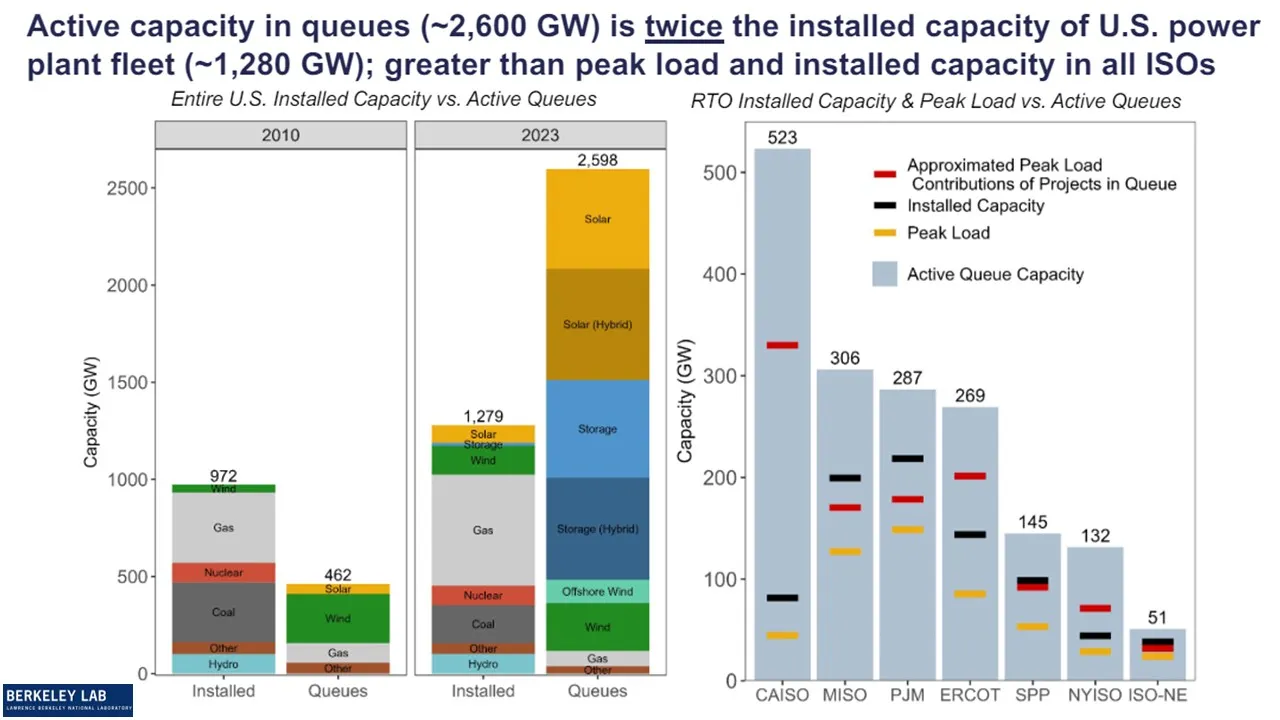

The still growing backlog of generation projects in U.S. transmission provider interconnection queues may soon be relieved by emerging innovative solutions.

Proposed generation and storage awaiting interconnection is about twice the estimated 1,280 GW of U.S. generation capacity, according to an April Lawrence Berkeley National Laboratory report. And while projects built before 2015 had taken “about 17 months” to go from application to operation, that time was “approaching 5 years for projects completed in 2022-2023,” the report said.

But in response to Federal Energy Regulatory Commission Order 2023, approved in July 2023, U.S. transmission providers and system operators have been developing new solutions.

FERC Order 2023 established some important new requirements for interconnection that update a 20-year-old process, said LBNL Energy Policy Researcher Joseph Rand. “It prioritizes more viable projects that have met readiness criteria and imposes financial penalties that require both transmission providers and system operators to step up their game,” he added.

But FERC’s order only begins to address the streamlining of the project interconnection process needed to meet newly growing loads, regulators and stakeholders agree.

Order 2023 “is an important step forward in the effort to address interconnection backlogs,” wrote former FERC Commissioner Allison Clements in her concurrence to its approval. But transmission providers, interconnection customers and other stakeholders should “consider the rule’s requirements a strong baseline and not a ceiling,” and develop further reforms, she added.

The Texas “connect and manage” streamlined interconnection option may prove viable in its energy only market, analysts said. And SPP’s work to link system planning with the interconnection process across its multi-state region could be a breakthrough in reducing queue backlogs when it is complete, they added.

