An 18-month fight over energy in Massachusetts just culminated in passage of a streamlined bill being called “a huge step” for clean energy and “transformational” for offshore wind.

“An Act to promote energy diversity” (H. 4568) passed in a 157-to-1 House vote on July 31 that was concurred by the Senate, which had already passed an earlier version. The next day, the biggest offshore wind energy developer in the world filed an interconnection application for an 800 MW project to be built off the Massachusetts coast.

Governor Charlie Baker (R) backs the bill and is expected to sign it into law. While many provisions were eliminated in vigorous deal-making between Senate and House lawmakers, the final, trimmed-down Act calls for the state’s utilities to make two large renewable energy procurements

One is for 1,600 MW of offshore wind by 2027. “This will start a new U.S. industry,” Massachusetts House Speaker Pro Tem Patricia Haddad (D) told Utility Dive. She introduced the original legislation 18 months ago.

The other important energy procurement in the bill is for 9.45 TWh of “clean energy generation.” It can come in three forms: hydroelectric generation, renewable resources, or renewables “firmed-up” with hydro in blended contracts.

This second procurement’s 9.45 TWh are an equivalent to approximately 1,200 MW of nameplate hydropower or approximately 1,700 MW to 3,000 MW of nameplate onshore wind, depending on capacity factor assumptions.

The two clean energy procurements will help Massachusetts deal with the coming closure of aging generation facilities like the 1,530 MW Brayton Point coal plant and the 690 MW Pilgrim nuclear station, Haddad said. It is also expected to help the state diversify a fuel mix that stands at about 64% natural gas, 7% coal and less than 10% renewables. But because an amendment barring electric utilities from buying gas pipeline capacity with ratepayer funds was left out of the final bill, some environmentalists worry it won’t do enough to stem the state’s reliance on the resource in the short term.

A 'transformational' madate

Compared to its peers in Europe, the U.S. trails in offshore wind.

When Deepwater Wind's 30 MW Block Island Wind Farm goes online this summer off Rhode Island's coast, it will be the first project in U.S. waters. But globally, the industry set an installation record in 2015, upping its 1,069 MW performance in 2014 to at least 3,996 MW.

Cumulative global offshore wind capacity is now over 11,800 MW and it is on track to reach as much as 47,000 MW by 2020, according to the National Renewable Energy Laboratory (NREL). Over 91% of offshore wind capacity, or 11,034 MW, has been built in waters off the coast of eleven European countries, says the Global Wind Energy Council.

U.S. offshore wind has lagged primarily because its installed price is still too high for most U.S. utilities to consider without a mandate or additional subsidy. But Massachusetts, like some of those European nations, has “world-class” offshore wind potential that is close to New England load centers that already pay high prices for electricity, a recent report from the Union of Concerned Scientists (UCS) noted.

Exploiting that resource, UCS said, could help the state “capture first-mover economic advantages” in the offshore wind manufacturing and supply chain industries and in the project development and operations and maintenance businesses.

The plan laid out in the new bill could very well do that, according the University of Delaware’s Willett Kempton, author of a Massachusetts offshore wind cost study from the university’s Special Initiative on Offshore Wind.

“Massachusetts has targeted a transformational quantity of capacity in a systematic sequencing of projects that will lead to a substantial lowering of costs and the establishment of a new U.S. industry," Kempton said.

Wind industry representatives echoed that sentiment.

The state can be “the cradle of an entirely new domestic supply chain that could revitalize East Coast port cities, supporting offshore wind development and potentially thousands of jobs,” said AWEA Advocacy and Federal Legislative Affairs Manager Nancy Sopko.

These economic benefits were pivotal to Rep. Haddad.

“New York is ready to get a project in the water,” the veteran state lawmaker said. “An offshore wind industry supply chain in my district along the south coast of Massachusetts could supply the proposed Long Island project and projects that get built in the future in the New England Wind Energy Areas.”

Critics question whether offshore wind will ever become competitive with traditional generation sources, but some independent projections support the industry’s optimism. A recent report from NREL concludes offshore wind is likely to be economically viable by the 2020s.

A combination of high retail electricity prices and industry efforts to brings offshore wind’s levelized cost of energy (LCOE) down will make the Northeast and some Eastern Seaboard regions the most likely early leaders in cost-effectiveness, NREL reported.

A homegrown offshore wind industry will make it possible for Massachusetts ratepayers to save $355 million on their electric bills and save another $4.57 billion dollars by avoiding fossil fuel price spikes, according to estimates by ReNew Northeast, an environmental group.

The bill’s offshore wind mandate confronts doubts about above-market development costs head-on.

“That 1,600 MW of offshore wind is an amazing number,” said UCS Sr. Policy Analyst John Rogers. “That is a serious vote for launching a U.S. offshore wind industry and for Massachusetts capturing the lion’s share of the economic benefits and jobs the new industry will offer.”

