Editor's note: The following is a viewpoint from Mark Dyson, manager for Rocky Mountain Institute.

Since its release last week, the Department of Energy’s grid study has been under the harsh scrutiny of a broad range of industry players.The study was roundly criticized well in advance of its release by many stakeholders expecting it to unjustifiably blame renewable energy for the challenges facing the grid. Thankfully, the study that emerged last week has failed to live up to those fears.

Instead, the report is generally fact-based and well-researched, and the key findings–that low natural gas prices and flagging load growth are primarily to blame for the economic crunch facing coal and nuclear power plants and that renewables pose no threat to our grid–are well-documented and well-understood by stakeholders ranging from the U.S. military to utility CEOs.

While the factual findings are reflective of industry consensus, the study’s recommendations continue to emphasize the uncertain benefits of “fuel assurance,” reinforcing a 20th-century definition of grid infrastructure that promotes big, costly, and risky bets over right-sized, cost-effective, and modular alternatives. The study thus fails to highlight the opportunity presented by clean energy innovation and its potential to reduce costs, risks, and carbon emissions as the U.S. reinvests in our grid.

Problems with an outdated view of grid infrastructure

The DOE study recommends that federal and state agencies accelerate “licensing, relicensing, and permitting of grid infrastructure such as nuclear, hydro, coal, and advanced generation technologies.” This list appears to suggest that the government should pick winners from a limited set of technology options, most of which have recently been losing quite badly when exposed to market forces.

The first item on the list, nuclear generation, is having a bad year. Existing nuclear plants, battered by low market prices, are much less cost-effective than they used to be, and utilities are finding that it’s more cost-effective to shut them down and replace them with energy efficiency and renewable energy than to keep them running.

Westinghouse’s bankruptcy has thrown the future of new nuclear projects into doubt, halting several ongoing projects in their tracks; this has left South Carolina ratepayers responsible for paying back their utilities for $9 billion–equivalent to 4 percent of annual state GDP–sunk into the abandoned V.C. Summer power plant. These customers are now paying 18 percent of their bills for a project that will never produce electricity.

Coal generators, also on the study’s list of fast-track grid infrastructure resources, are in a similar situation: the market has already spoken on their value, and it’s not clear how any acceleration of licensing and permitting will improve it. In a 2013 analysis, Fitch Ratings found that coal generating assets were worth 40–90 percent less on a net-present-value basis than they were in 2008, and in at least one case, coal-burning utilities themselves have determined that existing coal-fired generators are worth negative dollars.

Similar to the situation with nuclear, leading utilities are finding it cost-effective to shut down coal plants and replace them with renewable energy. Last year, investment bank UBS noted that monetizing failing coal assets would likely require legislative intervention, and indeed, recent months have seen a scramble by the coal industry and its supporters to prop up demand for the failing fuel.

Even “advanced generation technologies” are facing an uphill battle. The Kemper County generating station in Mississippi, utilizing an ambitious coal-gasification technology with integrated carbon capture and sequestration, was canceled after budget overruns adding up to more than $7 billion; the sponsoring utility now plans to run it as a conventional natural gas generator, albeit one that has cost approximately 10–15 times as much as comparable generators to build.

An opportunity for distributed energy resources as grid infrastructure

The DOE study’s recommendations suggest that the U.S. should fast-track the same kinds of traditional infrastructure projects that have led us to the current situation. Meanwhile, utilities and grid operators in leading states are beginning to reveal best practices for leveraging distributed energy resources (DERs) and utility-scale renewable energy to provide the services historically sourced from traditional infrastructure, often at lower cost and risk.

Often termed “virtual power plants” or “non-wires alternatives,” solutions that leverage DERs to perform grid services are a multi-gigawatt, multibillion dollar market in the U.S. alone. They are attractive for several fundamental reasons:

- Scalability and modularity: DER- and renewable energy-based solutions to serve grid needs can start small, scale with demand, and enjoy “learning-by-doing” that can make each unit of service delivered cheaper than the last. This can mitigate both the risk and the cost of pursuing distributed approaches to infrastructure needs, compared to large-scale alternatives, minimizing the impact of mis-forecasting future demand growth (noted by the DOE study as a major driver of excess capacity and costs in the U.S.). For example, Duke Energy is working with a community in North Carolina to scale up demand-side management programs over several years to delay the need for a new natural gas-fired peaking power plant, and maintain the option to avoid building the plant entirely if forecasted demand growth doesn’t materialize.

