRs scale in 50 MW increments – cutting construction and financing costs. Critics say that by shrinking reactor sizes, SMRs give up the economies of scale available to large reactors. The trade-off, proponents say, is that SMRs gain manufacturing scale because the reactors can be manufactured in factories instead of on site, resulting in cost savings.

Even though design certification for the first SMR technology is still about two years away, the DOE report lays out recommendations that could help move SMR development forward.

The report's authors argue that federal agencies should be allowed to enter into power purchase agreements of up to 30 years for power purchased from SMRs. The report also makes policy recommendations that would essentially provide subsidies for SMRs. The report recommends authorization of the DOE Loan Program to include SMRs and recommends that nuclear power be included in the definition of "clean power" and, if the Environmental Protection Agency's Clean Power Plan survives, a rule should be added that would encourage states to support SMRs by giving them "credit for the zero-carbon energy."

The report also recommends that the DOE and the Department of Defense collaborate to identify facilities that can benefit from hosting or having an SMR near the facility to achieve added energy resilience.

The biggest test for SMRs, however, will likely be the cost test. NuScale says it is targeting a cost of $65/MWh for its first project in Idaho that is due online in 2026. The project is for the Utah Associated Municipal Power Systems under its Carbon Free Power Project. NuScale has received a $16.7 million grant from the DOE for the project.

A 2013 paper, however, estimated the cost of a 45 MW SMR at between $4,000/kW and $16,300/kW. For a 225 MW SMR, it estimated a cost between $3,200/kW to $7,100/kW. And a U.K. report found that SMRs could cost as much as one-third more than the cost of a conventional nuclear plant.

In an environment in which a new gas-fired plant costs about $1,000/kW to $1,500/kW to build and where the costs of renewable resources continues to fall, SMRs could be a tough sell.

This article has been updated.