New federal and state supports for community solar and new efforts at cooperation between utilities and community solar developers can increase affordability, system reliability and clean energy access for all electricity customers, analysts report.

Community solar projects, typically 2 MW to 10 MW and interconnected at the distribution system level, have “subscribers” who contract for a portion of the output and earn bill credits on their utility bills, according to the 2022 National Renewable Energy Laboratory, or NREL, community solar report. Both the project owner and the subscriber can benefit from solar’s clean, low-cost generation, NREL reported.

Owned and operated by either utilities or third party developers, community solar growth supports the Biden administration’s goal to reduce power sector carbon emissions 50% to 52% below 2005 levels by 2030, an April White House fact sheet said.

But utilities like Xcel Energy Colorado, which expects an 80% clean energy power portfolio by 2030, have concerns. Customers should have the choice to subscribe to community solar, but “the times and locations where it strengthens system reliability and reduces system costs need to be better established,” said Xcel Regional Vice President, Regulatory Policy, Jack Ihle.

These concerns should not lead state policymakers to overlook community solar’s potential to rapidly deliver low-cost clean energy, advocates responded.

Because community solar interconnects at the distribution system, it “is in the sweet spot of utility expertise,” said Tom Hunt, CEO of national community solar developer Pivot Energy. By providing “full utility visibility and control,” community solar may be the “easiest way” for utilities to protect reliability and meet policy mandates and customer demand to have some solar ownership, he added.

With new federal and state incentives, community solar is forecast to rapidly grow and bring equitable clean energy access to electricity users without it, including the most energy burdened, analysts reported. But to have system benefits, utilities and developers must find ways to collaborate to streamline billing and overcome project interconnection complications, stakeholders agree.