California, with its just-approved interconnection enhancements, leads the innovation because it is already linking transmission planning and generation procurement with the project interconnection process, stakeholders agreed. But scoring of projects’ viability, commercial readiness and system value may not balance the needs of utilities and developers and may impede meeting load growth, some said.

California’s innovative enhancements

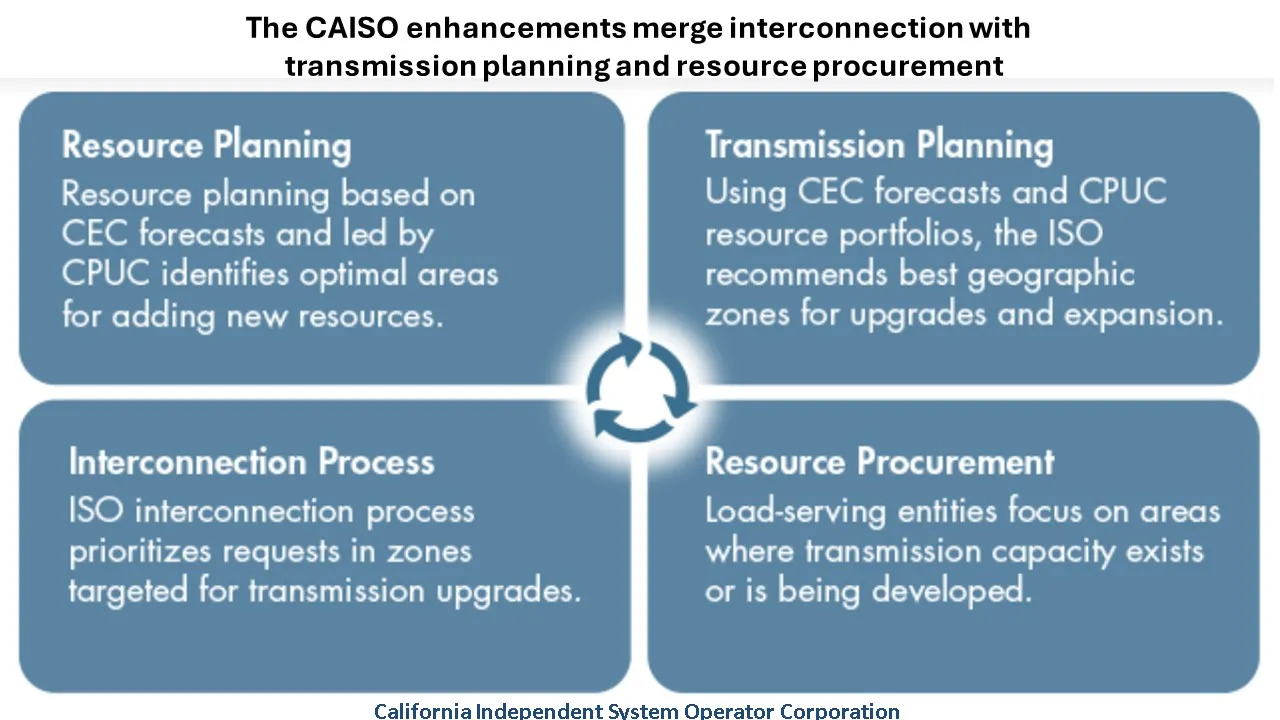

The CAISO Board voted 5-0 on June 12 to move ahead on identifying and prioritizing project interconnection where planning shows “transmission capacity exists or new transmission has been approved,” according to the just-approved plan. The enhancements are designed to interconnect projects with the most operational readiness and commercial and system value, the board added.

