Dive Brief:

-

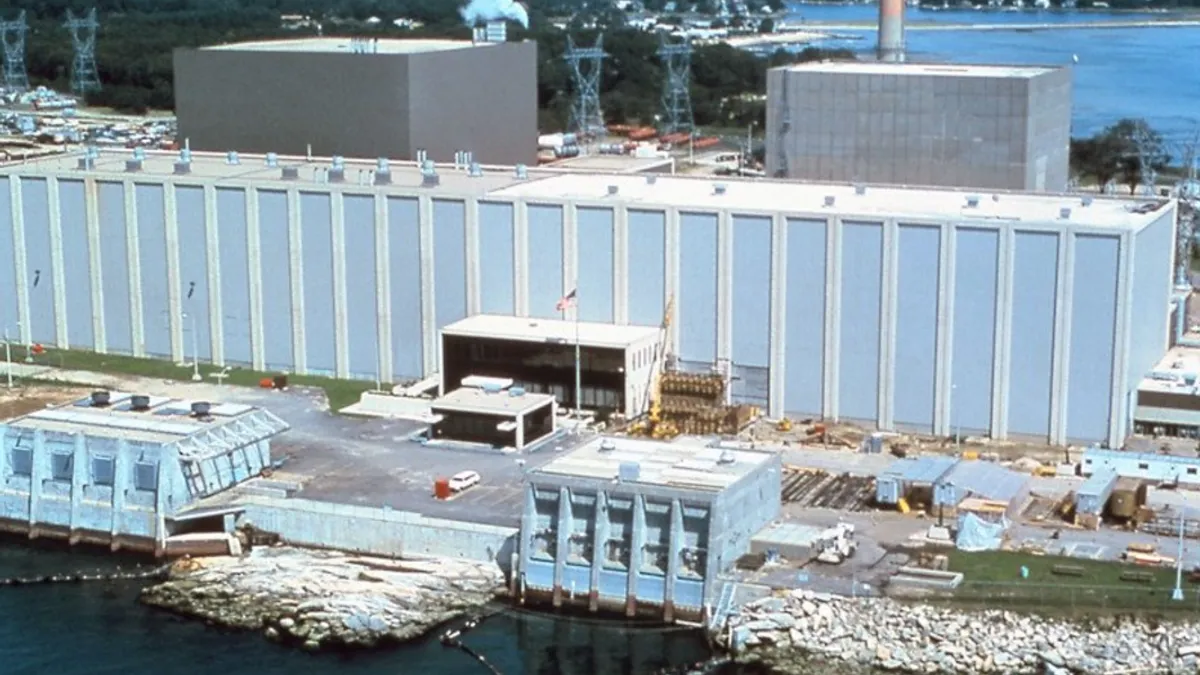

Connecticut lawmakers plan to introduce legislation to support the continued operation of the 2,110 MW Millstone nuclear plant in Waterford, according to local news reports.

-

The legislation, yet to be fully drafted, now only indicates it would "provide a mechanism for zero-carbon generating facilities to sell power to electric utilities." The Millstone plant, like other nuclear facilities in organized markets, is challenged by competition from cheap natural gas generation.

-

Independent power producers have objected to the proposed bill (SB 106), saying it would “unnecessarily funnel consumers’ money to some electric power resources in the state at the expense of the millions of consumers picking up the tab.”

Dive Insight:

Zero-emission credit schemes are becoming a popular mechanism for shoring up nuclear power plants in competitive power markets that are challenged by inexpensive natural gas generation and stagnant electricity demand growth.

In August of last year, New York regulators approved $965 million in additional revenue to three Exelon nuclear plants over two years, with continued payments until 2029.

That program became a guide for Illinois legislation, passed in early December, that provides $235 million to support two other Exelon nukes. Illinois law has been cited as a model for other states looking to shore up ailing nuclear facilities.

The Connecticut legislation is expected to be similar to a bill introduced last year in the state’s General Assembly that was passed by the Senate but failed to make it through the House of Representatives.

That bill would have let nuclear power participate in the state’s competitive solicitation for renewable or low-carbon power, instead of just competing in the wholesale electricity markets, where it is exposed to competition from gas.

Dominion says Millstone provides 47% of Connecticut’s electricity and 98% of its zero-carbon generation.

In a filing, the Electric Power Supply Association said the proposed legislation would “handcuff the state’s customers by locking in a price, quantity and technology types for all customers of the state’ electric dictribution companies for up to the next one of two decades.” EPSA called it “a classic case of privatizing profits while socializing” costs.

Zero-emission credits have been greeted with similar objections in other states. Exelon and New York state regulators recently filed briefs in federal court and the Federal Energy Regulatory Commission defending the state's nuclear subsidy program, which critics say infringes on federal jurisdiction over wholesale power markets.