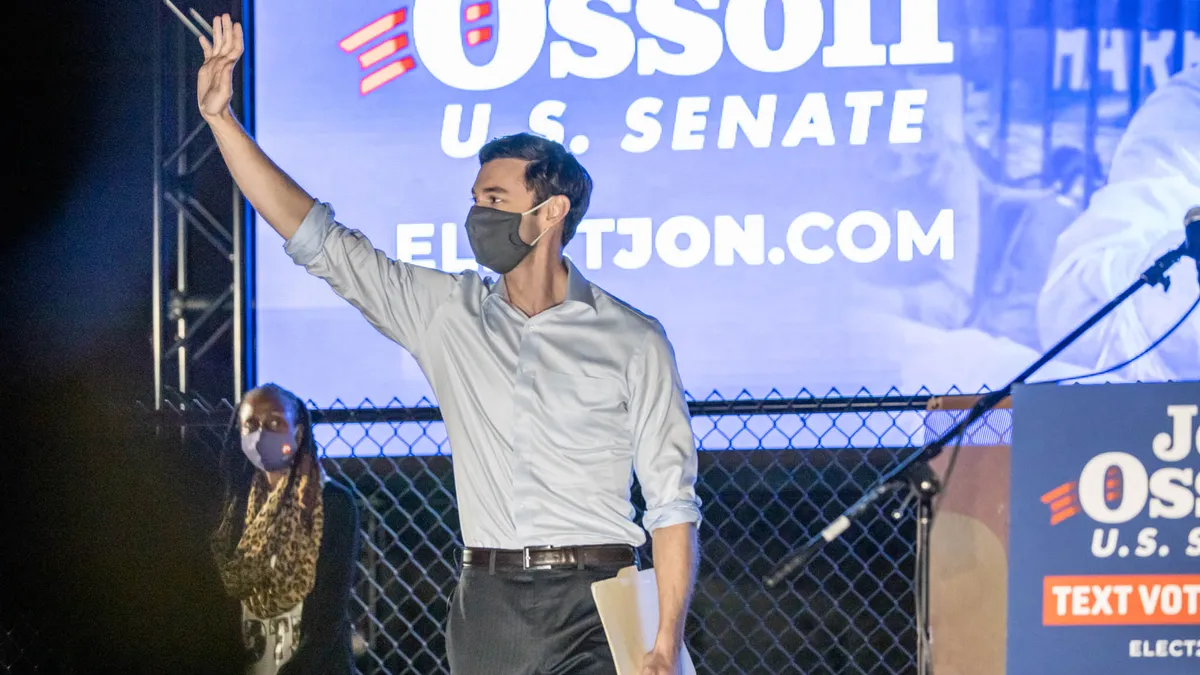

Democratic candidates Raphael Warnock and Jon Ossoff defeated their respective Republican opponents in Georgia's Senate runoff on Wednesday, giving Democrats the majority in both chambers of Congress. Analysts and stakeholders say the implications could be consequential for renewables and electric vehicle deployment, as well as broader carbon reduction policies.

Here are the top implications for the power sector:

Biden will have more power

A Democratic majority will generally give President-elect Joe Biden greater ability to push through his agenda — for example, his cabinet picks will have an easier time getting through the confirmation process, which could lead him to choose more progressive picks in some instances, said Leah Rubin Shen, director at Advanced Energy Economy (AEE). Thus far, Biden has announced his intent to nominate heads of the Environmental Protection Agency, Department of Transportation, Department of Energy, and Department of Interior, among other agencies.

Biden's ambitious plans to invest in renewable energy and electrification could also see more traction.

Senate Democrats in August unveiled a report laying out policy recommendations Congress should adopt to bring the U.S. to a net-zero carbon economy by 2050 that observers said could prove instrumental in defining climate policy under Biden. Further Senate Minority Leader Chuck Schumer, D-N.Y., has pledged to prioritize green infrastructure in the next stimulus bill.

Schumer, who has pledged to be bullish on green infrastructure, will control the Senate agenda

Senate Majority Leader Mitch McConnell, R-Ky., will be replaced by Schumer who has pledged to push for green infrastructure legislation and had previously forwarded a proposal to increase the number of zero-emission or electric vehicles on the roads.

Stakeholders say that having Schumer in the Senate could mean more green infrastructure provisions are included in a new stimulus package to address the economic downturn caused by the COVID-19 pandemic.

