Dive Brief:

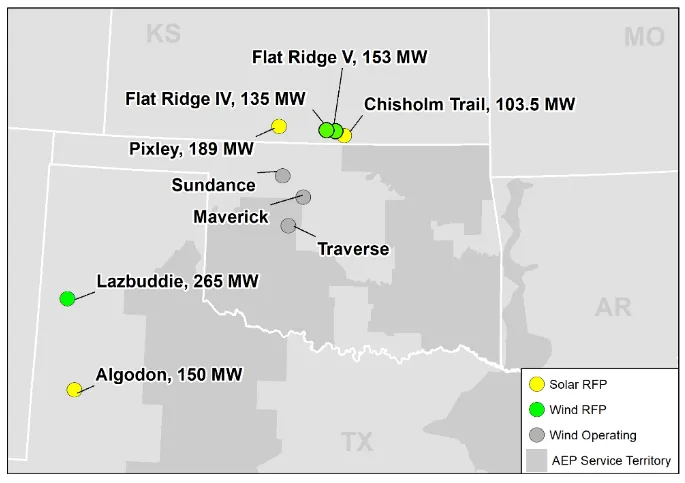

- Public Service Co. of Oklahoma, an American Electric Power subsidiary, would spend almost $2.5 billion to buy three wind and three solar generating facilities totaling roughly 995.5 MW to be built by Invenergy, according to Thursday filings with the Oklahoma Corporation Commission.

- PSO expects the planned projects in Kansas and Texas — 553 MW of wind and 442.5 MW of solar — will produce $1 billion in federal tax credits. The projects are set to be operating before January 2026 and produce a 2.1% rate increase that year, according to the utility.

- “PSO’s ownership of the Renewable Resources will be beneficial for customers by supplying needed capacity and fuel free energy,” the utility said in a filing. “Adding additional renewable resources to meet PSO’s capacity needs will help contribute to [PSO’s] customers achieving [their carbon reduction] goals and provide additional opportunities for economic development activities.”

Dive Insight:

The proposed deal with Invenergy grew out of PSO’s 2021 integrated resource plan, which called for acquiring 4,150 MW of renewable resources, Matthew Horeled, PSO vice president of regulatory and finance, said in a filing.

PSO received 17 proposed projects in response to requests for proposals for up to 1,350 MW of solar and 2,800 MW of wind on a fixed-price, turnkey basis. Utility affiliates weren’t allowed to bid in the process.

The projects will cost nearly $2.2 billion, or $2.2 million/MW, not counting related expenses PSO wants to add to its rates.

After PSO selected the projects in May, the utility let bidders update their offers based on changing market conditions, which included a significant increase commodity costs; increased fuel and transportation costs; COVID-19 supply chain effects; overall inflation, including labor costs; and the Inflation Reduction Act, which became law in August, according to the Tulsa, Oklahoma-based utility.

The wind and solar projects will provide fuel-free energy that will provide a hedge against the risk of more volatile fuel prices and potential future fuel price increases, Horeled said.

PSO’s planned ownership of the wind and solar farms, compared to buying electricity through a power purchase agreement, will provide better “alignment and balancing” of utility and customer interests, according to Horeled.

“Utility ownership puts reliability at the forefront by adopting design standards (including cold weather turbine packages) that focus on a high facility availability throughout the year and especially during times of grid stress,” he said.

PSO’s proposal is part of AEP’s overall plan to shift away from fossil fuels. The company expects its utilities will spend $8.6 billion from 2023 through 2027 on renewable energy, according to a Nov. 13 presentation.

AEP expects it will add about 8,170 MW of solar, 7,200 of wind, 1,530 MW of gas and 300 MW of storage in the next 10 years.