There are two impressive numbers to come out of the Maryland Public Service Commission's decision last month to dramatically expand the state's energy efficiency commitment: 2 and 33.

That's a 2% energy efficiency goal by 2020, for the five largest utilities in the state. Its a goal that will send the state into a leading position, nationally, when it comes to energy efficiency targets. It's a target that involved fundamentally reconsidering how energy efficiency is valued. It was a decision years in the making – and less than three dozen pages long.

“There is a lot of work in this. It's remarkable they managed to distill the order down to 33 pages,” said Deron Lovaas, director of the federal transportation policy, energy and transportation program for the Natural Resources Defense Council. “This is something that's been in the works for a couple of years.”

The new goals give utilities five years to reach the 2% target, and the ramp-up is gradual. Utilities will update their efficiency plans in 2017, and will be required to increase efficiency at least 0.2% annually up to the goal.

The PSC's order said they found consensus on many of the underlying ideas and issues in the proceeding, but that only the Office of People’s Counsel and the Coalition of Maryland Energy Efficiency Advocates advocated for specific efficiency targets (both supported the 2%). Utilities said they were waiting on the results of a study from the Maryland Energy Administration, but regulators said there was no need to delay.

“Continued lack of completion of the potential study can no longer be a barrier to establishing targets for EmPOWER,” the commission said, referring to the state's efficiency framework.

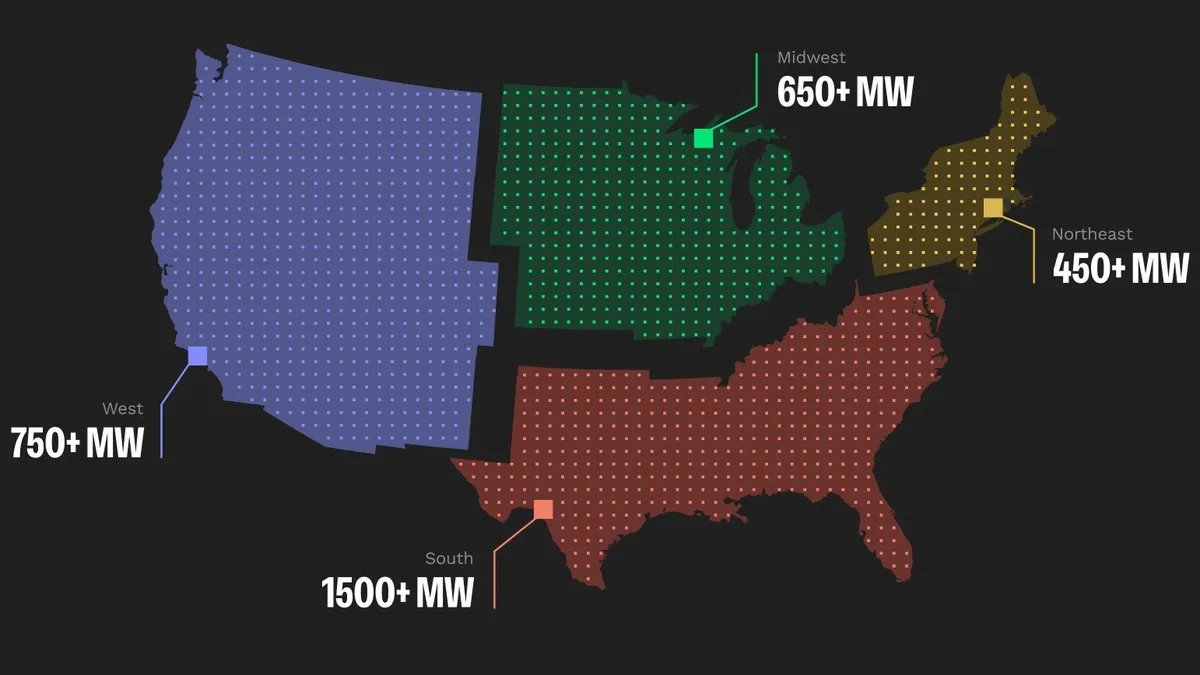

The goal puts Maryland alongside Massachusetts, Rhode Island and Vermont as a national leader in terms of efficiency goals, according to Brendon Baatz, senior research analyst for the American Council for an Energy-Efficiency Economy. So far utilities appear quiet in terms of the new goals and how they will meet them, but Baatz said some say early gains will be relatively easy.

