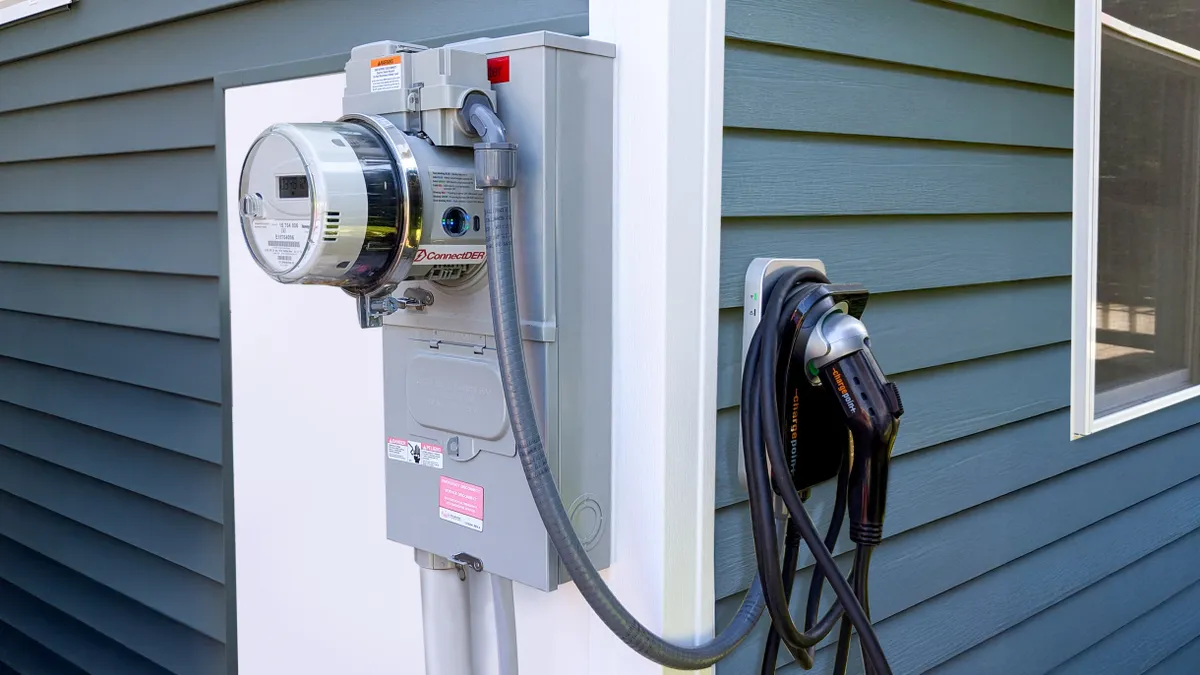

New York's quest to overhaul its energy system—envisioning a marketplace of clean and cost-effective distributed energy resources (DER)—has always been moving towards one central question: How do you value distributed resources?

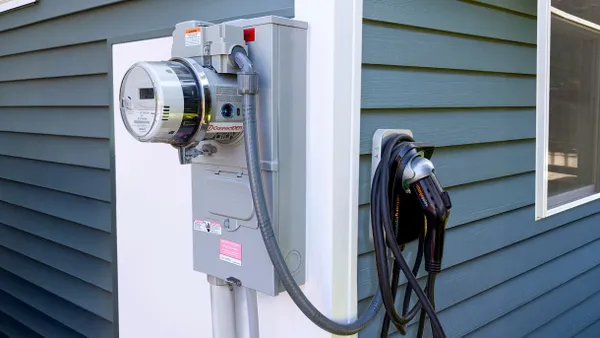

For years, net energy metering has been the relatively-simple solution: resources get paid the going retail rate for the energy they send back into the system. But that's become an issue in many proceedings, with utilities typically arguing that ratepayers are subsidizing the grid connections of many of these distributed generation customers, or that they can cause reliability issues.

New York's Reforming the Energy Vision (REV) has already launched several phases, but from the standpoint of market development a new proposal for valuing DERs is some of the heavy lifting. The report, issued by staff of the Department of Public Service, acknowledges the myriad unknowns and uncertainties, setting up a 20-year grandfathering period for existing net metering customers and putting a true-up in place for the first two years of the new pricing scheme: some types of resources can get paid more for their energy, but they won't get less than the NEM rate.

"Today, the customer side of the grid represents an enormous and largely untapped resource to optimize value throughout the electricity system," staff writes in the report. "REV will establish markets so that customers and third parties can be active participants."

The end result should be a more efficient electric system, including better utilization of bulk generation and transmission resources. But staff also stressed that changes will need to be made over time, acknowledging "the existence of uncertainty in terms of what values exist and how they can be quantified." And some potential may be limited by legacy issues—as the grid develops more bidirectional capabilities, more value will be unlocked.

The report is a "roadmap towards positive growth for DERs across the state, but there are some challenging details," said Sean Garren, who leads REV policy for advocacy group Vote Solar.

