The utility death spiral has been at the center of a debate about how well energy storage plays with solar power, but a new report from The Brattle Group questions death spiral premise and calls for utilities to play a larger role in combating climate change.

In the death spiral scenario, renewable energy penetration – facilitated by the ability of energy storage to fill in the gaps of solar and wind generation – fosters a vicious circle of declining utility sales and rising electricity rates.

Two recent papers, one by researchers from the University of Texas at Austin and the other by Rochester Institute of Technology researchers, took a close look at the threat posed to utilities when homeowners pair solar panels and storage.

The Austin paper found adding storage could increase energy consumption and, indirectly, increase carbon dioxide emissions.

The RIT study found that grid defection using solar and batteries makes economic sense today in only the few instances where customers face high electricity bills and unfavorable net metering or feed-in policies.

Both the Austin and RIT papers refer back to a 2014 paper on the Economics of Grid Defection by analysts at the Rocky Mountain Institute (RMI).

The Brattle paper cites RMI and argues that its study and other like it fail to take into account “the limitations on grid defections imposed by the absence of suitable roof space, the need to accommodate longer duration deviations of solar PV output from expected averages, and changes of retail rate structures.”

But for Brattle the larger question is the premise that underlies the death spiral concept — that technological change is the making the traditional utility model untenable.

The Brattle paper posits an alternative paradigm, one in which utility sales grow and in which utilities would be essential in achieving “the deep economy-wide decarbonization likely needed to minimize the risk of catastrophic climate change.”

The key to this transformation in Brattle’s view is the “fairly rapid” electrification of transportation and heating, which currently account for about 45% of U.S. greenhouse gas emissions.

Brattle does not take issue with Energy Information Administration estimates of flat electricity sales of about 0.6% and even says EIA could be overstating sales growth with their modest assumptions about the growth of distributed solar power.

Brattle cites a recent study by the National Renewable Energy Laboratory says rooftop solar could account for 30% of electricity consumption by 2050, a level of penetration that Brattle says could “easily erase any currently forecasted utility sales growth and possibly even lead to non-trivial reductions in utility sales over the coming decades.”

Full realization of that solar potential is unlikely, says Brattle, but even if it were utilities would still be responsible for the bulk of electricity produced. Even more significant, from a global warming perspective, Brattle argues that even if solar power were to reach maximum penetration that would not be sufficient to meet long-term GHG reduction goals.

In that scenario, utilities might not face death, but could face a “substantially reduced role,” even as GHG targets are missed. Even a full decarbonization of the power sector by 2050 would leave the U.S. “well above” its long-term GHG goals set in the Paris Agreement.

As an alternative, Brattle lays out a scenario in which “economy-wide GHG emissions, and ongoing transport developments involving electric vehicles and autonomous shared driving, all provide a pathway to an alternative future paradigm for electric utilities: economy-wide decarbonization through electrification.

Brattle says its modeling suggests that utility sales could double from 2015 levels by 2050 if the heating and transportation sectors were to switch from their current fuel mix to 100% electricity.

If electrification were coupled with a “significant decarbonization” of the power sector through the adoption of clean generation sources — renewables, nuclear power and carbon capture technologies – and modest reductions in other energy sectors, U.S. energy related GHG emissions could be reduced by 70% relative to 2015 levels, Brattle argues.

In Brattle’s vision, residential and commercial water and space heating now fueled by fossil fuels would gradually by replaced by heat pumps, electric water heaters, and electric ranges. In transportation, Brattle assumes that the light duty vehicles, commercial light trucks, and freight trucks would be replaced by a fleet of battery electric vehicles.

Brattles says a switch to a largely electric fleet 2050 could increase electricity demand by 56% of 2015 electricity sales, and a switch to electric heating by 2050 could increase electricity demand by 40% of 2015 electricity sales.

Brattle points out that is a sharp contrast to only a 10% cumulative growth of utility sales between now and 2050 under the same assumption about rooftop solar penetration without electrification.