“The low hanging fruit keeps growing back for energy efficiency,” Baatz said, predicting that utilities would find the goals challenging-but-achievable, with some already in stronger positions than others.

What the order does

The biggest change in Maryland is probably not the 2% target – though environmental advocates widely hailed the commission's decision to embrace efficiency as the lowest cost option. Maryland regulators found the lifecycle cost of a Kwh for efficiency was 2.6 cents, significantly lower than utility standard offers which range from 6.2 cents to 9.3 cents/kWh.

“For ratepayers across the state, it continues to be less costly to invest in energy efficiency than it is to pay for electricity,” the commission said.

But how energy efficiency is valued, how a program is determined cost-effective, may be the biggest change in Maryland. The commission committed to considering a far broader array of societal goods, known as Non-Energy Benefits, when trying to determine if a utility program will benefit ratepayers.

“More and more states are looking at various benefits,” said Lovaas, including not just reduced pollution but thermal comfort and long-term health impacts. “Cost effectiveness testing is becoming more comprehensive.”

And while the Total Resource Cost test is widely used, and will continue to be a factor, the commission went one step further and found that “a failure on our part to consider a broader societal impact stemming from the implementation of energy efficiency programs would ignore the codified intent of the General Assembly.”

State law calls for the Maryland Energy Administration, which administers EmPOWER, to provide “affordable, reliable, and clean energy for consumers.” And that isn't just limited to customers in an efficiency program, the PSC said.

“This directive is not limited to only those consumers who participate in an energy efficiency program, just as the benefits of energy efficiency investments do not accrue only to direct program participants,” the commission said.

The commission also said that while it would continue to perform a cost-effectiveness screening for limited-income customer programs, it could still approve programs regardless of the determination.

Among other issues the order tackled: The commission adopted recommendations to establish goals utility-wide and at the gross wholesle level, relying on weather-normalized retail sales.

How utilities can respond

Thus far utilities appear unsure of how they will meet the new targets, and how much it will cost.

Wayne Harbaugh, director of pricing and regulatory services for Baltimore Gas & Electric, said in a statement that “exactly how we intend to meet the new goals and what the potential costs are remains to be seen and plans will take some time to develop.”

Delmarva Power replied to questions about compliance and costs simply with a link to its extensive list of offerings.

BGE's Harbaugh said the new goals “will be challenging to achieve given they are substantially higher than the existing goals and the fact that so many of our customers have already implemented long-lived energy efficiency measures.”

The goal was to reduce usage by 15% by 2015, but advocates say more can be done.

“From what I've concluded, most of the utilities are already in a great position to meet the goals,” said Baatz. “The state of Maryland is far from being saturated in terms of energy efficiency penetration. There is still a lot of opportunity in Maryland, and hopefully the utilities are able to come up with plans.”

Some new programs are underway but not yet being counted by utilities, Baatz said. Voltage conservation, relatively new in the EmPOWER structure, is already being used by some utilities but the results have yet to be factored in, he said. BGE began ramping up its program last year, meaning it is further ahead than other utilities, but may not have counted the gains into its efficiency figures yet.

Baatz also said there has been talk of penalizing utilities for failure to hit efficiency targets, as part of the Exelon-Pepco merger proceeding, and performance incentives could be considered as well.

Lovaas agreed that the targets are likely well within utilities' reach.

“The odds are pretty good we'll look back on this order and realize it was really easy to get to the 2% goal,” he said. "Program administrators are going to have to take a look at their offerings and services and ramp them up."

Editor's Note: This post has been updated from its original version to include additional input from Brendon Baatz.