Hyzon Motors, a manufacturer of fuel-cell electric buses and trucks, said on Monday that it will expand an existing Chicago-area plant to produce a key component of hydrogen fuel cells, the membrane electrode assembly, for its commercial vehicles.

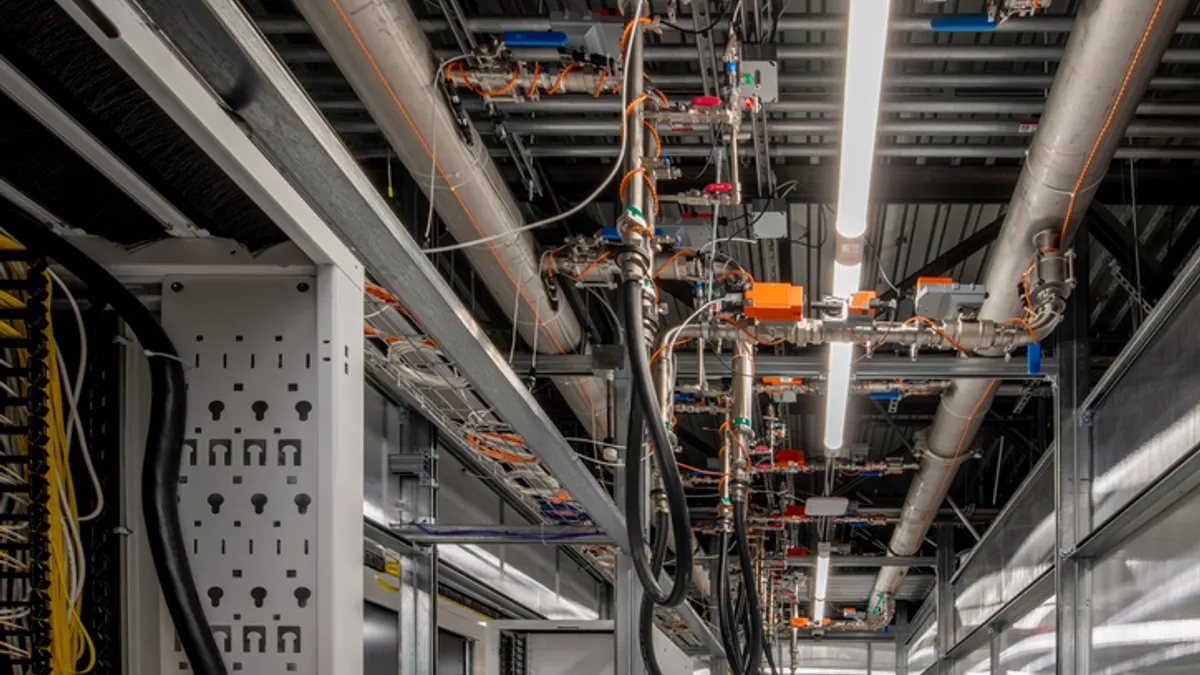

The plant expansion will help Hyzon reach production of up to 12,000 fuel-cell electric vehicles a year, Hyzon officials said in a news release. MEA production at the Hyzon Innovation Center is expected to start in Q4 with 28,000 square feet and go to 80,000 square feet in a second phase.

The expansion comes at a time when the competition is heating up between electric trucks and fuel-cell trucks. The truck OEM industry has major players taking sides.

Daimler Trucks and Scania declared they would focus on battery-electric trucks. But hydrogen-propelled trucks still have backers. Toyota and Hino Motors partnered last year to produce fuel-cell-powered prototypes for Japan. Cummins and Navistar announced last November they would produce a Class 8 hydrogen truck that Werner would test for regional hauls in California.

One reason hydrogen raises questions is the production and distribution of it. Unlike gasoline or electricity, there is no major national or regional distribution network.

But Craig Knight, Hyzon CEO, said the most important input he takes is from buyers, not hydrogen detractors, although he admits he hears and reads the hydrogen criticism.

"We hear it often," said Knight. "But we don't hear it from our customers ... We listen to our customers; we don't listen to people talking about what is possible or not possible."

"We listen to our customers; we don't listen to people talking about what is possible or not possible."

Craig Knight

CEO of Hyzon

Range and ease of refueling are things his customers want. Those, Knight said, he can provide. And fuel-cell electric trucks won't require the same extra space needed to refuel. In short, it will be easier for fleets to ready their lots and depots for hydrogen as opposed to electric, Knight said.

The big problem for electric trucks is their fuel supplier, the national grid. Knight said customers tell him that the grid is not ready for a large number of electric trucks, and even regional grids have had problems keeping up with electric buses and trucks.

An electric Class 8 truck requires between 1.7 megawatts and 1.8 megawatts to charge for an hour. Knight said buyers of electric buses and trucks are finding the vehicles have to be sidelined from time to time, because the grid cannot handle that kind of simultaneous demand.

Knight said even electric trucks designed for shorter hauls or daily urban work, such as garbage trucks, are coming up with limited range or time on the road.

"What would happen if you had 20% of your buses ... on electric? What would happen?" said Knight. "It just doesn't function."

A capacity problem for the nation's grid would be greater if more electric trucks hit the road, because there are more trucks than buses, Knight said. And buses have time to charge overnight. Trucks have less time in their schedule for slow charging, Knight said.

A benefit to hydrogen is the superior range as compared to battery-electric trucks, but Knight said he acknowledges the lack of a hydrogen fueling network.

"So, you know what? I don't go there," said Knight. "I don't sell to someone trying to do cross-country trucking ... A lot of our customers do ... back to base, or hub to hub."

Knight said decarbonizing heavy trucks is challenging, but hydrogen is not "crazy," as Tesla's Elon Musk said. Knight said customers tell him hydrogen is a "no-brainer."

One order Hyzon has taken is from an Australian mining company, for a passenger bus. Knight said Hyzon has plans for two Class 8 truck models, with a cab-over-engine design for the European and Asian markets, where the flat-faced design is popular. Knight did not disclose when full Class 8 production could start.

"One of the benefits to battery-electric vehicles, in general, is that they are simpler."

Tim Denoyer

Vice President and Senior Analyst for ACT Research

A challenge for Hyzon and other fuel-cell OEMs will be getting total cost of ownership down. In some cases, total cost of ownership for battery-electric trucks is lower than diesel trucks, said Tim Denoyer, ACT Research vice president and senior analyst.

"One of the benefits to battery-electric vehicles, in general, is that they are simpler," said Denoyer. That simplicity means the electric vehicles are efficient and use 90% of the energy the battery supplies. Efficiency in FCEVs is between 50% to 60%, Denoyer said.

And, of course, there is no national network of hydrogen fueling stations, Denoyer said. But at least one state government is aiming to remedy that dearth.

In September, the California Energy Commission granted $116 million to expand hydrogen refueling systems. Among the proposed recipients was Shell's Equilon Enterprises. Shell has nine hydrogen fueling stations in California, and proposes to add more, including some at gasoline stations.

Despite the challenges of convincing fleets to turn to hydrogen fuel cells, the technology has drawn investors to Hyzon. Later this year, Hyzon will go through a reverse merger with Decarbonization Plus Acquisition Corp., a special-purpose acquisition company, or SPAC.

The reverse merger will put $570 million into the cash account of Hyzon, according to an SEC filing in February. The merger is expected to close in the second quarter of 2021, company officials said.