Dive Brief:

- New economic analysis from Advanced Energy Economy pegs renewables and grid-edge technologies as a $200 billion industry in the United States, with annual revenues twice that of beer sales and equal to domestic pharmaceutical manufacturing.

- The trend is a global one as well: building efficiency products and services rose 14%, helping make clean energy a $1.4 trillion industry around the globe.

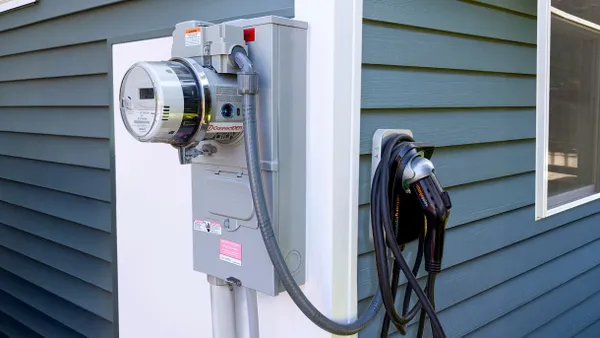

- Specific to the United States: advanced energy technologies like efficiency upgrades, electric vehicles, storage, and solar and wind generation all helped grow the market. Plug-in vehicle charging investments revenues jumped 11%, up a striking 600% in the last five years.

Dive Insight:

A growing interest in virtually all segments of clean energy helped propel revenues last year, according to a new report from Advanced Energy Economy, a national business group focused on evolving the electric distribution system.

According to AEE CEO Graham Richard, over the past six years the U.S. advanced energy market has grown 28% and supports more than 3 million jobs across the nation. The group, said Graham, is "committed to accelerating this business opportunity."

Specifically, building efficiency revenues grew 8%, led by advances in lighting and commercial retrofits. Those two segments reached revenues of $26 billion and $8 billion, respectively. Building efficiency is the largest segment of the advanced energy economy in the United States, and revenues reached almost $70 billion last year, AEE said.

Power generation technologies were up 5% in revenue, led by a five-year, 30% growth surge in solar. Revenues for solar rose $5.7 billion to $24.9 billion, a significant uptick. Wind power revenues held steady at $14 billion, AEE said. Extension of the wind production tax credit will help grow wind installations up to 9 GW between 2015 and 2018. It is a "welcome change from the boom-and-bust pattern," AEE said.

Energy storage revenues jumped more than 50% to $427 million, AEE said. Revenues from plug-in electric vehicles rose, mirroring a decline in clean diesel revenues. PEV revenue was up $2.5 billion, while AEE said investment in charging infrastructure jumped 11%, to $182 million—up nearly 600% percent since 2011.