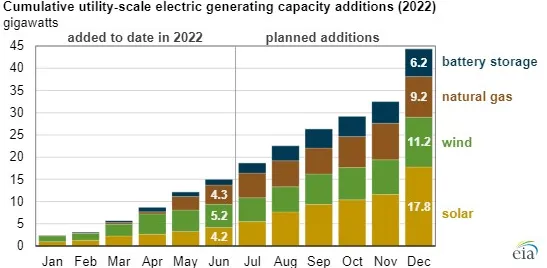

Developers and project planners expect to add 29.4 GW of new generating capacity in the U.S. in the second half of 2022, nearly double the 15.1 GW added in the first half of the year, the Energy Information Administration reported last week.

About half of the planned capacity in the second half is solar, with 13.6 GW of additions expected, followed by wind, with 6 GW of additions expected.

This is a change from the first half of the year, where wind power accounted for the highest percentage of the 15.1 GW of new capacity that came online, at 5.2 GW, or 34%, followed by natural gas, solar and battery storage.

Projections for solar capacity additions have fallen from 21.5 GW at the beginning of 2022 to 17.8 GW now. “Pandemic-related challenges in supply chains and a U.S. Department of Commerce tariff investigation are likely causes for this decrease,” the EIA noted.

In addition, the U.S. solar industry is facing new disruptions as shipments from several Chinese solar panel suppliers have been detained or sent back in the past several weeks, The Wall Street Journal reported Aug. 9.

U.S. customs agents are enforcing The Uyghur Forced Labor Prevention Act, which went into effect at the end of June.

Despite the challenges, renewables lead the planned capacity additions for 2022. The Inflation Reduction Act is expected to spur renewable and other clean energy development with new and updated tax incentives.

For the full year, EIA expects 44.4 GW of new utility-scale generating capacity to come online, led by solar’s 17.8 GW and followed by wind at 11.2 GW, gas at 9.2 GW and battery storage at 6.2 GW.

“As in previous years, many projects plan to come online in December because of tax incentives,” the EIA noted.

The largest renewable projects that came online in the first half of 2022 included the 999-MW Traverse Wind Project in Oklahoma, the 492-MW Maverick Creek Wind in Texas and the 440-MW solar and storage project at Slate Hybrid in California.

In terms of generating capacity retirements in 2022, U.S. operators plan to shut down 15.1 GW, with 8.8 GW already retired in the first half of the year. The biggest share of the 15.1 GW of retirements is expected to come from coal at 76%, followed by natural gas at 12% and nuclear at 9%.