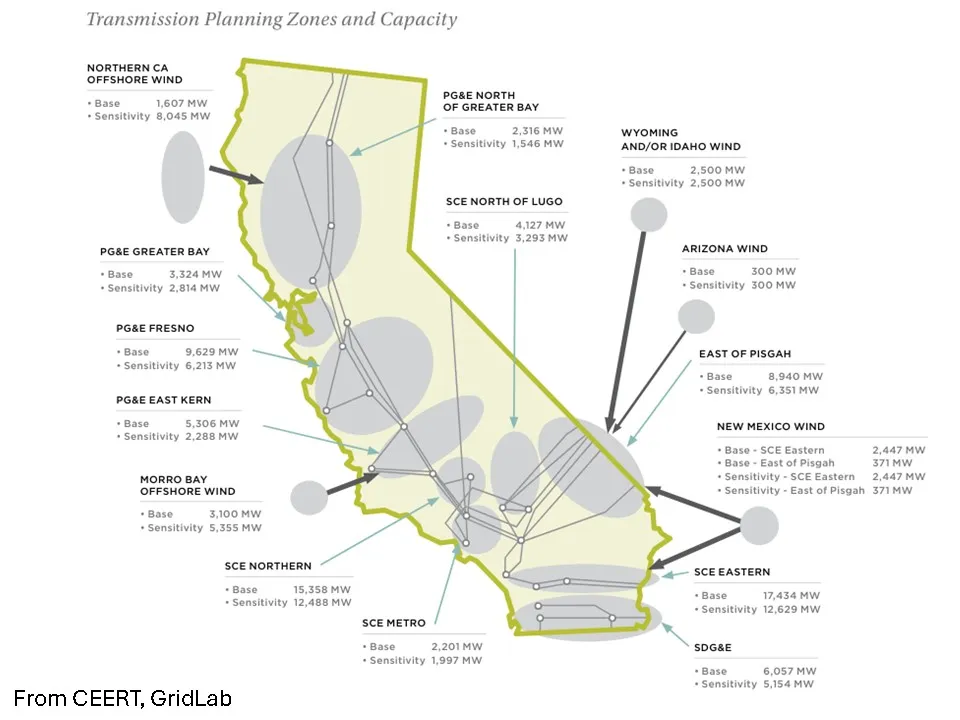

CAISO’s plan identifies “zones” where transmission capacity is available or will be built, said CAISO Principal of Infrastructure Policy Development Danielle Mills.

This zonal approach “is the cornerstone of the whole reform effort,” and other “procedural reforms” are to “enable the new approach,” Mills said. The plan guides developers to “transmission plan deliverability” zones with available transmission identified in CAISO planning, and gives utilities and other load-serving entities, or LSEs, incentives to procure those projects, she added.

Projects will earn 35% of their total “score” based on viability criteria, such as control of the proposed site and completeness of the engineering design. The project’s value as system-wide or local resource adequacy will determine another 35% of its score.

Demonstrated commercial interest by LSEs in a project will determine the remaining 30% of the score, though that could give LSEs negotiating leverage over developers who need LSE interest to score higher, both CAISO and stakeholders acknowledged.

In each zone, CAISO will select projects with the highest scores to study in detail, with the project’s value to the zone’s local distribution system as the first tiebreaker, Mills continued. For projects still tied, “the developer willing to pay more in a sealed-bid auction to have an interconnection study done wins and moves its project into the study process,” she said.

Developers of generation and battery system projects can also apply to interconnect where there is no available or planned transmission capacity, CAISO said. The developer must finance all network upgrades needed for the interconnection, and only some of the upgrade costs are eligible for cost recovery, it added.

These procedures limit CAISO studies “to the most viable projects,” but will include projects totaling 150% of the available transmission capacity to ensure LSEs have an adequate selection to procure from, Mills said. “That is the most original piece of the new process, because it ensures enough new generation to meet state goals but limits the interconnection queue to prevent backlogs,” she added.

The new enhancements bring dramatic if imperfect changes to a process that urgently requires reform to manage the interconnection queue and meet the state’s energy transition goals, CAISO’s Board of Governors agreed in its unanimous approval of the plan.

Two controversial questions

From early in the enhancements’ development, LSEs and developers debated the fairness of the influence provided to LSEs regarding projects’ commercial interest score.

An LSE could leverage its influence in the viability of a project through the expression of commercial interest to get exclusive rights or a lower off-take price from the project’s developer, said Phoenix Consulting Principal and Manager Susan Schneider, a consultant to the Large Scale Solar Association, which represents solar developers.

“CAISO is encouraging stakeholders to communicate about the projects,” but “there are no guidelines or regulations for LSE scoring of projects,” Schneider continued. Filings by large developer advocate and clean energy trade group American Clean Power Association and the Clean Energy Buyers Association supported Schneider’s concerns.

The lack of strong guidelines for LSEs has already led to LSEs trying to extract concessions, said Ryan Millard, west region senior director, regulatory and political affairs, for independent power producer NextEra Energy Resources, during the June 12 Board of Governors meeting.

An LSE recently told NextEra that “to secure LSE point allocations, developers will need to grant a right of first offer and submit a $5 per kilowatt deposit to secure that right of first offer,” Millard said. For “a 300 MW storage project, that's a $1.5 million deposit that we would need to post 10 years before [the] expected beginning [of] construction just to enter the queue,” he added.