The bill’s 1,600 MW mandate, along with commitments from New York, New Jersey, and Maryland that could total another 2,500 MW, will “lead to economies of scale and sector experience that will achieve good cost reductions,” Kempton said.

Kempton’s University of Delaware study concluded an offshore wind build-out at that scale over a decade could reduce the LCOE to $0.108/kWh. For comparison, Block Island’s 20-year power purchase agreement with National Grid is $0.244/kWh, comparable to ISO-New England wholesale prices this summer.

A price drop like the one envisioned in Kempton’s study would make offshore wind competitive in New England and Mid-Atlantic coast markets, even in the presence of low gas prices. Already, one developer has shown confidence in the new mandate. Denmark’s DONG Energy, the largest offshore wind developer in the world, filed an interconnection request Aug. 1, crediting what it called the first U.S. bill with “a specific commitment for offshore wind at a scale necessary to create a viable market in the United States.

DONG validated the New England market’s potential last summer, when it took over a Department of Interior Wind Energy Area lease site off the Massachusetts coast and opened an office in Boston. In Denmark’s recent July 2016 North Sea site auction, DONG delivered a contract at €72.70/MWh ($108/MWh).

The DONG interconnection application shows they are preparing to move ahead in Massachusetts, Kempton said. But OffshoreMW, the Wind Energy Area's other leaseholder, is also spending in anticipation of development.

Natural gas worries

Though included in some earlier versions, the final bill left out a provision that would have barred the state’s electric distribution utilities from signing long-term contracts for natural gas pipeline capacity.

That, noted Brydon Ross, vice president for state affairs at the Consumer Energy Alliance, will reinforce utilities’ option to use natural gas to meet unplanned electricity demand spikes.

“ISO-New England says the region will have a significant capacity shortfall in the coming years without increased natural gas supplies,” Ross said. “Consumers will need all types of options to keep the lights on at affordable prices.”

Peter Shattuck, director of Acadia Center Massachusetts, sees the issue differently. He pointed to the “Regional Electric Reliability Options Study” by the Massachusetts Attorney General’s office, which concluded a reduction in natural gas supplies will not lead to peak winter demand period electric system “deficiencies” through 2030, under existing market conditions.

The Attorney General’s study concluded New England should opt for more energy efficiency and demand-side management, rather than building new gas pipelines, a finding gas supporters say ignored dozens of studies to the contrary. Environmentalists, meanwhile, say other industry-supported analyses failed to take into account the potential of electric demand reductions.

Whether new pipelines are needed or not, both Shattuck and UCS’s Rogers expect the state’s Supreme Judicial Court to rule against the DPU decision, barring utilities from using money from the rate base to invest in gas pipelines once again.

Until offshore wind and other solutions scale up significantly, though, Massachusetts faces a choice between natural gas for the bulk of its generation and wind and hydropower imported from out-of-state.

Already, New England and Massachusetts are “well into the danger zone for overreliance on natural gas,” according UCS’s Rogers. The bill's clean energy procurement eliminates the climate change and health impacts of increased natural gas and offers economic benefits at what UCS's estimates show to be modest costs.

“Massachusetts is unlikely to stop using natural gas any time soon,” Rogers said. “But the state needs to face the overreliance and put its energy mix together in a way that makes utility customers less subject to the vagaries of natural gas prices.”

The option in the bill that allows wind, solar, biomass and other Class I RPS resources to compete in competitive bidding for the 9.45 TWh of clean energy is expected to help keep costs for the second procurement down, according to both Shattuck and AWEA.

“The cost of land-based wind has fallen by two-thirds in six years and it is among the least-cost options for generating electricity in many parts of the country,” AWEA said.

The price of “firm” contracts for hydropower and onshore wind is not certain, but it must include the cost of the transmission necessary to deliver the hydropower from Canada, Shattuck said.

“If a bid from onshore wind is $0.08/kWh, the hydro has to be competitive,” he said. “That will likely put downward pressure on clean energy market prices.”

The governor’s original proposal, filed last summer, called for 18.9 TWh of new clean energy by 2023. During the Senate-House negotiations that shaped the final bill, it was reduced to 9.45 TWh. But the House’s original proposal for 2,000 MW of offshore wind was only reduced by 20%.

During the early stages of the bill’s evolution, “people interested in bringing hydro from Canada said there were about 1000 MW of hydro that would not require any new transmission to deliver,” Rep. Haddad told Utility Dive. “I’m sure that same message was delivered to the governor’s office and the Senate.”

The original 18.9 TWh clean energy procurement, without offshore wind, would have reduced natural gas requirements by an estimated 10%, according to analysis from Power Advisory LLC President John Dalton.

It would have reduced wholesale natural gas prices to consumers by an estimated 5%, the state’s wholesale electricity costs for energy and capacity by an estimated 8%, and New England greenhouse gas emissions from electricity generation by an average of 7.2 million metric tons per year, Dalton’s report added.

