Dive Brief:

- SunVault Energy and Edison Power Co. have signed a solar energy generation and large scale battery storage project for three fire stations in Delaware.

-

The total size of the project is 484 kW with both solar photovoltaics and a 600-kW/300-kWh battery storage system.

-

SunVault indicated in a statement that the project will have EBITDA of about $250,000 a year for the expected 20-year life of the project.

Dive Insight:

SunVault Energy and Edison Power Co. are among the most recent partners to develop a solar+storage project. Their project, to install 484 kW of solar panels and 600 kW/300 kWh of storage on three firehouses in Delaware, is relatively small, but the companies’ ambitions are large.

The installation is being project financed and built on a build-own-operate-transfer model and involves a power purchase agreement with a utility operator, SunVault CEO Gary Monaghan said.

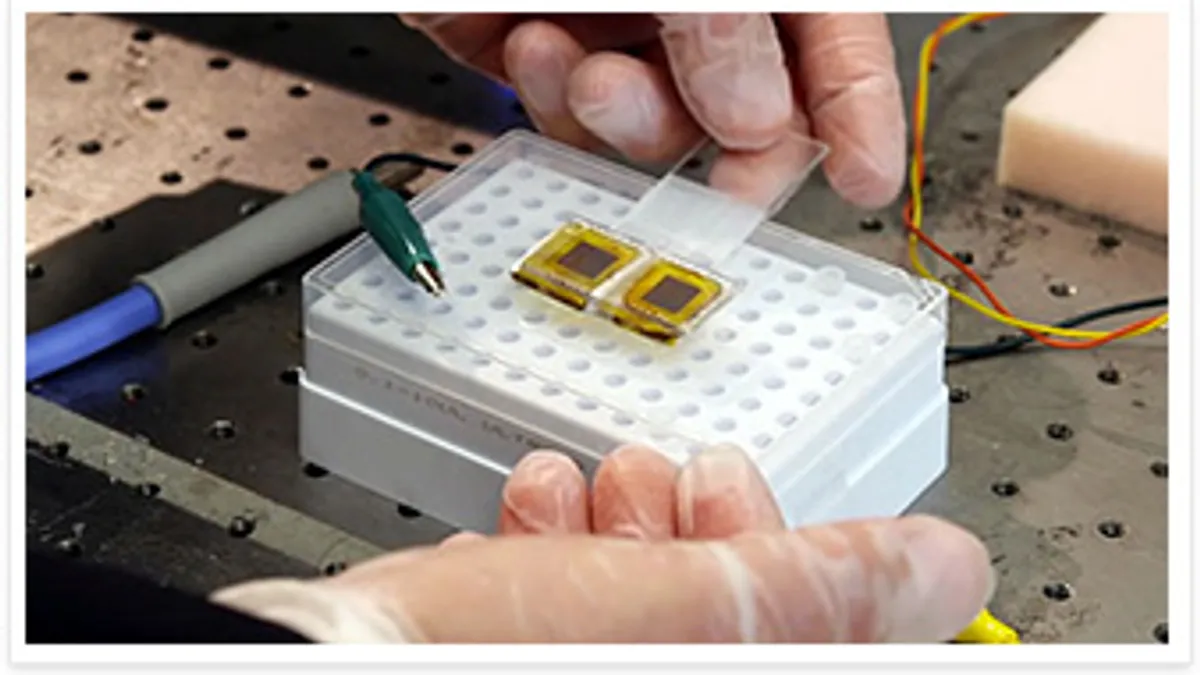

The company indicated construction on the project will be able to start immediately because SunVault has an existing inventory of solar panels. In addition to conventional solar panels, the project will use a SunVault/Edison Graphene Electrical Energy Storage device, if certification of the device can be obtained in time.

"We are very pleased to be brought into this deal by Edison in Delaware and look forward to progressive expansion as we build out," Monaghan said in a statement.

“We like infrastructure projects,” Monaghan told Utility Dive, adding that his team at SunVault has the experience and background to get them done.

The company’s website lists former U.S. Secretary of Energy Bill Richardson and Dr. Robert Murray-Smith, a scientist involved in graphene research, as directors.

Edmonton, Alberta-based SunVault has close ties to Edison Power Co., who Monaghan said brought the Delaware project to SunVault. He said the firehouse installations could lead to the development of another 3 MW of projects, for schools in the same region.

In April 2015, SunVault signed a binding letter of intent under which Edison Power would serve as a retail power provider in deregulated markets. At the time, SunVault said its first focus would be the Alberta market, followed by other markets that have time-of-use pricing.

Monaghan said the relationship will begin the process of introducing the company’s graphene supercapacitor storage technology into the market for grid stabilization.

Graphene seems to be at the heart of SunVault’s ambitions. It is an allotrope of carbon and is also called a two dimensional element because it is only one atom thick.

Graphene is thin, transparent, about 200 times stronger than steel and conducts electricity better than copper. When it comes to storing energy, “It is about seven times better performing than lithium-ion,” Monaghan said. Graphene is lighter weight, more conductive, does not need cooling, charges faster and has a long life cycle, he added, adding that it is also cheaper than lithium-ion, costing about $300/kW compared with about $1,000/kW for li-ion.

When graphene storage technology hits the market, it will be “spectacular,” Monaghan said. SunVault is working on two types of graphene storage devices, a supercapacitor for quick response applications and a battery for longer discharge uses.

Monaghan said SunVault is in the process of getting third-party verification of its graphene energy storage technology and will follow that with certification, which he hopes to obtain by the end of March.

He also said SunVault has sent a 5-kW prototype graphene battery to a utility for field testing. He declined to name the utility.

In addition to uses on electric grid, Monaghan envisions a variety of uses for graphene storage, including cell phones and electric vehicles.

SunVault and Edison Power also are developing an electric car.

Corporate plans call for Edison Power to acquire SunVault’s shares to create a single stock and to bring “all the technology under one roof,” Monaghan said.

Graphene was first isolated at a laboratory at the University of Manchester in England in 2004. Since then, hundreds of laboratories and research institutions have sprung up around the world to work on graphene technology. And, in addition to start-ups like SunVault and Graphene Batteries of Norway, several large corporations such as BASF, Repsol, Lockheed Martin and Samsung are engaged in graphene research.

Despite the promise of graphene as an energy storage material, some scientists say the requisite breakthroughs are still to come. One of the biggest hurdles, they say, is bridging the gap between lab performance and commercialization and being able to economically manufacture graphene of high enough quality.