Dive Brief:

- ICF expects U.S. electricity demand will grow by 9% by 2028 and 18% by 2033, an increase of 2% per year, on average, relative to 2024 levels, the consulting firm said in a report published Thursday. Peak demand could grow 5% over the next four years, ICF said.

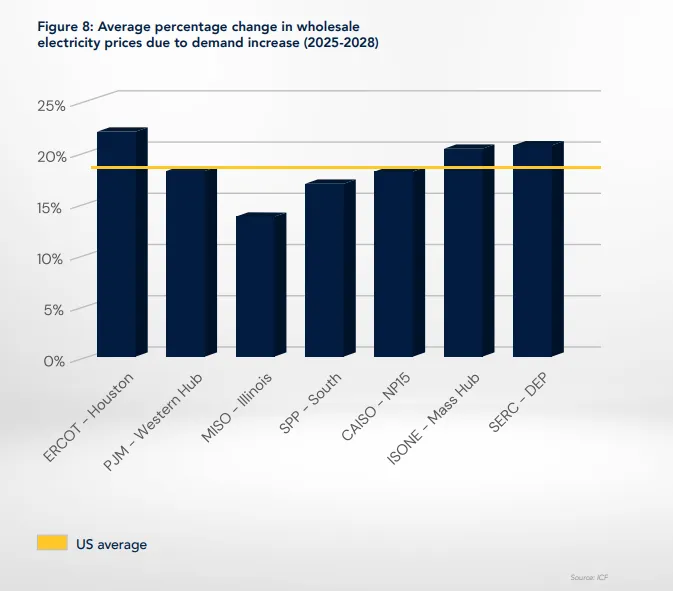

- The demand increase — driven by building and transportation electrification, data center growth, cryptocurrency mining and battery and fuel cell manufacturing — could drive up the amount that utilities pay for electricity by 19% by 2028, ICF said. Texas, and parts of New England and the Southeast, could see larger increases, the report warned.

- A power sector survey published Sept. 10 by Black & Veatch echoed ICF’s conclusions, pointing to an “urgent need for grid modernization.” Renewables integration and aging infrastructure were cited as the industry’s biggest challenges by respondents, the firm said.

Dive Insight:

ICF’s analysis shows electricity demand growth is expected in every region of the United States but “the largest increase by far is projected in the mid-Atlantic region,” where demand could grow 68% by 2050, compared to the U.S. average of 57%.

SERC Reliability Corp., covering 16 southeastern and central states, could see peak demand grow 31% by 2050. ISO New England could see peak demand grow 124% across the same timeline, the report found.

“As the U.S. navigates the surge in electricity demand, utilities have become even more critical in their role of managing demand and ensuring customers have reliable, affordable power,” Anne Choate, ICF executive vice president for energy, environment and infrastructure, said in a statement.

The Electric Reliability Council of Texas could see wholesale energy prices jump 22% by 2028, the report found, while the Midcontinent Independent System Operator region and much of the South is expected to experience a 14% increase. Parts of ISO New England and SERC Reliability Corp. could see wholesale prices rise more than the U.S. average, ICF found.

To reliably meet the new demand, utilities “will need to leverage new technologies and collaborate to integrate a balanced mix of new electricity supply and advanced customer programs,” Choate said.

ICF outlined six recommendations for utilities, including establishment of “more robust planning processes” that look at the electric system holistically.

Improved planning processes will require “an integrated approach across all asset classes, including generation, transmission, distribution, distributed energy resources, conservation, and load management,” the report said. “This will equip utilities to consider long term investment strategies that enhance grid reliability, resilience, resource adequacy, and operational efficiency.”

The ideal siting of renewable energy resources will also be key, and requires utilities to consider grid capacity, government incentives, future power prices and arbitrage opportunities, land availability, environmental permitting and other factors.

Other recommendations in the ICF report are:

- Distribution system upgrades to allow for electrification and distributed energy resource adoption. “Targeted deployment of DER programs ... that allow for co-benefits to customers and utilities [to] be realized should be considered to offset traditional distribution investments”;

- Energy efficiency programs will continue playing an important role in managing baseload demand “but they’ll need to be complemented by new, more active load management programs that balance intermittent renewable electricity closest to the source of the demand”;

- Smart meter data can be managed with emerging artificial intelligence platforms, allowing utilities to improve planning, forecasting and optimizing customer programs; and,

- Utilities must engage with regulators about the energy transition, including how to incentivize investments in new resources and research, tariff development and cost recovery for non-traditional investments.

An ‘urgent need’ for grid investments

Black and Veatch’s survey of 700 U.S. power industry stakeholders found the sector is “grappling with a slew of challenges mixed with opportunity” as it faces rising demand.

“Data centers have proliferated on the commercial power landscape, and their load requests ... are exponentially larger than anything previously seen, compounding challenges in the U.S. power industry,” B&V said in a report analyzing the survey responses.

However, about 45% of respondents said they are not confident in their forecasting for data center loads, “perhaps due to the large amount of uncertainty that can come with data center power requests and expectations,” B&V said.

Respondents said grid modernization is being driven by renewable energy penetration and extreme weather but “evolving regulations continue to roil uncertainty and dampen investment” in an upgraded electric system, according to the analysis.