But none of this will happen in Brattle’s view if utilities do not play a leading role in decarbonizing the power sector and providing access to electric power infrastructure.

Those changes will present multiple challenges to utilities. Brattle puts regulatory challenges at the top of that list. Wide scale electrification would increase electricity use and electricity bills. That could be “viewed critically by the regulatory community if not understood in a broader context,” the consultancy cautions.

Utilities would have to work with regulators and the public to ensure they understand that while electricity costs would rise, overall energy costs might decline and bestow wider societal benefits in the form of reduced GHG emissions.

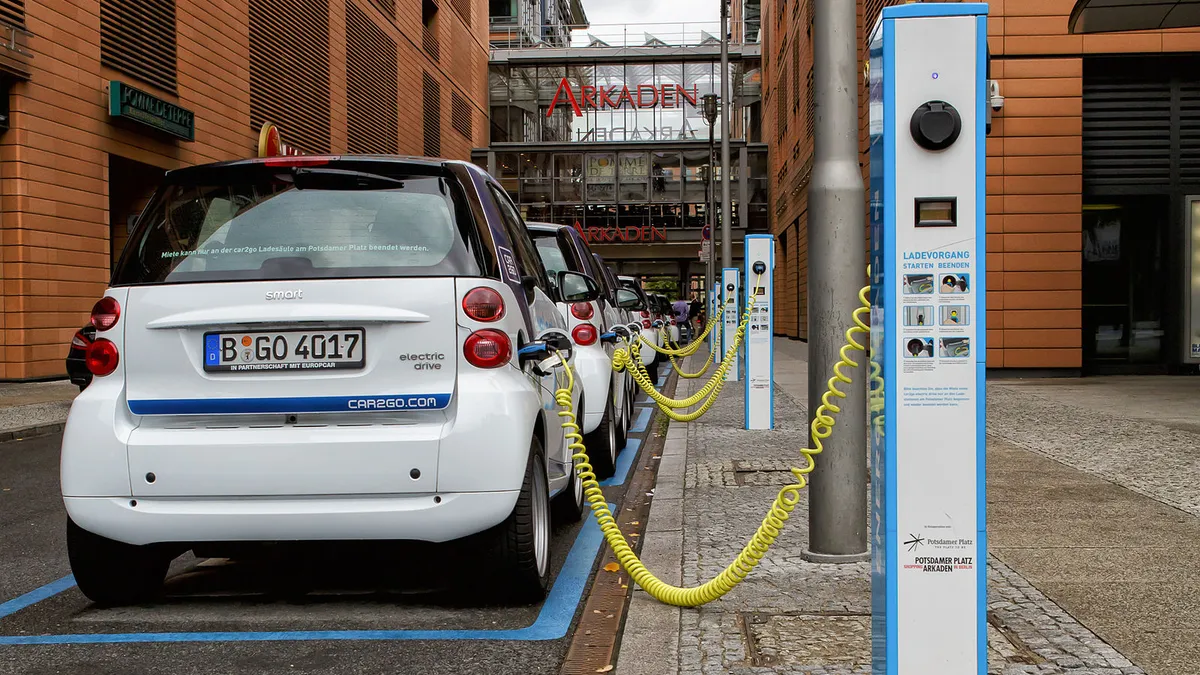

Brattle also sees a utility role in fostering the development of the charging infrastructure needed to facilitate wide scale adoption of electric vehicles, whether a utility owns or operates that infrastructure as monopoly or as a competitive provider.

Utilities should also take a role in revamping rate design such as the inclining-block rate structure that is designed to discourage consumption by charging customers more as their use rises. Brattle says that structure would be at cross purposes with a goal of full electrification.

And, last but not least, Brattle argues that utilities will have to take a fuller look at both the supply and demand assumptions in their resource planning processes in order to prepare for full electrification.

"Due to the rapid arrival of new transportation modes, such as autonomous driving, shared vehicles, etc., charging patterns based on even large-scale pilots with existing BEV owners may not be sufficient for planning electric infrastructure to support a rapid expansion of electric driving in particular," the report cautions.