The IRA acceleration

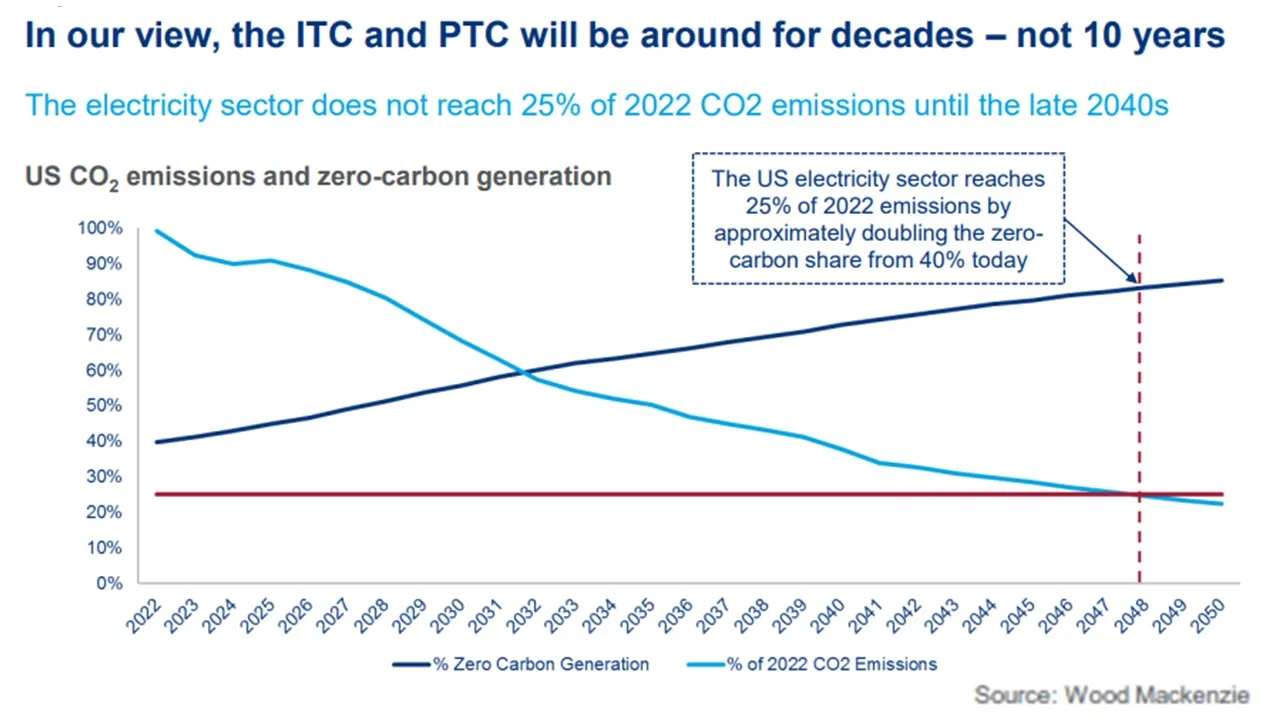

Benefits of the 2022 Inflation Reduction Act will drive an acceleration in every sector of the energy transition, including community solar, analysts widely agree.

The IRA is “a gold mine of opportunity,” Norton Rose Fulbright Co-Head of Projects, United States, Keith Martin told the Wood Mackenzie Solar and Energy Storage Summit 2023 on June 22. Tax credits could pay “as much as 70%” of new clean energy project costs and, with depreciation, “84 cents of every dollar invested could be covered,” he said.

And the tax credits are available until U.S. power sector emissions fall 75% from 2022 levels, which is likely to be in the 2040s, Martin added.

Qualifying community solar projects will receive a base tax credit of 30%, with another 10% if the project uses enough domestic content, and another 10% if it is located in a qualifying energy community, Martin said. Community solar and other projects focused on low-income electricity customers and communities could receive an additional tax credit of up to 20%, he added.

Community solar is well positioned to take advantage of the IRA because it can be located to serve energy communities and low-income customers, added Wood Mackenzie, or WoodMac, Research Analyst Caitlin Connelly.

But based on IRS guidance to date, “overall tax credit benefits are more likely to be below 40%,” said Jason Spreyer, executive vice president, business development, at community solar developer Summit Ridge Energy.

The tax credits can also now be upfront payments to non-taxable public power utilities and electric cooperatives that “typically partnered with third-party developers before the IRA,” said American Public Power Association Director, Research and Development, Paul Zummo. It is possible some will now want to be more directly involved in community solar projects, he added.

The EPA’s $27 billion Greenhouse Gas Reduction Fund, created by the IRA, will also lead to expanded or new community solar programs for low-income customers, according to Coalition for Community Solar Access, or CCSA, President and CEO Jeff Cramer.

The IRA will attract investment capital that accelerates community solar growth, agreed David Schieren, CEO of New York state distributed generation developer EmPower Solar.

But it is not yet certain whether utilities, third party developers, or both will lead the resulting community solar boom.

Utility-led community solar

Power providers own and operate utility-led community solar projects, with program designs and rates approved by their state regulators or governing bodies, according to CCSA. Third-party-led community solar projects are typically enabled by state legislation, implemented through regulatory proceedings, and developed and owned by private sector developers, CCSA said.

Without enabling legislation, third-parties often face challenges and costs for customer acquisition and limitations in enrolling low-income customers, according to CCSA.

