Efforts are accelerating to address the obstacles to interconnecting large distribution system resources like community solar and big box store rooftop solar arrays, advocates of recent reforms report.

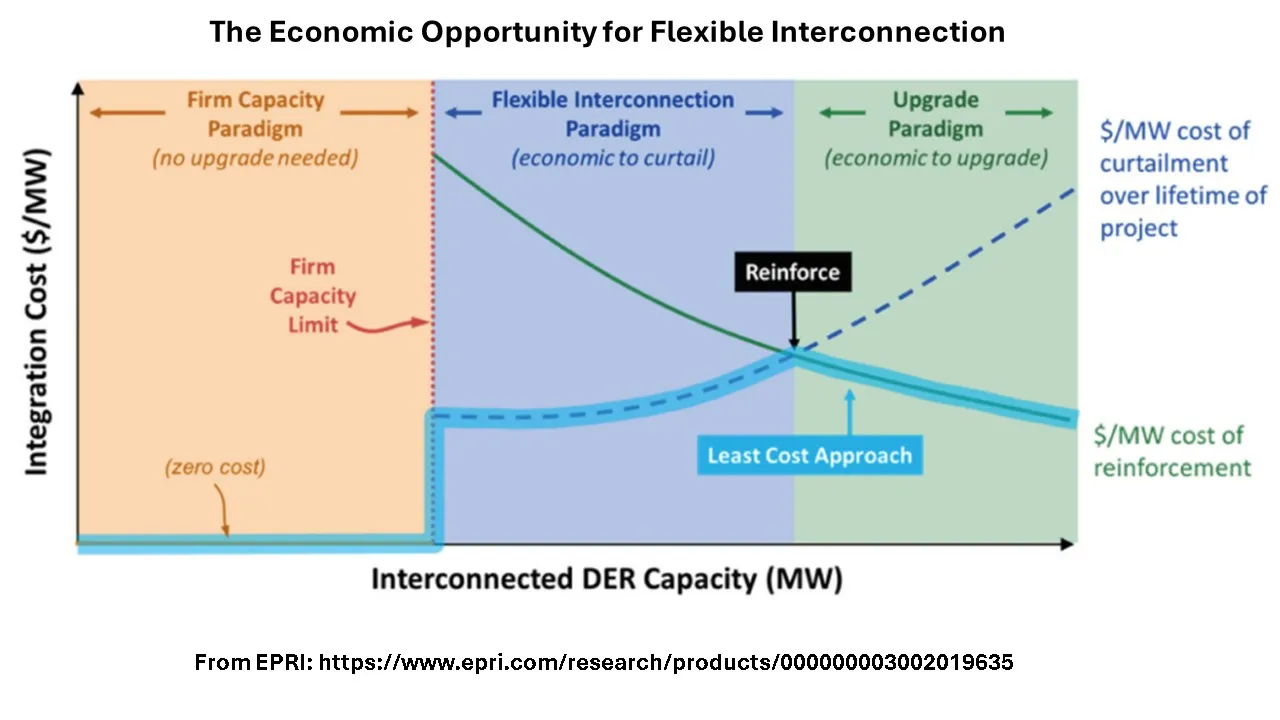

Distribution system-connected resources, especially those in the 1 MW to 5 MW range, can offer flexibility to meet electricity demand spikes without requiring significant power system upgrades, the advocates said. But costs to increase system carrying capacity under current interconnection practices make many projects that require system upgrades uneconomic, they added.

California’s limited generation profile, or LGP, option, approved March 24, will be the first state-wide implementation of the emerging “flexible interconnection” innovations for distribution system resources, which also include C&I customer-owned rooftop solar and solar plus battery systems, analysts and stakeholders agree.

The LGP option “allows developers to schedule export limits during periods of power system congestion to protect against overloads,” said Sky Stanfield, attorney for interconnection reform advocate Interstate Renewable Energy Council, or IREC, and a partner at Shute, Mihaly, and Weinberger. But losses from curtailed exports will be less than costs to upgrade power system carrying capacity, she added.

Policymakers in other states, including New York, Illinois and Colorado, are moving toward even more flexible interconnection practices for these large distribution system resources.

