Dive Brief:

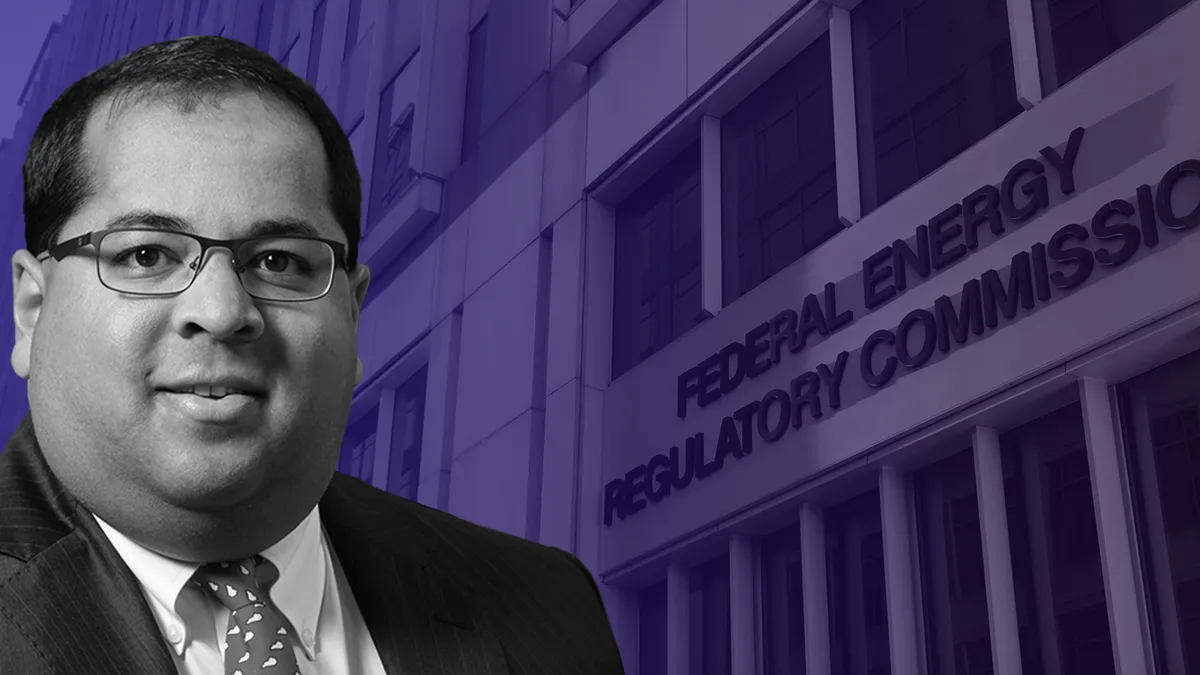

- The acting chairman of the Federal Energy Regulatory Commission told reporters Thursday he is working on an interim plan to support baseload generation while the regulatory body considers a controversial cost recovery proposal from the Department of Energy.

- Chairman Neil Chatterjee said FERC is likely to act on the DOE's cost recovery proposal for coal and nuclear plants by Dec. 11, releasing an "interim solution" and a framework to complete work on the DOE plan. An interim solution could give the regulators more time to evaluate the DOE plan, which critics say could unravel wholesale power markets if enacted.

- The call for an interim solution echoes comments filed at FERC by coal generator FirstEnergy, Bloomberg notes, and Chatterjee said he has met with the company's CEO to discuss its "thoughtful" proposal.

Dive Insight:

Each passing day seems to bring more evidence of the coal sector's direct influence on the DOE's controversial Notice of Proposed Rulemaking (NOPR).

On Wednesday, Andrew Wheeler, nominated to be deputy administrator of the Environmental Protection Agency, told a Senate committee that he had been present for conversations planning the baseload support package as a lobbyist for Murray Energy, the nation's largest coal miner.

The next day, FERC Chairman Chatterjee told reporters he met with generator FirstEnergy to discuss its proposal to save coal generation from retirement, and indicated he was keen to put one of their key recommendations into policy.

"We met with the FirstEnergy team, with our team at the commission, to really kick the tires on what they proposed and challenge them on some of what they had put forward," Chatterjee said, according to Bloomberg.

In comments on the NOPR filed at FERC, FirstEnergy advocated a temporary compensation package in which any plant designated as "resilient" by regional grid operators would receive "a payment each month equal to its full costs of operation and service," minus the plan's market revenues.

In reply comments filed this week at FERC, the company pushed harder, saying "only FirstEnergy's proposal," out of hundreds of comments filed, "lays out how the resilient units can be reasonably compensated within a market construct."

"[T]his issue is too important, too pressing, and too critical to the Nation’s security and grid reliability to leave to the never-ending vicissitudes of the so-called RTO/ISO stakeholder processes," FirstEnergy argued.

Chatterjee echoed those comments in his roundtable with reporters on Thursday.

"What I don’t want to have is plants shut down while we’re doing this longer-term analysis, so we need an interim step to keep them afloat,” the acting chair said.

FirstEnergy's meeting with Chatterjee is not the first indication of its influence over federal policy. In August, the Associated Press revealed a series of letters between Murray Energy CEO Bob Murray and White House advisors. President Trump, one letter claimed, turned to an aide during a meeting with Murray and FirstEnergy CEO Chuck Jones and directed the aide to "tell [National Economic Council Director Gary] Cohn to do whatever these two say."

"If we want to create jobs and save jobs, which is frankly what all this is about — save FirstEnergy, save jobs, save friends — why aren't we investing in training people for jobs in the future?" said Brownell, who signed on to comments opposing the NOPR with seven other former commissioners.

Regardless of FirstEnergy's influence, Chatterjee acknowledged that he will still have to win the support of at least two of his colleagues on the five-person commission. Commissioners Robert Powelson and Cheryl LafFeur have both expressed concern that the plan could "blow up" power markets.

"I don't know that we can get everybody in the lifeboat, but I think it's important that [for] plants we may need down the road, we need to evaluate and make that determination," Chatterjee said, pledging not to support any interim step that merely studies baseload generation issues.

Just last week, the Senate confirmed two new FERC commissioners — energy lawyer Kevin McIntyre and Senate staffer Richard Glick. During their confirmation hearings, which took place before the NOPR was issued, the new regulators did not address cost recovery questions directly, but pledged to keep the commission independent and fuel-neutral.

“The importance of [baseload] resources cannot be denied,” said McIntyre, who will become FERC Chairman when he is sworn in. “However, FERC is not an entity whose role includes choosing fuels for the generation of electricity. FERC’s role rather is to ensure that the markets for the electricity generated by those facilities proceed in accordance with law.”

Handing off the gavel to McIntyre won't alter the commission's evaluation process for the NOPR, Chatterjee said.

"There can only be one chairman at a time and, until a new chairman is sworn into the commission and designated to serve as [chairman] by the president, I've got to continue. It's my responsibility to continue to push forward on the work that's before us."