Dive Brief:

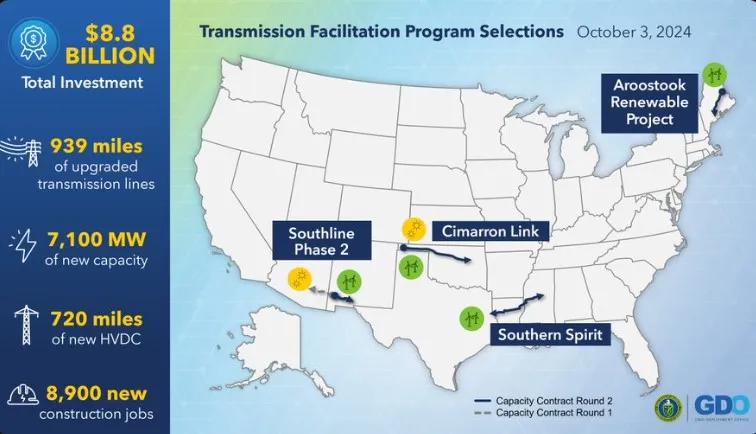

- The U.S. Department of Energy plans to enter into negotiations to buy up to $1.5 billion of capacity on transmission projects being developed by Avangrid, Invenergy, Pattern Energy, and Grid United and its partners, DOE said Thursday.

- The projects, which could deliver 7.1 GW, were selected in a solicitation for access to DOE’s Transmission Facilitation Program, a $2.5 billion revolving fund that was part of the bipartisan infrastructure law. The awards are expected to be finalized in January, according to Invenergy.

- After this round and combined with awards from an initial funding round, the revolving fund is nearly depleted, according to DOE. The department’s Grid Deployment Office will evaluate the revolving fund’s balance as projects advance in construction and relieve the department of its obligations, according to the office. DOE said it intends to launch new funding opportunities when the program’s coffers are replenished.

Dive Insight:

Under the TFP program, DOE can serve as an “anchor customer” for transmission projects by buying up to half of a project’s capacity and later selling the contract to recover the department’s investment. The program can help project developers obtain financing for their projects by providing them with guaranteed revenue.

Before entering into capacity contracts, DOE consults with transmission planners in the area where the project is slated to be built about the region's needs, according to the department.

“We are encouraged to see federal action to advance transmission planning here in the US that can incentivize more rapid development of new projects and strengthen links between different regional grids, ultimately increasing the overall resiliency of the grid,” Anthony Allard, executive vice president and head of North America for Hitachi Energy, said in a statement.

Here’s a look at the projects DOE selected:

Pattern Energy’s Southern Spirit Transmission project will receive up to $360 million. The 320-mile, 525-kV high-voltage direct-current line would be able to deliver 3 GW back and forth between a wind power zone in the Electric Reliability Council of Texas and Mississippi. The project, which will end in western Louisiana, will connect to Texas via a roughly 40-mile, 345-kv transmission line to be built by Garland Power & Light.

“Interconnecting Texas to the Southeast will expand access to diverse resources and improve grid resilience in high demand and extreme weather events, benefiting ratepayers in both regions,” DOE said.

The project has faced opposition in Louisiana. In May, Louisiana Gov. Jeff Landry, R, signed a bill that requires a transmission project to be approved by an independent system operator to bolster grid reliability, or to directly serve Louisiana, before the project’s developer can use eminent domain to secure a route for the transmission line.

Avangrid’s Aroostook Renewable Project will receive up to $425 million. The project would deliver 1.2 GW from northern Maine into ISO New England via a 111-mile, 345-kV transmission line.

Driven by a state law, the Maine Public Utilities Commission is preparing to issue a request for proposals for transmission and at least 1.2 GW of generation in northern Maine. In a previous solicitation, the PUC selected LS Power to build a transmission line and Longroad Energy to build the 1-GW King Pine wind farm. The contracts were never completed, however.

Avangrid plans to bid its Aroostook Renewable Project into the PUC’s solicitation, the utility company said Thursday. It expects winning bids to be announced next year.

“By expanding our transmission infrastructure, this investment can make the electric grid more stable and reliable and allow us to harness affordable, clean energy generated right here in our own backyard instead of having to import expensive and harmful fossil fuels from out-of-state,” Maine Gov. Janet Mills, D, said in a press release.

Invenergy’s Cimarron Link project will receive up to $306 million in funding. The project would deliver 1.9 GW of wind and solar generation from the Oklahoma panhandle to fast-growing load centers in the eastern part of the state using a 400-mile HVDC transmission line. The project will cross an area with major transmission congestion, according to DOE.

The generation mix that will use the Cimarron Link is not finalized, but advanced-stage wind and solar projects near the western end of the transmission line, including Invenergy’s roughly 2-GW States Edge Energy Center, could directly connect to the project, Erika Huffman, director of public affairs for Invenergy, said in an email.

Invenergy said it has acquired over half of the rights-of-way it needs to build the Cimarron Link project, which it expects will be operating in 2028 after two to three years of construction.

Grid United and Black Forest Partners’ Southline Phase 2 project will receive up to $352 million. After awarding $477 million for Southline’s first phase, DOE has decided to back a 108-mile, 345-kV segment that will deliver 1 GW of bidirectional capacity between Hidalgo County, New Mexico, and Las Cruces, New Mexico.

When the two phases are complete, the Southline project will extend about 280 miles between the Tucson, Arizona, area to near El Paso, Texas. The project’s developers expect the project will deliver wind and solar energy to key markets. Since DOE awarded funding for the project’s first phase last year, Grid United and Black Forest Partners have made “substantial commercial progress with transmission service customers,” the companies said Thursday. The companies expect construction to start on the first phase in the first half of next year.

“High-voltage transmission projects like Southline will be the backbone of our clean energy transition, delivering carbon-free power generated in New Mexico to market,” Sen. Martin Heinrich, D-N.M., said in a press release. He urged Congress to pass transmission permitting reform to help connect large-scale clean energy and storage projects onto the grid.