Through the Microgrid Resources Coalition, or MRC, companies such as Bloom Energy, Google and Schneider Electric are backing an extension of the federal investment tax credit for microgrid controllers, the equipment that enables microgrids to operate.

Reps. Jimmy Panetta, D-Calif., and Claudia Tenney, R-N.Y., this fall introduced H.R. 5807, a bill that would extend by eight years the 30% tax credit for microgrid controllers, which expires at the end of next year when the clean energy tax credit framework becomes technology-neutral.

The effort to extend the tax credit for microgrid controllers comes amid headwinds facing microgrid developers, such as a jump in interest rates and general uncertainty around pending guidance from the Treasury Department on hydrogen tax credits, which may delay other needed guidance, according to Pierson Stoecklein, MRC executive director.

Microgrids are a network of distributed resources, such as solar panels and backup generators, and loads that can disconnect from a wider grid or operate in areas that don’t have a grid system.

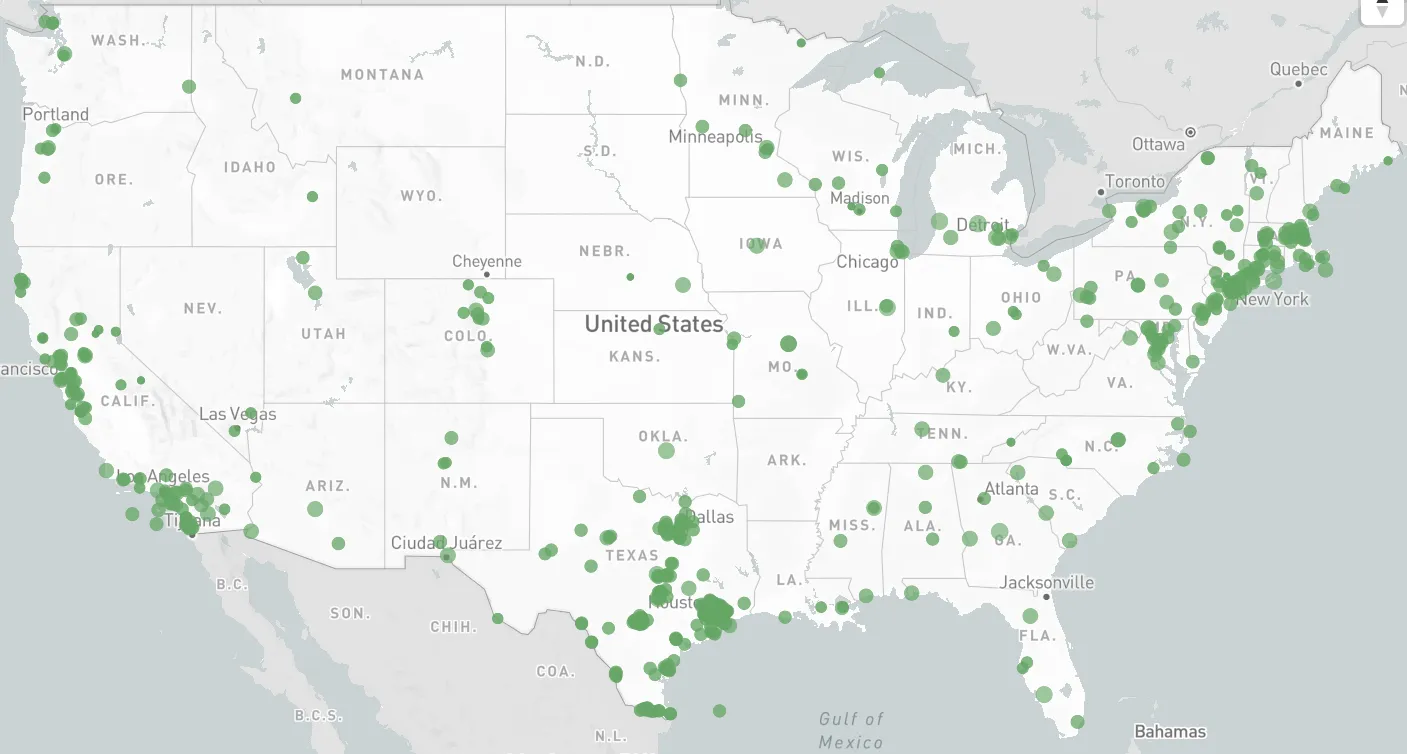

There were 671 microgrids totaling 4,357 MW in the United States as of Jan.1, up from 173 microgrids totaling 2,211 MW a decade earlier, according to the Department of Energy.

States with the most microgrid capacity include Texas with 840 MW, followed by New York with 637 MW, Alaska at 522 MW, California at 425 MW and Hawaii at 234 MW, according to DOE. The microgrids use a mix of power sources, including gas- and diesel-fired generators.

Guidehouse, a consulting firm, expects clean energy microgrids across the world to grow by 18.7% a year to about 20 GW in 2031 from 4.3 GW last year, with the most capacity installed in the Asia Pacific region, followed by North America.

Generally, distributed resources account for about 70% of a microgrid’s costs, but the controller is its most important technology, according to Peter Asmus, executive director of the Alaska Microgrid Group and a former microgrid analyst for Guidehouse.

Microgrid trends

There are two major trends in the microgrid sector, Asmus said.

First, Asmus expects microgrids will increasingly be merged into virtual power plants that can provide grid services.

A microgrid is the “perfect” demand response resource because when it islands, a grid operator knows all of that load is off the system compared to other demand response resources that may or may not respond to requests to reduce electricity use, according to Asmus.

When power supplies were tight during a 2022 heat wave, San Diego Gas & Electric called on Marine Corps Air Station Miramar to run its microgrid to ease stress on the grid, Asmus said.

Second, Asmus expects to see more modular microgrids, such as ones developed by Bloom and Scale Microgrids. The commercial and industrial sector is the fastest growing segment for microgrids, he said.

Microgrids are also receiving support at the state and federal level, according to Stoecklein. The Department of Energy last week announced $3.5 billion in grid resilience funding, including for at least four microgrid projects.

And earlier this year, the Texas Legislature passed an energy bill that included $1.8 billion for microgrids and expedited siting and interconnection, according to Stoecklein. In addition, the Colorado Energy Office aims to develop a microgrid “road map” by next summer.

Key challenges remain

However, the microgrid industry faces major challenges, including a selloff in the stocks of some companies involved in the sector, Stoecklein said. In the last six months, for example, Ameresco shares have dropped about 36%, Bloom Energy shares are down about 34% and Sunnova Energy International stock has plunged 53%.

At the same time, interest rates are roughly double from a year ago, making project finance challenging, especially when many companies involved in microgrids cannot afford to finance them directly, according to Stoecklein.

The Inflation Reduction Act is helpful for companies that can use its direct pay option or find a tax equity partner, but the law’s tax credits only become available after a project is built, he said.

Everybody is wondering when interest rates will ease, according to Stoecklein. “It either has to be that we see a reprieve or industry in general resets and gets comfortable with a new metric for what is a reasonable rate of return on your investment,” he said.

One of the key challenges for microgrids is finding a way for third party microgrids to be compatible with incumbent utilities, Stoecklein said.

“There's just a fundamental tension between a whole lot of behind-the-meter distributed assets being deployed in a particular [utility] service territory because then suddenly that's a customer that is not paying the utility,” he said. “We need to find ways to remove that tension because otherwise it becomes a zero sum game.”