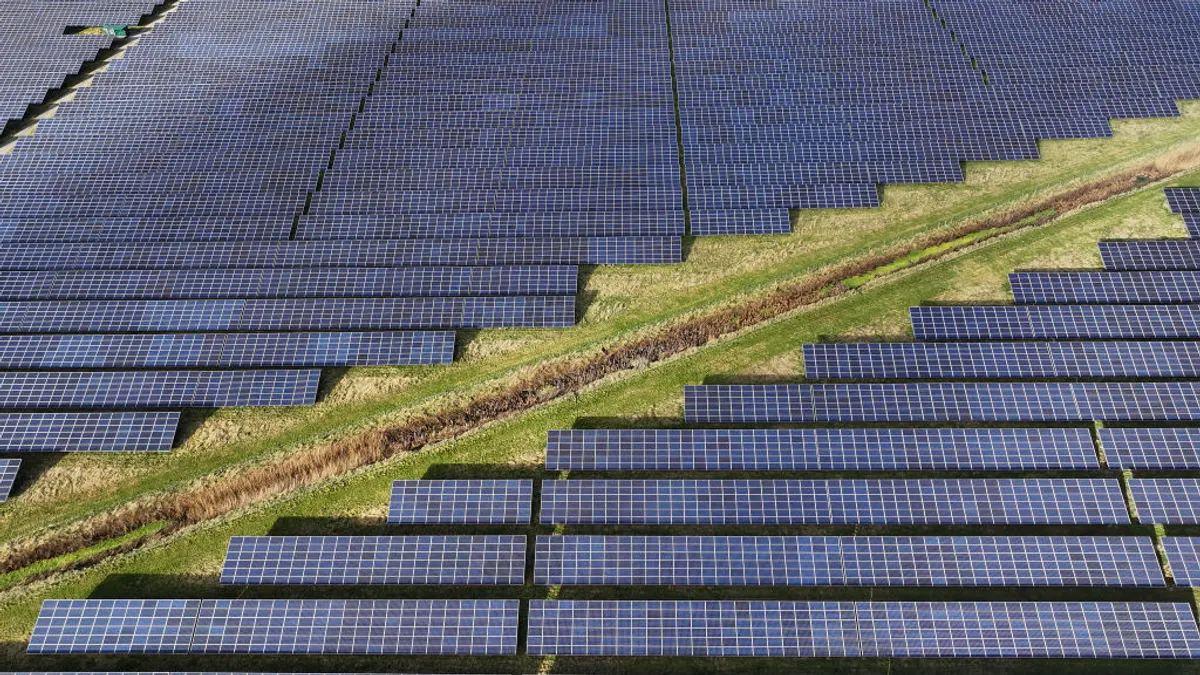

- Plummeting costs: The recent cost declines of renewable energy and DERs, in particular battery energy storage, are increasingly making them default choices for utilities seeking the lowest cost for their customers. For example, Xcel Energy, AEP, and other utilities have pioneered the “steel for fuel” swap, installing wind turbines at a cost lower than running their existing fossil fuel generator fleet, while Tucson Electric Power has contracted a solar-plus-storage system for a price of $0.045/kWh for dispatchable power, a level almost unimaginable even a year ago. Analysts forecast that these prices will continue to fall.

- Increasing resilience and reliability capabilities: Utility-scale renewables and behind-the-meter DERs are evolving from resources that grid operators viewed as “in the noise,” to active supply resources that can be relied upon to provide grid services. In California, grid operators have shown the potential to provide reliability services with utility-scale solar PV, using hardware (i.e., inverters) already paid for by their primary use case of conditioning power delivered to the grid, and storage, which can be deployed quickly to meet emerging grid needs. Across the country, demand response is an increasingly common and cost-effective component of the resource portfolio, handily beating new gas-fired generation in PJM’s latest capacity auction, even under strict year-round performance standards. Pilots and technical studies have shown that DERs can also provide other reliability and resilience services, from frequency response to black start.

Building on this mounting evidence, studies of investment options in California, Minnesota, and other states are beginning to indicate, on an asset-by-asset basis, that traditional infrastructure projects can be avoided, often at comparable or lower costs, by portfolios of renewable energy and DERs.

Capturing the opportunity

There are several avenues to capture the opportunity for DERs and renewable energy to serve as low-cost, low-risk grid infrastructure. At the federal level, following the recommendations of the DOE study, FERC and other agencies have an opportunity to better define the menu of grid services needed to ensure reliability and resilience in a rapidly-changing technology landscape, and encourage system planners and operators to procure them in a technology-agnostic way. FERC’s proposed rulemaking on aggregating energy storage is a promising start, and more efforts that fully value the capabilities of aggregated DERs can help further move the market.

At the state level, leading utility projects and regulatory efforts can continue to drive the market for solutions that leverage DERs as grid infrastructure. States typically have jurisdiction to ensure that retail rate design fully reflects the value that DERs offer, that DER owners can monetize all possible value streams that they provide to the grid, and that utilities have the correct economic incentives to pursue DER investment as a complement to traditional capital spending.

Finally, there is an expanded role to play for technology developers to further drive down costs and increase the capabilities of DERs and renewable energy solutions that meet the needs of the grid. The road to “energy dominance” requires moving beyond 20th-century technologies to meet our needs, and continued innovation in clean energy costs, capabilities, and business models can help accelerate the transition towards 21st-century leadership.