Connecticut’s two investor-owned utilities and a quasi-state energy investment bank announced Wednesday the opening of the second tranche of commercial and industrial energy storage capacity under the state’s Energy Stotrage Solutions, or ESS, program.

The second tranche of the program, at 100 MW, is more than double the first and is two years ahead of schedule due to strong demand, said Connecticut Green Bank, a co-administrator of the ESS program with Eversource Energy and Avangrid subsidiary United Illuminating. The program was launched in 2022 following a state law establishing a goal of 1,000 MW of energy storage in Connecticut by the end of 2030.

Commercial and industrial customers are eligible for upfront incentives to help reduce the cost of purchasing a battery system with a maximum incentive of 50% of the project cost. Business customers also will receive performance incentive payments based on the average power their electric storage project contributes to the grid during critical periods.

Some 27 projects in the first commercial and industrial tranche were submitted to the Green Bank program for funding by six project developers representing 20 towns and several water treatment plants, manufacturing facilities, public schools and health clubs, the Green Bank said.

Businesses that have benefited from funding for storage projects include a Navy contractor that manufactures lighting products using rooftop solar photovoltaics and the Bushnell Performing Arts Center in Hartford capitalizing on long-term, fixed rate financing to replace a boiler.

The ESS program has so far approved 46.4 MW of commercial and industrial energy storage with a total capacity of 139.4 MWh. The battery systems also pay ongoing incentives for 10 years for energy sent to the grid on high demand days.

The program offers incentives to commercial and industrial customers to help reduce the upfront costs of buying a battery system. Commercial and industrial customers enrolled in the program “will also receive performance incentive payments based on the average power their electric storage project contributes to the grid during critical periods,” according to ESS.

Bryan Garcia, president and CEO of the Connecticut Green Bank, said the residential sector has progressed more slowly than the commercial and industrial sector, but new investment due to the Inflation Reduction Act and other factors will “spur interest and investment” in the residential energy storage sector this year.

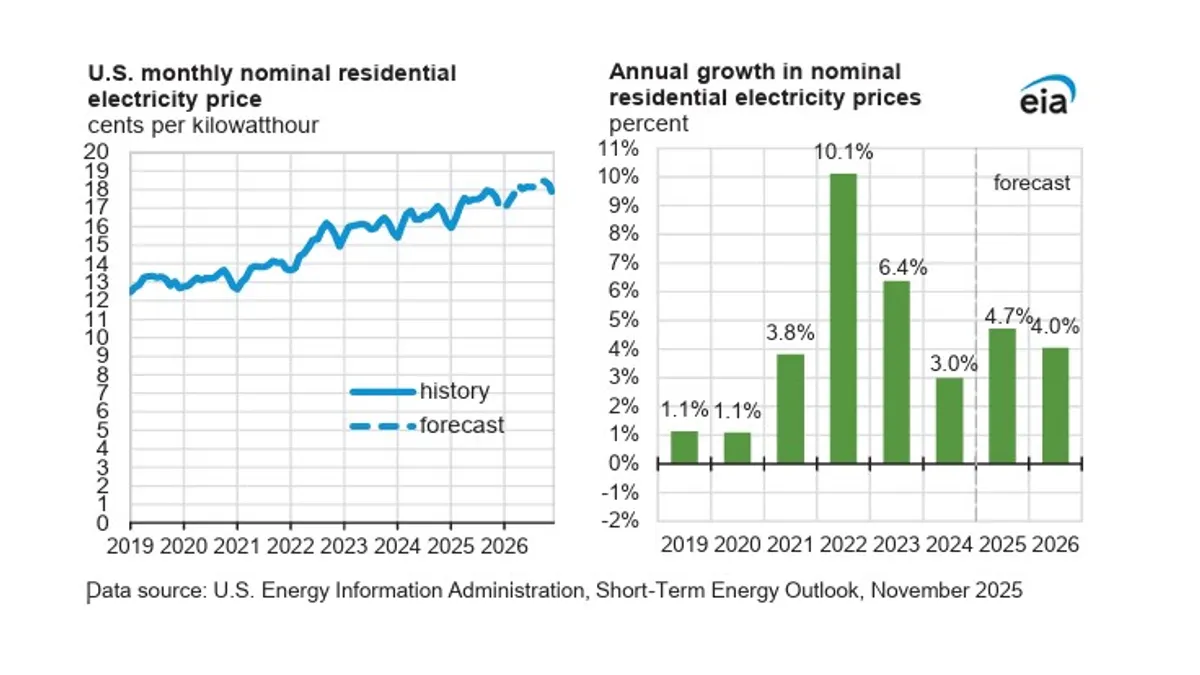

“In these times of high electric rates and climate instability, we expect to see solar PV deployment, in combination with battery storage, to both reduce energy burden and increase energy security for Connecticut families, especially those in vulnerable communities,” Garcia said.

The residential portion of ESS has exceeded 1 MW of approved capacity.

From 2012 to 2022 the Connecticut Green Bank has drawn nearly $2.3 billion in private capital with $322.4 million it invested, it said.