"Chuck Schumer has made it abundantly clear that infrastructure packages, major stimulus, it's going to have a climate angle and climate benefits," said Ryan Fitzpatrick, director of Climate and Clean Energy at Third Way, a center-left think tank. EVs are likely to be a major focus of any climate legislation because of their potential to create job growth in hard hit areas of the economy, he added.

"It's something that resonates with a lot of communities that ... need some assistance and reassurance that they have long term economic stability," he said.

The last stimulus package included extensions on solar and wind tax credits, added tax credits for offshore wind, energy efficiency provisions and more, but Democrats and clean energy advocates would still like to see action on incentivizing vehicle electrification, as well as broader, more aggressive climate policy. Renewable energy advocates had also hoped to see a direct pay option for renewable energy tax credits, which could have more momentum now, say observers.

"I think there's a lot of appetite to do some climate stuff through the stimulus. I think that'll be a lot easier now," said Rubin Shen. "I'm also curious what the appetite is going to be for standalone climate legislation."

But legislation is unlikely to follow a purely progressive Democratic agenda. There will still be appetite for bipartisan legislation, say stakeholders, and action is likely to happen among moderates.

"The winners are the centrist Republicans and Democrats," said Heather Reams, executive director of the Center for Responsible Energy Solutions, a center-right think tank. "I think they're the power brokers for new thinking in the Senate."

Manchin will lead Senate Energy and Natural Resources

Sen. Joe Manchin, D-W.Va., will lead the Senate Energy and Natural Resources Committee, with John Barasso, R-Wy., serving as Ranking Member. Both senators come from heavy coal-producing states, which could mean a boost for tools such as carbon capture and storage. Observers also note Manchin has long been willing to reach across the aisle — he and current Chair Lisa Murkowski, R-Alaska, forwarded the American Energy Innovation Act that was included in the last stimulus package.

"My sense is that he's been pretty good about giving space to members in his side of the caucus in general," said Rubin Shen. Further, Manchin will also likely play a major role in determining who takes over Federal Energy Regulatory Commissioner Neil Chatterjee's role after his expected departure at the end of his term June 30, giving FERC a Democratic majority.

FERC will likely have more on its plate

FERC's role under a Democrat-led House, Senate and executive branch will also likely accelerate.

"The focus on the agency as a linchpin of clean energy policies really has been pretty remarkable," said Jeff Dennis, managing director and general counsel at AEE. "So there are going to be a lot of expectations, and they're going to have to prioritize given bandwidth."

Part of FERC's priorities under a Democrat-run government will depend on what passes Congress. If a clean energy standard is implemented, for example, that will require FERC to ensure transmission providers are developing infrastructure in line with those policies, as well as modify market structures accordingly, Ari Peskoe, director of the Electricity Law Initiative at Harvard Law School wrote in a November paper.

Transmission reform should be an infrastructure priority for Congress, regardless of whether a clean energy standard, or similar policy, is put in place, said Devin Hartman, director of energy and environmental policy at free market think tank R Street Institute.

"Congress could address siting and permitting barriers that stifle new development," he said in an email. "Meanwhile, FERC has the tools to overhaul regulatory practices to let competitive forces flourish in transmission planning and management. FERC's new composition may well have the willpower to challenge incumbent transmission owners — the dominant player who benefits from the status quo — especially if transmission customers and competitive suppliers form a joint agenda."

Industry could be more aggressive investing green

The power sector has traditionally responded to Democrat control by accelerating green investments, and that trend is likely to continue under this Senate, say analysts.

"The general theme is that the more democratic control, the more likely green initiatives will take place," said Paul Patterson, analyst at Glenrock Associates.

"The election of President-elect Biden [and] a Democratic controlled Senate will lead to utilities moving quicker than they otherwise would have" in order to get in front of future policy, said J.R. Tolbert, managing director at AEE.

Under President Donald Trump, utility commitments to clean energy accelerated, which some credit in part to the wave of aggressive state clean energy goals that included strengthened renewable portfolio standards. A major relief for utilities has been investments in clean energy technologies that can help them reach some of their zero or net-zero carbon goals, said Reams.

"That has been a relief to me that a lot of technology research and development has been passed," Reams said, allowing momentum to continue. Others credit that acceleration with market enablement more broadly. "[M]arket forces are best positioned to drive" the transition, said Hartman.