The Federal Energy Regulatory Commission's (FERC) latest infrastructure report outlining capacity additions for the country over the last year highlights several slow but steady changes in the way the U.S. makes electricity.

These changes reflect utility resource decisions as well as state and federal policies. They're affecting power markets, transmission plans and air emission levels.

But before delving into the details, we have a spoiler alert: coal is tanking.

In 2013, new renewable resources, including hydro and waste heat, totaled 5,355 MW, accounting for 38% of all new capacity in the country. Sounds like a lot, right?

The big surprise here is that this is the lowest amount of renewables added in the last five years, and the second lowest amount as a percent of new capacity, according to FERC data.

Renewables accounted for 52% of new capacity in 2012 and 42% in 2009. Not surprisingly, those were also banner years for wind generation. About 9,450 MW of wind was added in 2009 and 12,425 MW was installed in 2012. In contrast, only 1,129 MW was added last year.

So if wind and coal are down, who broke out this year? Here are the winners, losers and surprises of 2013.

Wind stalls

Wind power's ups and downs are driven by Congress' habit of extending the federal production tax credit (PTC) for wind every few years. There is always a rush to build wind farms just before the tax credit ends. Then wind development stalls as the industry waits for the credit to get extended, and the process repeats itself.

Last year, the PTC was tweaked so that projects are eligible for the credit if they were “under construction” by the end of 2013 instead of having to be operational as required under the previous credit rules. About 12,000 MW is currently under construction. This means that in the next two years, we'll see a sizable jump in new wind farms coming online.

Overall, wind capacity now makes up 5.2% of all capacity in the U.S., up from 3.4% in 2010.

Digging deeper into the renewable capacity additions, we find that two technologies, biomass and solar, have been growing steadily since 2009.

Biomass keeps truckin'

Last year was a banner year for biomass. About 780 MW was installed, accounting for 14.5% of all new renewables. In 2009, 276 MW of biomass was added in the U.S., and it has grown each year since then.

Two things to note on biomass: some utilities have been adding it to their coal-fired power plants to reduce the amount of coal they burn, so it is being used more than the FERC numbers indicate. Environmentalists generally oppose it because they argue that it does nothing to reduce carbon emissions. This opposition could temper biomass' growth prospects.

To keep the biomass numbers in perspective, the technology now accounts for 1.36% of all installed capacity in the U.S., up from 1.17% in 2010.

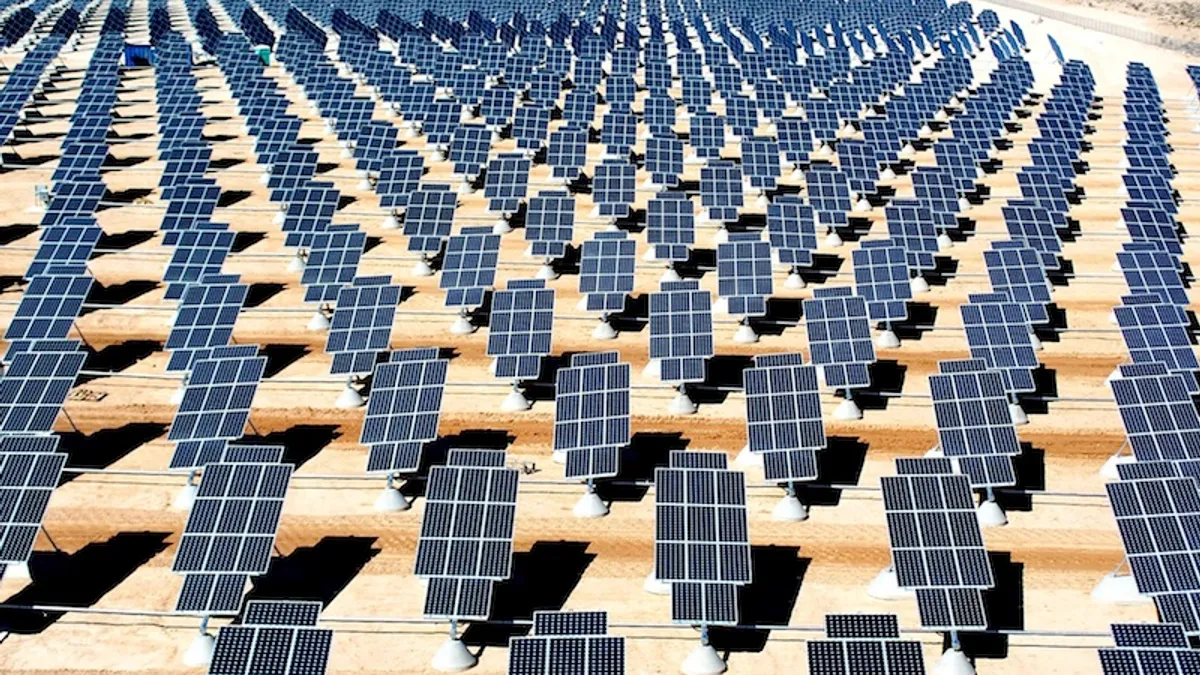

Solar takes off

Solar had a standout year last year, with 2,936 MW getting added to the grid.

For the first time, more solar was added than wind. Solar accounted for 55% of all new renewables last year. And FERC's data doesn't even include rooftop solar.

Like biomass, solar has been growing each year since 2009 when 286 MW was added. The technology took a major leap in 2010 when 1,131 MW was installed, followed by 2,056 MW a year later. With several utility-scale projects being built in the West, these numbers will grow.

Hydro limps along

Hydro has also been growing, but barely.

Last year, 378 MW of hydro was added, up from 18 MW in 2009. In part, this points to the difficulty of permitting new hydro plants. The industry has been trying to change that and FERC may be speeding up the permitting process.

Coal down, gas up

As for fossil fueled plants, 1,543 MW of coal was added last year, down from 3,574 MW in 2009. About 7,270 MW of natural gas-fired plants was installed, down from 10,633 MW five years ago.

Coal capacity is shrinking and gas capacity is growing. Gas, the number one resource in the U.S., grew to 42% of all capacity last year, up from 40.8% in 2010. Coal fell to 28.6% of all capacity last year from 30.4% in 2010.

Finally, you may be asking, what about nuclear? The reality is that there have been no nuclear plant additions since 2009, but there are several plant expansion projects underway.

Looking ahead

There's no reason to think the main trends that FERC is highlighting will change.

Coal will keep slipping, especially with more plant retirements expected in the next three years, and gas will climb. Of course, we'll be watching the renewables. Can hydro bust out? Will biomass keep growing? Will utility-scale solar level out?

In time, we'll have our answers.