Dive Brief:

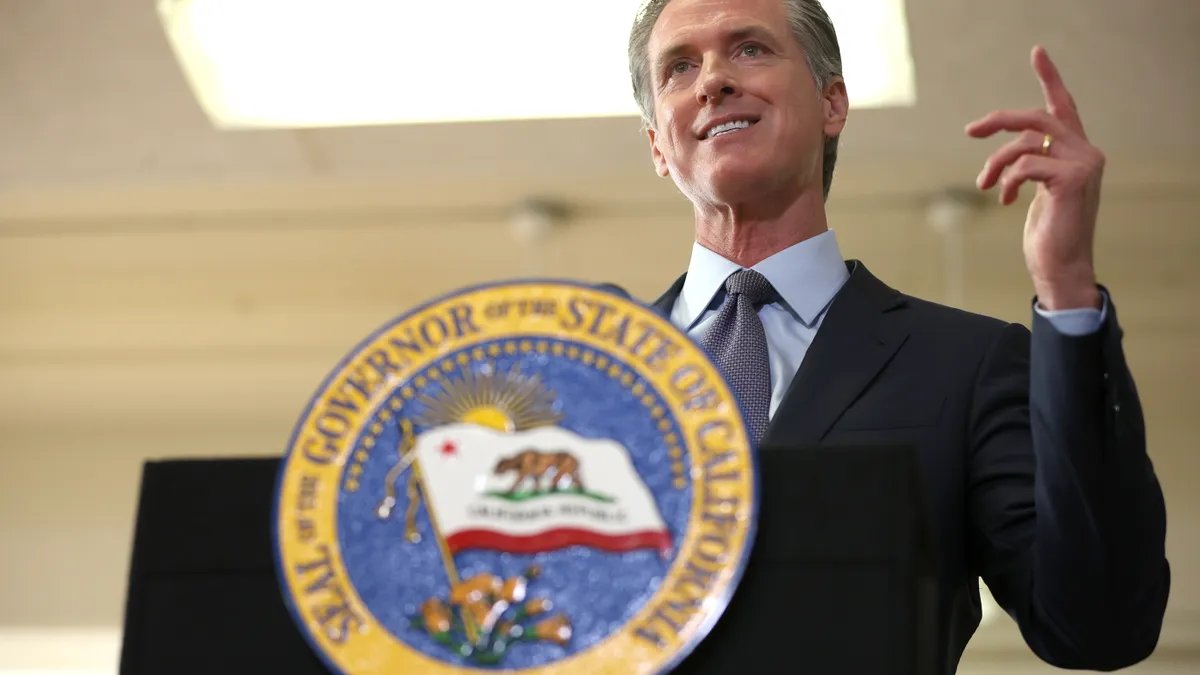

- California Gov. Gavin Newsom, D, on Saturday signed two climate-related legislative measures that push for more climate-related transparency from large companies.

- Senate Bill 253 would require business entities operating in California with annual revenues exceeding $1 billion to report their greenhouse emissions each year, whereas Senate Bill 261 would require business entities with revenues exceeding $500 million to publicly disclose their climate-related financial risks and countermeasures.

- Though signed, the execution of the bills could face a delay as Newsom raised concerns over the implementation deadlines and the “overall financial impact” the bills would have on businesses across California.

Dive Insight:

Both SB 253 and SB 261 were passed by the California Senate and Assembly in mid-September and were presented to Newsom to be signed or vetoed by Oct. 14 — a motion the California governor proceeded to act upon last week.

The signing of the two bills aligns with efforts by federal regulators to require more transparency from companies on carbon emissions and climate risk, and to curb greenwashing practices.

According to SB 253, California would pass regulations by 2025 that would require companies making more than $1 billion in revenue to publicly disclose their scope 1 and 2 emissions to a reporting organization in 2026. Starting in 2027, companies would then need to begin reporting their scope 3 emissions. The bill also requires companies to report their greenhouse gas emissions in a “manner that is easily understandable and accessible to residents of the state,” and requires such public disclosures to be independently verified by a third-party auditor. The bill would impact more than 5,300 companies operating in California, sustainability nonprofit Ceres estimates.

The legislation received support from major corporations such as Microsoft, Ikea U.S.A., Patagonia and, most recently, Apple.

SB 261 focuses on climate-related financial risks posed by companies’ operations. Those that generate more than $500 million in revenue would need to prepare biennial reports of their climate-related financial risks and strategies for risk management, beginning no later than Jan. 1, 2026. The legislation is expected to impact more than 10,000 companies operating in California, according to a Senate floor analysis from last month.

Despite signing the bills and showing support for California’s “bold responses to the climate crisis,” Newsom expressed concerns regarding the deadlines outlined in the bills, and the financial impact the legislation could have on businesses.

“The implementation deadlines in this bill are likely infeasible, and the reporting protocol specified could result in inconsistent reporting across businesses subject to the measure,” Newsom said in a press statement for SB 253.

“I am instructing [the California Air Resources Board] to closely monitor the cost impact as it implements this new bill and to make recommendations to streamline the program,” he added.

The California governor mirrored this sentiment for SB 261 as well and said his administration would work with the authors of both bills and the legislature to address these issues next year.

“Given the reach of California’s new rules, the message for any business … that meets the stated revenue thresholds is the same: start building — or building on — institutional capacity to make emissions and climate-related disclosures,” Bessie Daschbach, a partner at Hinshaw & Culbertson focused on sustainability and litigation, told ESG Dive.

“For those businesses who may have been hoping to wait out the SEC’s finalization of its disclosure rules, there is no longer room to do so,” she added. “California’s rules have expedited the trajectory.”

Interested in this type of news story? Industry Dive’s newest daily publication, ESG Dive, is set to launch Oct. 23. Sign up now.