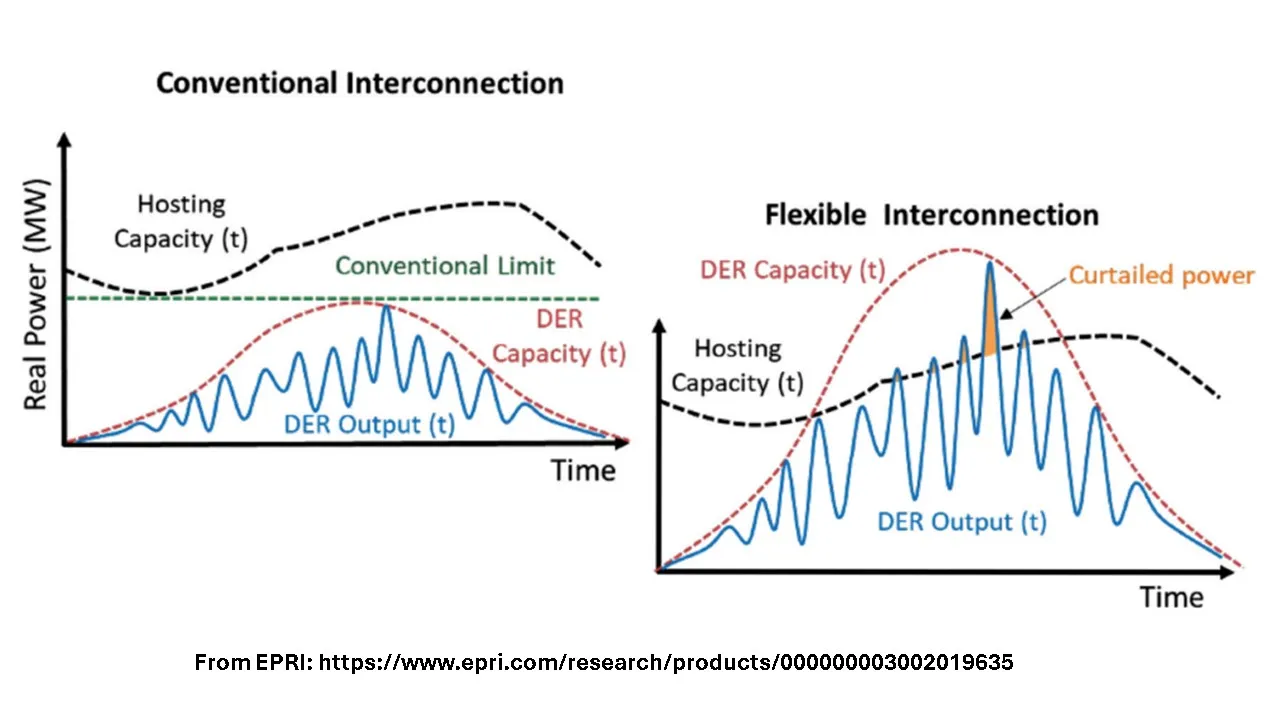

Flexible interconnections “pre-define” the annual percentage of curtailment, said Electric Power Research Institute Program Manager for DER Integration Nadav Enbar. The “central calculation” is whether the upgrade cost or the cost of unscheduled curtailments of generation from distribution system resources’ generation during periods of high power system carrying capacity congestion is more economic, he added.

Flexible interconnection options allow projects to interconnect faster by accepting limited curtailments, which supports achieving policy goals, advocates and analysts said. But the rapidly changing dynamics of U.S. distribution systems will make it challenging to protect reliability and keep developer costs predictable, they acknowledged.

The cost to interconnect

Anecdotal reports show new interconnection options for distribution system resources seem to be needed, though there is limited validating interconnection data to prove that need, stakeholders and analysts across the country agreed.

“As DER applications and penetrations rise, there tend to be more bottlenecks and longer timelines,” said IREC Director, Regulatory Program, Mari Hernandez. Public sources have reported distribution system interconnection backlogs in Maine, Massachusetts, Minnesota and other states, she added.

And a locationally-specific analysis showed a “more granular LGP” would add “significant” generation to the state’s power system, the California Public Advocates Office reported in April 2023.

The Department of Energy’s 2021 Solar Futures Study, which showed a potential for up to 200 GW of distributed U.S. solar by 2050, did not conclude anything about interconnection, acknowledged National Renewable Energy Laboratory Renewable Energy Policy and Market Analyst Manager Jeffrey Cook.

The best evidence that streamlined interconnection options are needed comes from project developers.

Distribution upgrade costs “are generally doubling developer costs in New York,” with some costs “increasing as much as six times,” reported Nexamp Director, Grid Integration Strategy and Policy, Benjamin Piiru. Without Illinois’s pilot flexible interconnection option, “we would have walked away from a project rather than pay for a $50 million upgrade,” he added.

California’s huge backlog of transmission system interconnection applications has impacted distribution system project interconnections, added Forefront Power Senior Manager, Market Development, Victoria Moroney. As a result, the vast majority of 1 MW to 5 MW projects are being delayed, and the LGP “can be a viable alternative,” she said.