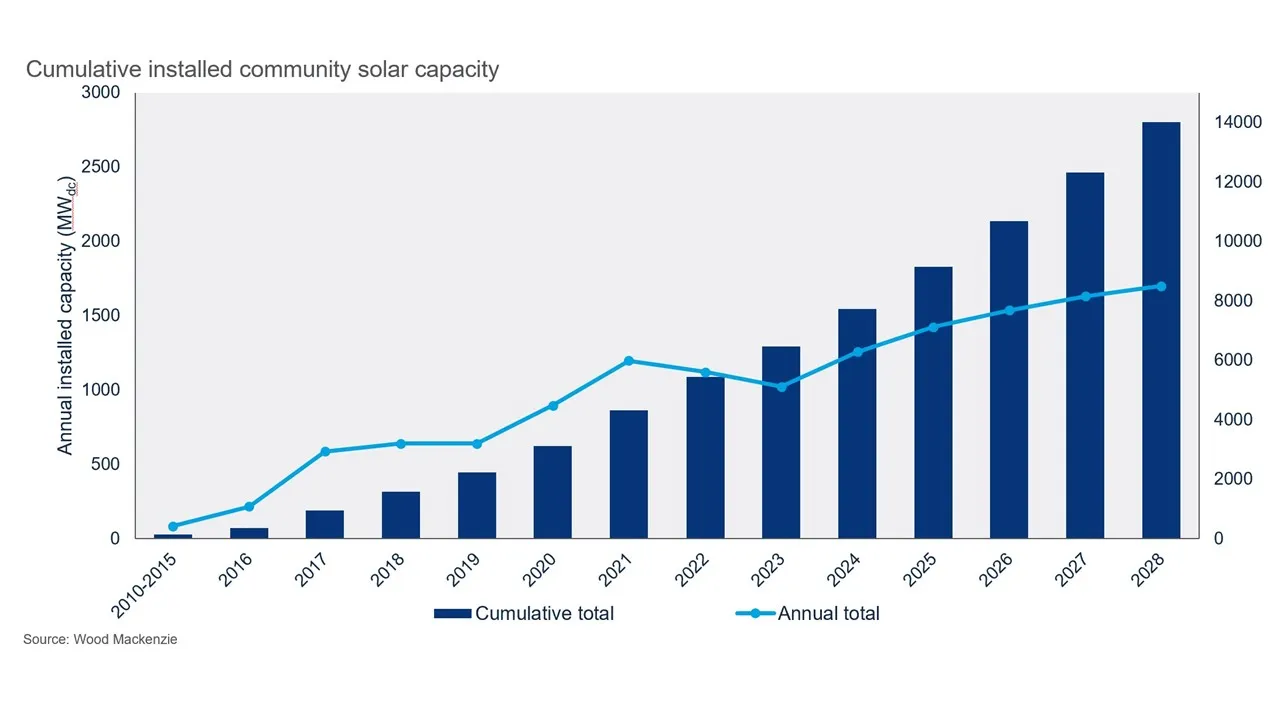

Cumulative U.S. community solar capacity will exceed 6 GWdc this year, and IRA financial support and new state enabling legislation are expected to add another 8.6 GWdc through 2028, WoodMac reported.

The largest individual U.S. community solar projects are utility-led programs in Florida, according to the 2022 NREL report. The state lacks legislation enabling third party development of community solar, which sharply restricts their activity. State regulators approved a Florida Power and Light program for 1.5 GWac of community solar and a Duke Energy Florida 750 MW program. Both are investor-owned utilities.

Duke’s program offers 26 MW for income-qualified subscribers and FPL’s program offers 37.5 MW, with FPL planning to add 45 MW more by 2025, the utilities reported. Both income-qualified customer allotments are a small part of overall growth, but were recognized as significant progress during the regulatory approval process for the projects, solar advocates said.

Florida’s utilities, guided by regulatory oversight, “are exhibiting leadership and designing innovative policies,” Southern Alliance for Clean Energy Solar Program Director Bryan Jacob wrote of the programs. But clean energy advocates secured those low-income subscriber provisions through regulatory proceedings.

And utilities in other states that limit third-party developer access have not matched the Florida utility programs, Jacob, Southern Environmental Law Center Senior Attorney Jill Kysor, and other analysts reported.

Multiple Biden administration community solar initiatives include targets for low-income and disadvantaged communities, the April White House announcement said. A key Biden administration focus will be developing and piloting a digital platform for managing low-income subscribers to help utilities and developers relieve “high energy burdens,” it added.

Austin Energy found that “the first logical step to any community solar program is to engage the community, which is a heavy lift but vital,” said its Customer Renewable Solutions Manager Timothy Harvey.

Its two fully subscribed utility-led projects require no upfront cost or exit fee and guarantee a bill discount on the 50% of capacity reserved for qualifying low-income subscribers, Harvey said. The other half of the project’s capacity goes to residential and commercial subscribers who have stronger obligations and may pay an above retail electricity price for solar, he added.

Utility-led community solar offers the highest value when it is designed to meet the utility’s specific objective, whether it is serving low-income customers or meeting distribution system needs, added Xcel Colorado Manager, Renewable Choice Programs, Kerry Klemm.

Other utilities are learning that lesson.

Community solar serving utilities

There are ways policymakers can move community solar forward, said Brad Klein, senior attorney for the Environmental Law and Policy Center.