The commission will take public comments on the recommendations, but is also moving quickly to roll out the test of the new valuation. Initial comments are due Dec. 5, and reply comments are due Dec 19. Regulators said in a statement they expect to take action on the recommendations in January.

Distributed generation projects, such as solar for large commercial customers, fuel cells, farm waste generators, and micro combined heat-and-power, would transition to the new valuation system, if approved by the Department of Public Service.

"The public comment period is going to be really critical to see how the proposal develop and what are the reactions, once developers have had a chance to really dig in and have their project finance folks look at it," Garren said. Overall, he was optimistic that the new pricing mechanism would lead to more opportunity for third-party providers.

"This provides a big open program to support DERs," Garren said. "We’re talking about hundreds of megawatts of community shared solar, and larger projects, across the state."

Ryan Katofsky, vice president of industry analysis at Advanced Energy Economy (AEE), said his initial impression was that staff had "struck a reasonable balance," but also said the speed with which the second phase will start means the policy could evolve quickly.

"We didn’t get everything we were asking for, but I don't think anyone got everything they wanted," he said.

Staff's phase one proposal focuses on resources already covered by net energy metering, which does not include stand-alone storage. "We'd have liked to see the phase one proposal be a little more encompassing," he said. "But the proceeding is not over and I think we’ll get there."

The Value Stack: Moving past net energy metering

At the heart of staff's proposal is the "value stack": a set of inputs that go beyond NEM's traditional Commodity, Distribution and Surcharge model. Locational pricing, compensation for installed capacity value and the inclusion of a social cost of carbon will all contribute to a more accurate energy product.

This first phase of the value of distributed energy resources (VDER) model is a "significant first step in basing compensation on calculated value streams associated with eligible generation facilities," staff said.

The report acknowledges that the overall impact of the change is "likely significant," and said a declining Market Transition Credit would be used for some community projects likely to be disadvantages. Key components of the new VDER model include:

- Energy values would be based on the New York ISO's hourly LBMP energy prices at the time of generation. Compensation would be calculated similarly to mandatory hourly pricing customers, and will already include avoided losses.

- Compensation for installed capacity for eligible generation facilities would be made with a monthly lump sum. Staff described the payments as equal to a resource's MW performance during the peak hour in the previous year, multiplied by the actual monthly generation capacity spot prices from NYISO’s installed capacity market that month.

- Intermittent technologies will receive per kWh compensation based on the capacity portion of the utility’s full service market supply charges.

The hourly energy rate is important, said Vote Solar's Garren. "It begins to really differentiate the pricing signals throughout the day. ... It starts to open up the combination of solar plus storage or other dispatchable technology.

Katofsky however, said he would like to see staff "looking to start the process of getting a more precise valuation."

Staff said the environmental value of eligible behind the meter generation is likely "at least equal to" the U.S. Environmental Protection Agency's Social Cost of Carbon, but also said that may not go far enough in recognizing the full impact. Instead, staff recommended using the price of Tier 1 Renewable Energy Certificates (RECs) in New York’s market.

The new product will have “values pretty close to retail net energy metering,” said Garren, and it provides a “clear and consistent direction for how you get into it. ... All of those are going to finally put financiers and developers on a stable platform which is going to really enable us to move forward.”

An added benefit, staff said, is that energy sources included in its proposal are largely eligible to produce Tier 1 RECs, and the state's Clean Energy Standard directs utilities to purchase those credits in addition to taking voluntary actions to meet goals.

And, there is the locational and demand reduction value of DERs, an issue where debate is likely to occur. "All parties agree that DERs can reduce delivery costs, but recognize that we are at the beginning stage of calculating that value," staff warned, adding that it expects "significant evolution" in the second phase.

"This begins to point value towards certain locations," Garren said. "There’s an opportunity here to raise the revenue your project receives by being in a high-value location. … developers are going to start to react to locational signals."

Thus far, utilities say they are waiting for the comment period to take a substantive position on staff's proposal. Consolidated Edison spokesman Allan Drury said the utility was reviewing the proposal "to see how it balances the needs of all customers, how it fits with the overall goals of the Clean Energy Standard, and whether it makes the best use of customer funds to achieve the state’s objectives."

Market Transition Credit will ensure no 'cliffs'

Projects now operating under NEM rates will keep those for 20 years, under the staff's proposal. But as resources interconnect and begin utilizing the new VDER rate, safeguards will be put in place to ensure the market changes take effect gradually and are functioning.

Particularly in the realm of distributed community generation, staff said it "is cognizant of the need to avoid cliffs or

uncertainty that could harm this market’s development."

The Market Transition Credit will essentially raise any compensation values below NEM up to that level for the first two year. But during peak hours, dispatchable technologies will have the opportunity to receive increased compensation, with respect to both installed capacity compensation and locational demand reduction compensation. If the value stack indicates a project receives compensation in excess of NEM, they will receive that rate.

A collaborative, second phase of study to improve the accuracy of VDER compensation will begin "immediately," staff said.