CAISO will “monitor the new processes for potential manipulations,” but it is up to state and local agencies to regulate procurement, responded CAISO President and CEO Elliot Mainzer.

Pacific Gas and Electric and Southern California Edison insisted regulatory oversight will protect developers and ratepayers.

There is an “urgent” need to process the interconnection backlog, and commercial interest is “essential,” said Ed Smeloff, consultant to the Center for Energy Efficiency and Renewable Technologies. “There are adequate governance structures to assure project developer concerns will be heard by the LSEs,” he added.

CAISO has over 500 GW of interconnection requests, “10 times more than its roughly 50 GW peak load,” which has kept its focus on reducing the queue, said LBNL Energy and Environmental Policy Research Scientist and Engineer Will Gorman.

But available transmission may not accommodate California’s forecasted load growth of eight GW per year, some stakeholders said.

Many of the 541 projects in 2023’s Cluster 15 could be lost because available transmission plan deliverability zones will be taken up by the over 300 projects in the 2021-22 Cluster 14, said LSA consultant Schneider. And to interconnect projects where there is no remaining transmission capacity, “merchant developers would need to fund expensive upgrades and face the risk of not being reimbursed,” she added.

A June 14 CAISO report showed approximately 30 GW of transmission plan deliverability zones was allocated to Cluster 14 projects, said CAISO Vice President of Transmission Planning and Infrastructure Development Neil Millar. Some 30 GW or more of pre-Cluster 14 projects also received allocation, and the more than 60 GW of allocated transmission plan deliverability should allow meeting projected load growth and policy goals through 2030, he added.

“An additional level of analysis will be available in August to show what transmission plan deliverability is left for Cluster 15 projects,” Millar said. But “LSEs ultimately do the procurement that allows these projects to move forward,” he added.

The CAISO enhancements “reflect the reality of queue backlogs,” former FERC Commissioner Clements told Utilty Dive. “The solution is not neatly penciled out yet, but California is trying to find that path.”

Other innovations are even less developed, observers said.

Three alternative innovations

California’s enhancements “are probably the most substantial changes from the status quo interconnection process in the country,” said LBNL’s Gorman.

But to comply with Order 2023, other ISOs RTOs, and transmission providers have been developing new approaches.

The Southwest Power Pool plan to integrate planning, procurement and interconnection is still a year from going before FERC for approval, according to Steve Gaw, senior vice president for infrastructure and markets with the Advanced Power Alliance and a member of several SPP advisory committees. “It is designed to avoid the time and costs of redundant studies,” by using planning and procurement results to inform the interconnection process, Gaw said.

The concept is like California’s enhancements but is “more challenging to achieve” across SPP’s 14 states, Gaw continued. Specifically, the RTO’s Strategic and Creative Re-Engineering of Integrated Planning Team faces “the challenge of allocating costs for transmission upgrades,” he said.

But “SPP has a history of diverse states working together, and in this new moment of load growth and the need for new resources, utilities and states are more inclined to be cooperative,” said former FERC Commissioner Clements.

Developers in the Electric Reliability Council of Texas system can interconnect projects without incurring system upgrade costs if they are willing to incur the costs of curtailments. Called “connect and manage,” it is “a relatively fast and consistent interconnection process,” according to a February 2024 paper by Grid Strategies and The Brattle Group.

Introduced in the U.K. in 2010, connect and manage has allowed Texas to lead the U.S. in bringing new generation online in 2021 and 2022.

But “proactive transmission planning is needed to manage congestion,” said Grid Strategies Founder and President Rob Gramlich. And “because Texas renewables still face significant congestion and curtailment, some developers are critical of connect and manage,” he added.

The Texas interconnection success “is compelling evidence” that connect and manage can work in an energy-only market but may not work “in non–energy-only markets,” according to a 2023 Nicholas Institute paper. It would be especially difficult to replicate in multistate RTOs, because of cost allocation and resource adequacy and capacity requirements, the paper added.

No region outside of Texas is moving toward connect and manage right now, but researchers are studying ways to “delink resource adequacy from the interconnection process,” said LBNL’s Gorman.

These and other interconnection innovations are vital because “our nation is facing a grid infrastructure crisis,” former FERC Commissioner Clements wrote in her concurrence to Order 2023. The order’s changes “will help to ameliorate interconnection backlogs, but are inadequate, on their own,” she added.