Dive Brief:

- The July enactment of the Advanced Nuclear for Clean Energy, or ADVANCE, Act and the U.S. Department of Energy’s June announcement of up to $900 million in funding for early small modular reactor deployments are positive developments for NuScale’s business, CEO John Hopkins said on the company’s earnings call. These developments came amid increased interest from hyperscale data center operators and manufacturers seeking reliable, emissions-free electricity, Hopkins said.

- But project complexity and risk aversion among potential offtakers have dogged NuScale’s efforts to close revenue-generating customer agreements, Hopkins said during the call’s Q&A session.

- Actions taken by NuScale to reduce operating costs and improve efficiency, including an approximate 28% reduction in its workforce earlier this year, helped the company trim operating losses in Q2 2024, the company said Thursday. NuScale reported an operating loss of $41.9 million in the quarter ended June 30, down from an operating loss of $56.1 million in Q2 2023.

Dive Insight:

The rapid growth of data centers in support of artificial intelligence is the “most exciting source of new demand” for clean, firm electricity, Hopkins said on the call.

In the investor presentation accompanying its earnings release, NuScale cited a May projection by the Electric Power Research Institute that data centers could account for up to 9.1% of U.S. electricity demand by 2030 from an estimated 4% today.

Onshoring of heavy manufacturing operations is also expected to drive demand for 24/7, emissions-free power, Hopkins said.

Rather than own their own power generation facilities, hyperscale data centers and other large-scale power consumers prefer “a build-own-transfer or a build-own model where they provide the long-term PPAs required and our global developer partner helps bring the financing and [development capability],” he said.

NuScale has been working with ENTRA1 Energy, its development partner, for nearly two years to refine its approach to building power generation facilities while working to close individual deals with large offtakers, Hopkins said.

“We're in almost daily … communications trying to drive closure to some of these projects,” he said during the Q&A session. “We're as anxious as you are.”

Hopkins did not directly mention NuScale’s previously announced relationship with Standard Power, a digital infrastructure services provider that tapped NuScale last year as its technology partner for nearly 2 GW of SMR-powered data center capacity in Pennsylvania and Ohio.

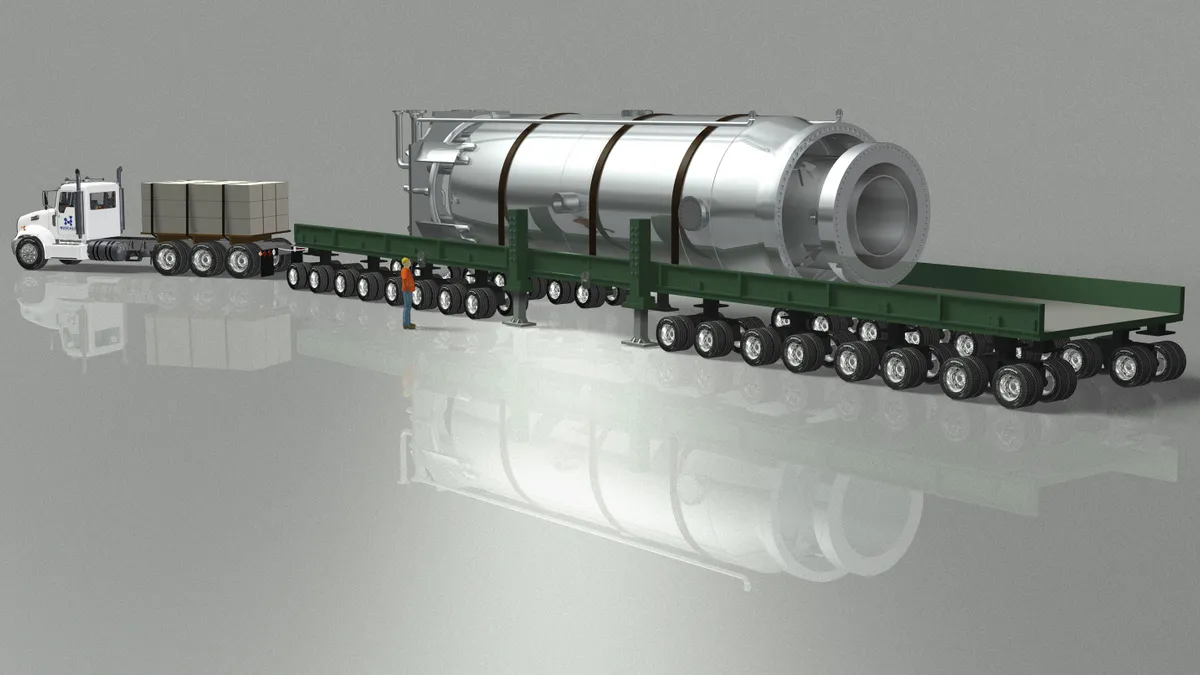

Hopkins reiterated on the call that NuScale’s technology remains the only SMR to receive design certification from the U.S. Nuclear Regulatory Commission. Though the NRC’s Jan. 2023 certification was based on an earlier 50-MW version of NuScale’s VOYGR reactor, the company’s application for NRC approval of a 77-MW version is on track to conclude by mid-2025, Hopkins said.

Several other SMR and advanced nuclear reactor technology developers have NRC license applications in process, including TerraPower, Westinghouse, GE-Hitachi Nuclear Energy and Holtec International.

Following the November demise of the 462-MW Carbon Free Power Project, NuScale’s most advanced project is an effort to build a 462-MW nuclear generation facility on the site of a former coal-fired power plant in Romania, Hopkins said. That project is proceeding now into an approximately 12-month engineering and design phase, after which the Romanian government could approve general construction, he added.

NuScale is working as a subcontractor to Fluor Corporation, the project developer, Hopkins said. Fluor Corporation spun off NuScale ahead of NuScale’s 2022 initial public offering and remains the company’s majority owner.

Hopkins cited the recently passed ADVANCE Act as a boon for its international projects. The ADVANCE Act expands NRC cooperation with international partners on regulation, development and export of advanced nuclear reactor technologies and directs the DOE to improve its nuclear technology export approval process, according to law firm Sidley Austin.

The ADVANCE Act could also support NuScale’s domestic activities by streamlining coal-to-nuclear conversions, Hopkins said. The DOE in 2022 identified more than 300 retired or retiring coal-fired power plant sites as potentially suitable for nuclear reactor development.

DOE’s upcoming SMR solicitation is another significant domestic opportunity for NuScale, Hopkins said.

The solicitation has two tiers, according to DOE: as much as $800 million in “first mover team support” for up to two teams of “utility, reactor vendor, constructor, and end-users or power off-takers committed to deploying a first plant while at the same time facilitating a multi-reactor, Gen III+ SMR orderbook,” and as much as $100 million in “fast follower deployment support” for awardees committed to addressing bottlenecks in design, licensing, supply chains and site preparation.

“We believe NuScale is well-positioned for consideration to be a recipient or a recipient partner under both of these awards,” Hopkins said. The DOE is expected to announce final award selections in mid-2025, he added.

NuScale officials on the call did not discuss an ongoing investigation by the SEC into the company’s employment, confidentiality and severance agreements.

The SEC first requested information from NuScale in Dec. 2023 and asked for additional information on July 31, according to a news release from Hagens Berman, a law firm soliciting investor claims for a possible class-action lawsuit.