Average savings for Massachusetts in 2020 dollars, not including new infrastructure costs, would be approximately $603 million/year over 25 years.

For the 9.45 TWh clean energy procurement in the final bill, the estimated impacts would be “roughly half,” Dalton said.

He estimated the offshore wind procurement will add about 6.7 TWh, making the cumulative procurement about 85% of the amount of clean energy assessed by the study. But it will likely have less than 85% of the estimated impacts because offshore wind will, at least initially, have a higher price and less capacity value than the firmed hydro-plus-renewables contracts, Dalton said.

‘A group effort’

State Sen. Ben Downing (D) and House Telecommunications, Utilities and Energy Chairman Thomas Golden (D) championed the bill, according to AWEA’s Eastern Region Policy Director Andrew Gohn.

Several of those interviewed for this article attributed yeoman’s work to Haddad (D), though they asked not to be identified in this election year. Other sources mentioned important work by Sen. Mark Pacheco (D).

“It was a group effort,” Haddad told Utility Dive. “Members of the House and Senate and representatives of the governor had clearly made up their minds this was important to everyone and did the work.”

“Secretary of Energy and Environmental Affairs Matt Beaton and Gov. Charlie Baker wanted this to work and they showed it," she added.

It is widely assumed the Governor will sign the bill into law because of his office’s role in negotiating the final bill.

“I have to give the Governor’s office a lot of credit,” Haddad said. “They were very helpful in the negotiating process.”

ISO New England, the state’s grid operator, has already studied what it would need to reliabily interconnect large amounts of onshore and offshore wind, according to Spokesperson Marcia Blomberg.

“To interconnect to new resources in the north, whether it’s Canadian hydro or onshore wind in remote areas of northern New England, more high-voltage transmission lines will be needed,” she cautioned.

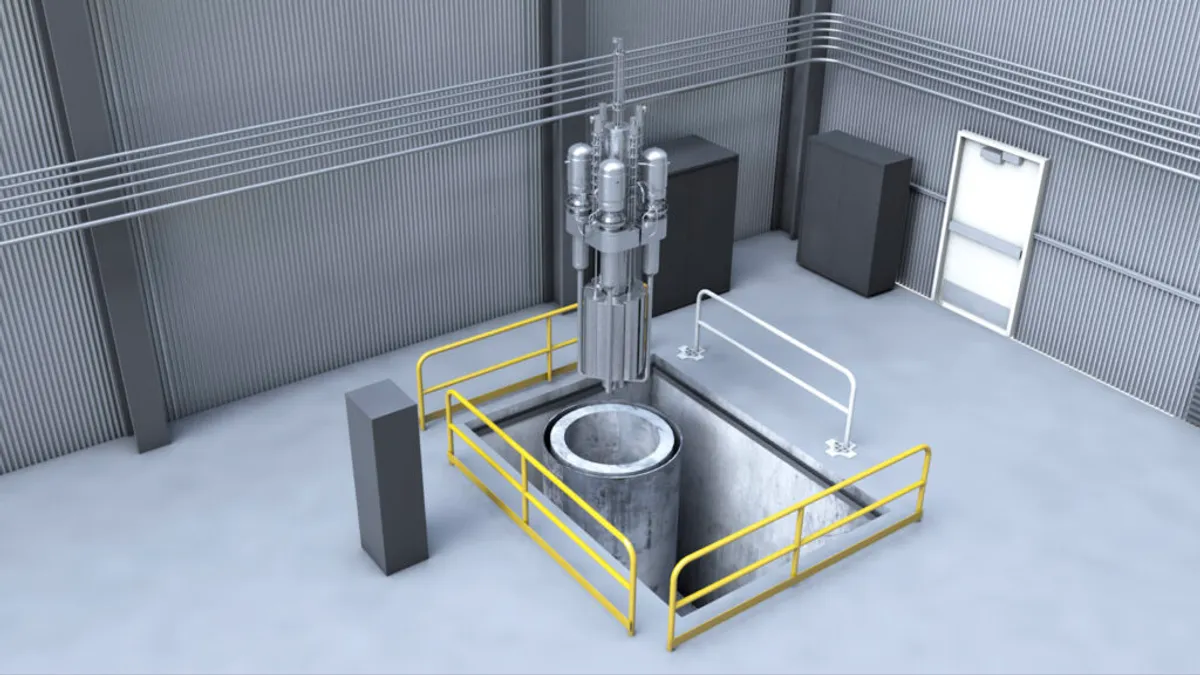

The final bill includes the expansion of energy efficiency through a Property Assessed Clean Energy (PACE) financing program. There is also an order to the Department of Energy Resources (DOER) to develop a 2020 mandate for energy storage, a requirement for higher level attention to natural gas pipeline integrity, and an order forming a nuclear facility decommissioning authority.

But Haddad is already looking ahead. “People were disappointed that the bill did not increase the RPS,” she said. “I may focus on that in the next session.”