The LGP option will be complicated and is only possible because of California investor-owned utilities’ years of work mapping their distribution systems, utilities and advocates said.

Limited generation profiles

LGPs allow developers to voluntarily schedule reduced generation from their projects at times when congestion is expected at their locations on the power system rather than pay to expand system carrying capacity, IREC’s Stanfield said.

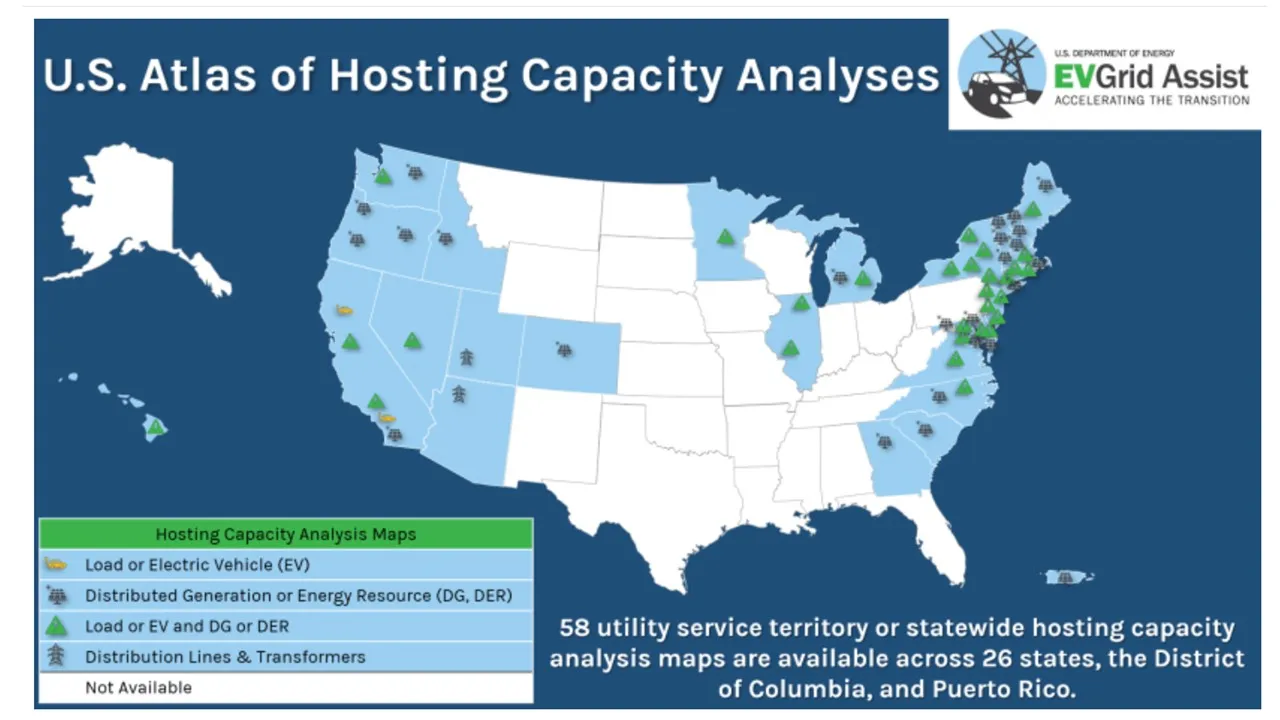

LGPs are possible because of monthly-updated, location-specific distribution system maps of hosting capacity analysis developed by California’s investor-owned utilities, Stanfield said.

Using them, California distributed energy resource providers “will for the first time in the U.S.” have the option to make the requirement to pay for increasing system carrying capacity unnecessary by “proposing an export schedule based on system conditions,” Stanfield said.

“Utilities will need assurances the necessary power control technologies are capable of maintaining developer commitments,” Stanfield acknowledged. The CPUC order postponed LGP implementation “until nine months after DER power control systems are certified” under Underwriters Laboratory, or UL, standard 3141, she added.

And with more LGP scheduling, changes in system load and supply could lead to new locations with congestion, Stanfield added. The CPUC addressed that by allowing utilities to curtail projects’ generation outside LGP schedules if there is a “sustained load reduction,” she said.

The CPUC order allows generation project owners to schedule two daily periods when their generation can be reduced below 100% of its capacity — based on patterns of distribution system capacity at the specific interconnection point, the CPUC decided. If changed monthly, that would create the maximum 24 changes in generation allowed for a project.

Southern California Edison believes LGPs can help meet clean energy goals and protect reliability, but they add “operational complexity,” Jeffrey Monford, the utility’s spokesperson, said. CPUC-ordered allowance of special load loss curtailments, required UL hardware certification, and limited scheduling changes will ensure reliability, he added.