A key step is including community solar in distribution planning because that guides community solar to its “highest value times and locations,” Klein added. Policymakers in Illinois, Michigan and Minnesota are working on initiatives that would add distributed energy resources into their planning frameworks, he said.

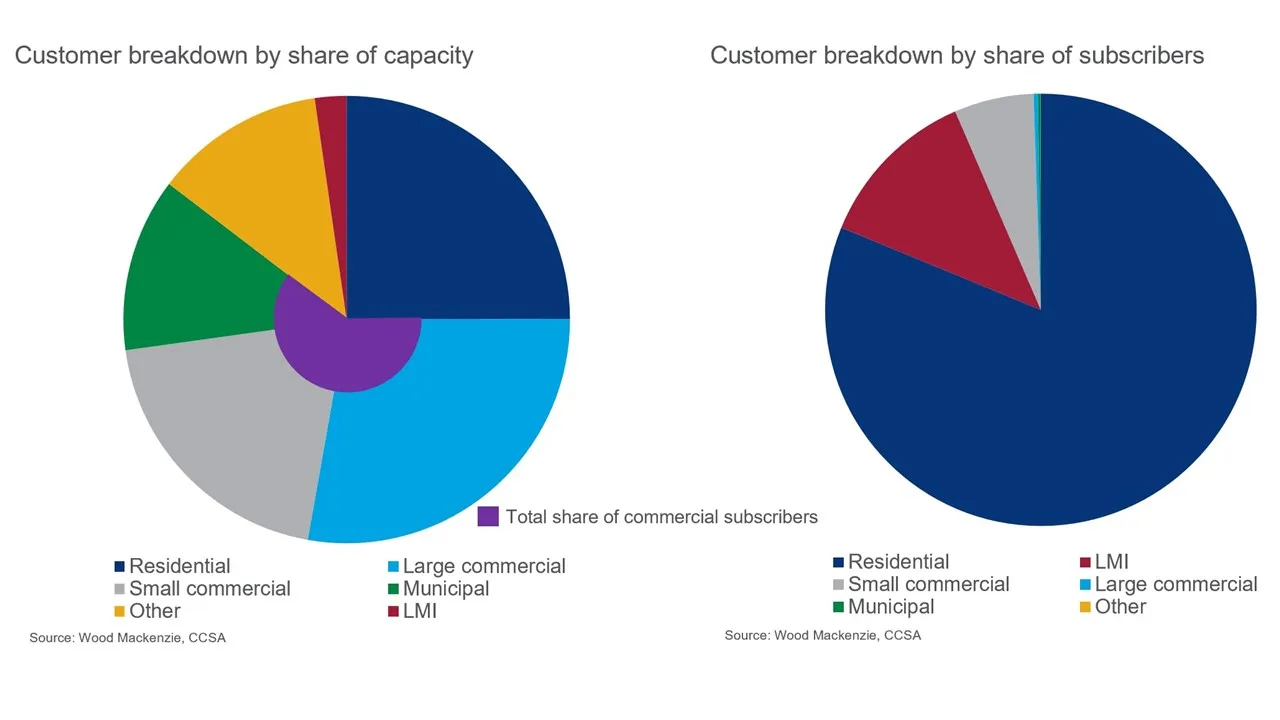

New state policy efforts enabling third party developers of community solar should also stress ways to increase service to low-income customers from its current estimated 1% to 2% of subscribers, added Steph Speirs, CEO and co-founder of national third-party developer Solstice. Hunt and other community solar advocates agreed.

Pairing storage with community solar is another way to increase the utility benefit by supporting system reliability, said WoodMac’s Connelly. And pending IRA benefits “may open up that opportunity even more,” she added.

A key way to reduce community solar costs is through well-designed competitive community solar project solicitations like those done though Xcel’s community solar programs in Colorado and Minnesota, said Xcel’s Klemm.

Those programs were among the nation’s first and continue to evolve, she added. Competitive solicitations in Colorado’s program “have worked well,” but the larger, less competitive Minnesota program has “had high bill impacts to non-participating customers,” Klemm said.

Recent legislative updates address that concern with measured additions of residential subscribers and underserved communities and compensation linked to system value, responded Minnesota Solar Energy Industries Association Executive Director Logan O’Grady.

