Dive Brief:

-

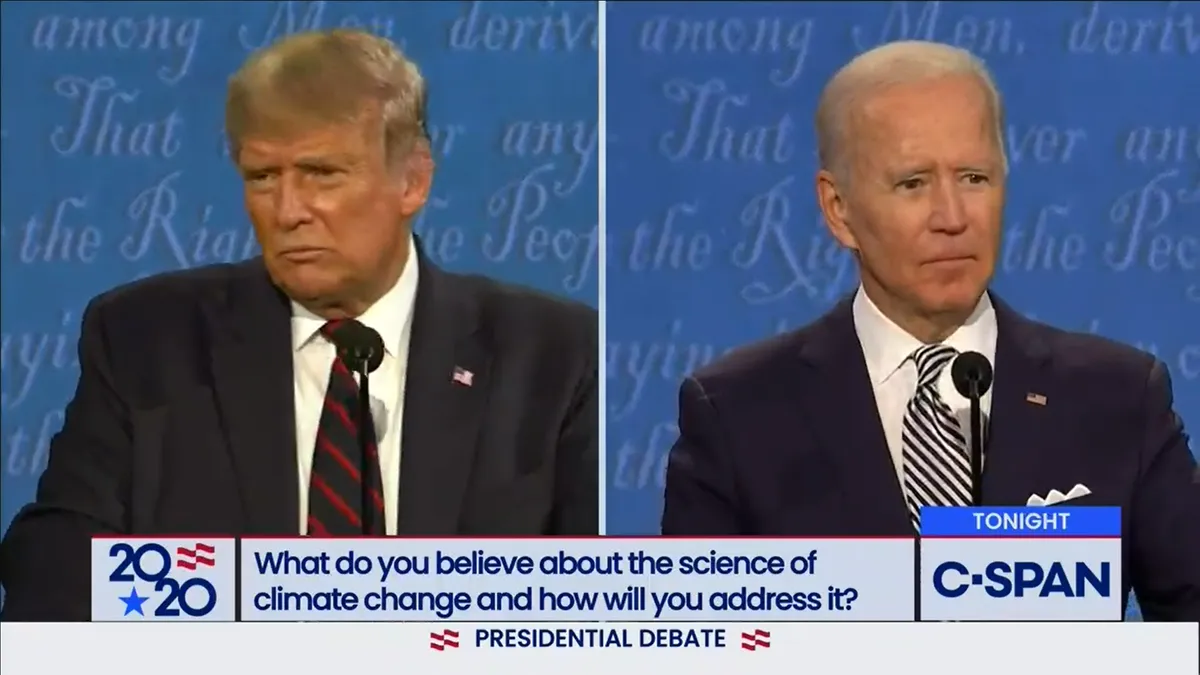

U.S. utilities will likely maintain their current trajectory with regard to renewable energy adoption regardless of who wins the presidency, according to a new analysis by S&P Global Ratings.

-

A victory by Joe Biden could trigger rapid acceleration in renewable energy deployment and increased installations of residential solar and storage, according to the report. Under Donald Trump, oil and gas development could benefit from greater federal subsidies.

-

While many states have enacted climate policies in excess of federal regulations, a Biden administration could spur states that have taken fewer actions on greenhouse gas emissions, according to the report, which could result in financial impacts to electric customers if utilities are forced to quickly adapt to new policies.

Dive Insight:

A victory by the Biden administration could nearly double the annual rate of solar deployment in the U.S., according to a new report by S&P Global Ratings, but the presidential candidate's pragmatic approach to the nation's ongoing energy transition could result in a more gradual implementation to minimize financial impacts to customers.

U.S. utilities have, largely of their own accord, begun an energy transition, with the utility industry "cutting in half its reliance on coal generation, and increasing its reliance on natural gas generation," the S&P report reads. "The industry's robust capital spending is centered on renewable energy, battery technology, and natural gas generation. We expect that regardless of the U.S. administration, the utilities will continue on this path."

J.R. Tolbert, managing director of the national business group Advanced Energy Economy, holds views similar to the S&P report.

"Under a Trump administration we expect to see continued growth of advanced energy as these technologies are now competing on price and performance with natural gas and even better against coal and oil," he said. "This despite Trump's attempts to resuscitate coal has been a failure in the face of technology and market forces. Embracing clean energy technology and moving away from fossil fuel commodities is simply a better long-term economic solution than fossil fuels."

The results of the presidential election could, however, serve to enable different outcomes for specific energy resources. Biden, according to S&P, would likely foster greater adoption of solar energy in particular, thanks in part to his administration's goal of installing 500 million solar panels by 2025. S&P analysts estimate that if this goal is achieved, it could result in the installation of some 30 GW of solar per year for the next half decade. The current record for annual solar deployment in the U.S., the report notes, is 15 GW in a single year.

"It's clear this target would represent a game-changer for solar," said Aneesh Prabhu, a senior director with S&P Global Ratings.

If coupled with a Democratic sweep in congress, S&P predicts that a win by Biden would bolster residential solar and storage companies in particular. Biden's policies could also increase the cost of fossil fuel production while decreasing demand, a dynamic that coupled with the effects of the pandemic could result "in a crush of stranded assets," according to the report.

Trump, on the other hand, is likely to implement additional subsidies and tax cuts for the oil and gas industry "under the auspices of encouraging domestic production and promoting energy independence."

Advanced Energy Economy also expects that a Trump administration could attempt to impede state climate commitments and rules related to competitive wholesale markets, Tolbert said.

"Under a Trump administration that continues to throw hurdles in front of a global growth sector, we may lose our competitiveness," Tolbert said.

A Biden presidency would also likely accelerate the development of offshore wind, while a Trump administration could slow offshore wind deployment by allowing lengthy impact analysis studies to delay projects and eliminating tax credits, Prabhu said.

In states that have not adopted climate-related policies, a rapid shift to such renewable energy targets could result in increased electricity bills for consumers, according to S&P. However, the report anticipates that "the utility industry will coax some exceptions from a possible Biden administration" resulting in a more gradual but more affordable transition.

Prabhu noted that Biden differs from some of his Democratic counterparts in his support for nuclear energy and his willingness to allow fracking to continue as a matter of practicality.

"As long as you don’t have to supplant existing resources," Prabhu said, "you can usher in a change over time."

And analysis by Advanced Energy Economy, Tolbert said, suggests this approach could result in economic gains across the nation, ranging from a four-fold return on investment in Florida to a fourteen-fold impact in Arizona.

"Bottom line," Tolbert said, "advanced energy technologies are competing now on cost and performance. The next president can choose to hamper this exponential growth and reduce U.S. competitiveness, or accelerate it and benefit from millions of new jobs."