But utilities “will still need to develop systems and operating practices to implement LGPs,” and that complex implementation will require “clear and timely” CPUC guidance, Monford said.

California’s LGP rule “is a great first step toward flexible interconnection” and “could be a gamechanger because it allows granular calculation of a project’s financial viability,” said Nexamp’s Piiru. But the developer’s decision “might be even easier under more flexible interconnection rules that set a specific maximum percent per year of curtailment,” he added.

More flexible interconnection rules are already being advanced, developers, utilities and analysts said.

Even more flexibility

Timely and cost-effective interconnection can be done in ways that give developers greater benefits and utilities more control, most stakeholders agree.

Flexible interconnection is a spectrum of approaches that “may not always be the right choice but do expand project developer options,” said Coalition for Community Solar Access Senior Director, Interconnection and Grid Integration Policy, Samantha Weaver.

California’s LGPs are “one end of the spectrum,” and New York, Illinois and other states, are piloting more flexible approaches at “the other end of the spectrum,” Weaver said.

Flexible interconnection requires utilities to have advanced communications and DER management systems, or DERMS, “to handle unscheduled but capped curtailments,” Weaver continued. For those approaches, tariffs, curtailment rules and caps will be important, she added.

Commonwealth Edison’s flexible interconnection pilot “successfully enabled 6.75 MW of solar capacity,” with only 17 curtailment event days during seven months in 2022, reported David O’Dowd, the utility’s spokesperson. The pilot showed “curtailment events and duration are not broadly predictable,” and scheduling them “would result in unnecessary curtailment,” he added.

DERMS-managed flexible interconnection is also valuable because most states’ hosting capacity analyses , including those in New York and Illinois, are inadequate for interconnection, IREC’s Hernandez said. A national standard is needed to establish a requirement for how often data should be reported and how data reports can be validated for use in interconnection decisions, she added.

Cost sharing of upgrades could also be tested in pilots, Nexamp’s Piiru said. After multiple projects interconnect at a feeder and upgrades are needed, “all the developers, instead of just the last one to apply, could share the costs,” he added.

Xcel Energy’s flexible interconnection pilot anticipated Colorado Senate Bill 24-218, which calls for the state’s regulators and stakeholders “to modernize energy distribution systems,” said its lead sponsor, state Senator Chris Hansen, D. The bill was approved by Colorado Governor Jared Polis, D, on May 22.

The utility is reviewing existing policies and gathering stakeholder feedback, reported Xcel spokesperson Kevin Coss. It will finalize plans “for a small-scale demonstration pilot within the next six months” to evaluate “policy and technical considerations needed for a broader deployment,” he added.

“Flexible interconnection is a tool,” Senator Hansen said. “With growing curtailments in Colorado, it gives project developers an incentive to add storage options to increase the use of their generation during peak demand periods when generation is not curtailed, which increases the project’s value to the system and to DER builders and owners,” he added.

Ultimately, new technologies will be needed to resolve potential complexities in flexible interconnection approaches, Hansen, Xcel and others agreed.

Still to be solved

Solutions that work for interconnection under some conditions may present impediments to interconnection under other conditions.

“The dynamics of power system operations make precise curtailment forecasting problematic,” EPRI’s Enbar said. “Even if a developer interconnects at an unconstrained location allowing full export, other interconnections there can eventually use all that feeder’s capacity, and require developers to pay for an upgrade,” he added.

But cost allocation between developers for upgrades “is not an easy question, because their revenues will be modified,” Enbar said. “Flexible interconnection can be an effective stop gap while the upgrade is built and cost allocation is worked out,” he said.

It will also be critical to define “the difference between curtailments from flexible interconnection and from a grid service program like demand response,” said Pacific Northwest National Laboratory Electricity Infrastructure and Buildings Division Principal Investigator and Project Manager Karyn Boenker.

“Developers with flexible interconnection agreements may face curtailments and financial losses, and demand response programs to protect system reliability are voluntary and compensated,” Boenker said. Policymakers must decide “how to separate compensation to each,” and regulators must decide “whether ratepayer or developers will pay” for the needed new technologies, she added.

But the current norm of relying on system upgrades “eliminates potential innovation,” said NREL’s Cook. “Interconnection processes can be tailored, and best practices will vary depending on the level of DER penetration, the utility, customer, and developer characteristics and preferences, the attributes of the electrical system, and other factors,” he added.

“There may be complicated puzzles to solve, but streamlined distribution system interconnection can save billions of dollars, reduce emissions and drastically improve reliability,” Colorado’s Sen. Hansen responded.