“Utilities face fossil fuel price volatility and needs to decarbonize, increase energy equity, and leverage distribution system resources to meet reliability and resilience issues,” said CCSA’s Cramer. Community solar “can be developed quickly to meet those challenges,” he added.

Improved cooperation between utilities and developers has, in states like New York, proven to accelerate community solar growth through initiatives for easier bill handling, faster interconnections, and more focus on energy equity, community solar developers said.

Utilities and developers together

Regulatory and legislative guidance in New York has required utility-third party cooperation to advance community solar, analysts and advocates said.

Though some issues “can be disruptive to both developer and utility business models,” New York policy produced a state community solar program that “has been transformative,” said Empower Solar’s Schieren.

New York installed a record-breaking 532 MWdc of community solar in 2022 and brought its U.S. leading installed capacity by third party developers to over 1 GW, WoodMac’s Connelly reported.

At least 20 other states and D.C. have passed third party-enabling legislation, including at least eight bipartisan or Republican-sponsored bills, CCSA reported. And with IRA incentives and transmission constraints, portfolios of smaller distribution system level community solar projects are now cost-competitive and could see average annual growth as high as 7% by 2027, it added.

Interconnection complications are one of the two most common challenges, Hansen said. Developers and analysts agreed. The other is automating the consolidation of community solar bill credits with monthly electricity charges so that subscribers don’t have two bills, they also said.

Colorado developers report that Xcel’s inadequate distribution system is impeding community solar growth, said Democratic Colorado State Sen. Chris Hansen, who sponsored this year’s now enacted HB23-1137 to revise and expand the state’s community solar enabling legislation.

It is not yet clear whether changes in the bill will resolve Xcel Colorado’s interconnection issues, Hansen added. But “grid modernization is the next legislative focus, to enable interconnecting and leveraging clean energy in the transition to greater building and transportation electrification,” he said.

Slow interconnection and handling of bill credits are more complex in community solar projects because they involve the utility, third party developers, and customer acquisition processes, stakeholders agreed. Much work is going into streamlining those processes in states with the best community solar policies, they added.

“New York has the most proactive interconnection policy, though nobody has it figured out and it remains a roadblock in many states,” Pivot Energy’s Hunt said.

Community solar “interconnection is complicated and multifaceted,” Empower Solar’s Schieren said. But utilities and other stakeholders in New York are working collaboratively on ways to “increase distribution system hosting capacity and allocate infrastructure upgrade costs equitably between utility ratepayers and developers,” he added.

Consolidated billing for community solar was mandated in New York’s enabling legislation and is being developed in several other states, according to CCSA. Where it is not mandated, “few utilities have provided it, though that is changing because some utilities are moving in that direction to maintain the customer relationship,” Summit Ridge’s Spreyer said.

New York also has “the most robust consolidated billing” for community solar, said Pivot Energy’s Hunt. It takes advantage of the state’s value of distributed energy tariff to compensate subscribers for solar delivered at its most valuable “times and locations,” he added.

Utilities and other stakeholders in service territories as different as Maryland’s Pepco and New Mexico’s PNM also reported working on enabling legislation requiring improved interconnection, bill consolidation and low-income customer provisions for community solar.

California’s September 2022 AB 2316 could be a template for other states, CCSA’s Cramer said.

The legislation, which revises a 2013 community solar law, has “all the most innovative program design ideas, including third party participation and a New York-like compensation framework,” said Pivot Energy’s Hunt. It also requires paired energy storage, avoiding a cost shift to non-participants, bill consolidation and “a heavy focus on low-income subscribers,” he added.

Final regulatory approval of the enabling law is expected in the third quarter this year and could result in 1.5 GWdc of community solar paired with storage by 2028, WoodMac reported. “Developer interest is immense,” WoodMac’s Connelly said.

“California seems like it might be a template for the next generation of community solar,” said Solstice’s Speirs. And by requiring that at least 51% of capacity serve low-income customers, California recognized “the real importance of community solar, which is that it is the most affordable and accessible clean energy product for regular people,” she added.

Correction: We have updated this story to correct the bill number for the bill Colorado enacted this year to revise and expand its community solar enabling legislation.