Mandi McReynolds is the chief sustainability officer at reporting software firm Workiva and serves as the vice president of their global ESG arm.

Environmental challenges remain a critical focus for societies, governments and businesses worldwide. The urgency to address climate change has never been more apparent, with more than 60 global elections this year and global temperatures hitting record highs. Furthermore, 70% of industry professionals agree that businesses are not moving fast enough to meet their ESG goals. Stakeholders across the globe will continue to demand concrete action and measurable progress on sustainability initiatives as they increasingly realize the benefit ESG initiatives can have on reimagining operations, innovating products and creating lasting societal impact. For businesses, although the climate transition represents a challenge, it also presents a transformative opportunity.

At the core of this transition is one key fact: businesses are responsible for enhancing resilience and paving the way for a more sustainable economy. Too often, we see data gathering and reporting inefficiencies that make it nearly impossible to remain on track with climate targets. The shift to a more climate-focused way of business goes beyond compliance and risk mitigation; it’s about enhancing resilience and paving the way for a more sustainable future.

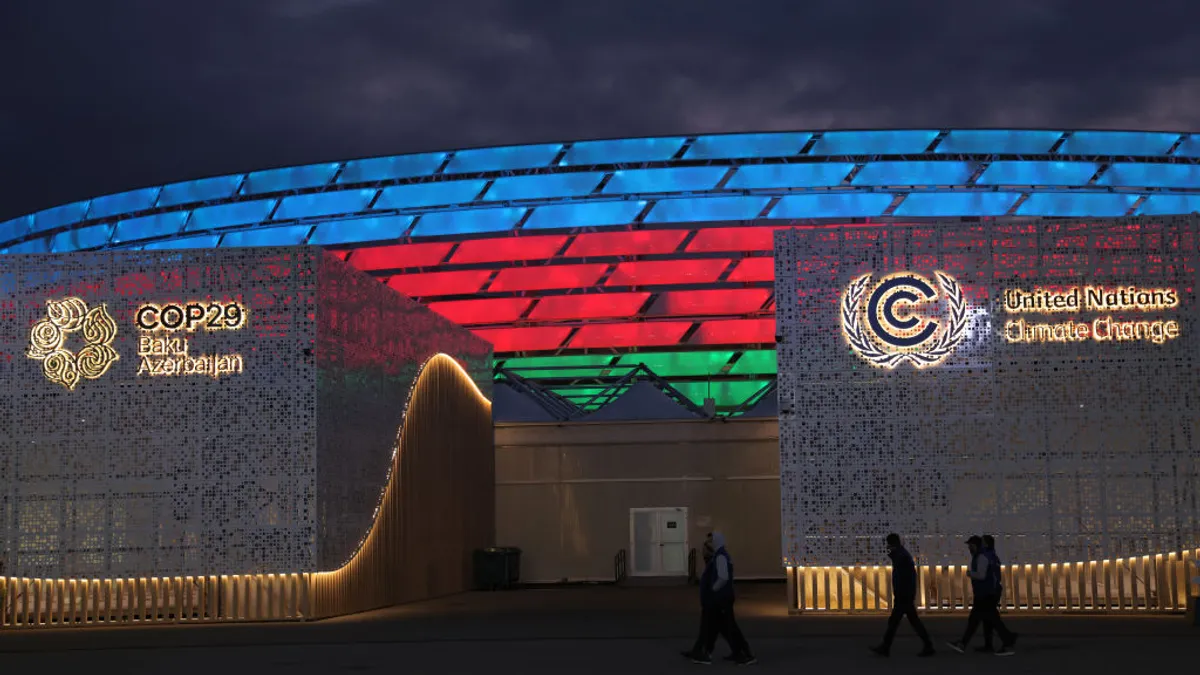

As over 32,000 delegates gather in Baku, Azerbaijan, for COP29 this week and sustainability-related regulations and mandates continue to gain traction across the globe, the climate conference is presented with a unique opportunity to set meaningful climate goals and fast-track the world to a clean energy transition. To achieve this target, it’s integral to take into account some of the key trends that have emerged in this space:

Heightened scrutiny of corporate ESG reporting presents new opportunities

Since last year’s COP summit, stakeholders have demanded greater transparency about companies’ sustainability practices. Businesses are, therefore, under pressure to go beyond compliance with standard reporting to appease multiple parties and gain a competitive edge.

However, we find that leading companies are able to grow their business sustainably, aligning with global expectations and preparing for regulations like the European Union’s Corporate Sustainability Reporting Directive, or CSRD. In fact, according to our research, 91% of executives agree that integrated financial and ESG reporting offers a holistic view of performance, and 81% of companies that are not subject to the CSRD still indicate plans to comply. Many businesses recognize that it is a transformational opportunity for them to operate successfully in a future economy and have a positive impact on society.

Alignment with global and local ESG standards

While the regulatory landscape continues to evolve globally, CSRD remains the gold standard on the international stage, but U.S.-based companies will have to navigate regional and even state-level differences over the next several years. There is a growing push for unified sustainability standards across different countries and regions, which aims to improve comparability and increase accountability on a global scale. At such a pivotal time of regulatory shifts, COP29 will undoubtedly shape the landscape of ESG and sustainability reporting with far-reaching implications for businesses worldwide. The development of consistent, accurate and scalable standards that embrace double materiality and transparency are critical for stakeholders who need to assess and compare performance across regions. Beyond that, a standardized approach would help reduce confusion and increase the overall usefulness of disclosures, and those companies that take on a proactive approach to reporting will thrive.

Commitment to prioritizing transparency and data driven decisions

The pressure to meet climate goals from regulatory bodies and other businesses continues to grow despite recent target pushbacks across industries. Globally, over 4,200 companies and 23,000 organizations have set science-based targets — representing half of the global market capitalization — and report emissions data through initiatives like the Carbon Disclosure Project. Companies committed to transparency are increasingly turning to data analytics to inform their efforts. A comprehensive, data-driven approach across all business functions allows companies to set precise targets, measure progress more accurately and adjust strategies dynamically in real time. Focusing on data both enhances the effectiveness of a company’s sustainability efforts and creates a more robust foundation for stakeholder communication.

Climate action as a competitive advantage

The ability to accurately measure and report the costs, risks and benefits associated with the climate transition is becoming a key differentiator for businesses. It's no longer enough for companies to set vague sustainability goals or engage in surface-level initiatives. Workiva’s recent ESG Practitioner Survey revealed that 88% of finance and sustainability professionals agree that strong ESG reporting gives their organization a competitive advantage. Today's business leaders are expected to understand, measure and effectively communicate their climate-related impacts to remain competitive in the marketplace.

COP29’s influence on the future of business performance

Dubbed as the “Finance COP,” COP29 will be a critical moment in the global climate transition as the conference is expected to further shape the landscape of ESG and enable companies to push towards their sustainability goals leading into COP30. Companies must review the outcomes and understand the implications for their organizations following COP29. They should also prepare for accountability from regulations, consumers and stakeholders as 2025 marks a critical point, just five years away from corporate pledges and deadlines due in 2030. This is a pivotal moment for companies around the world to realize their role in a new sustainable economy.